- White Mountains Insurance Group recently launched a modified Dutch auction self-tender offer to repurchase up to US$300 million of its common shares at prices between US$1,850 and US$2,050 per share, with the offer set to expire on December 19, 2025 unless extended.

- This move follows the company's sale of a controlling interest in its Bamboo homeowners’ insurance platform for US$1.75 billion, while retaining a 15% equity stake, highlighting active capital management and portfolio reshaping.

- We'll explore how the self-tender offer and Bamboo platform divestiture reflect White Mountains Insurance Group's evolving capital allocation priorities.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is White Mountains Insurance Group's Investment Narrative?

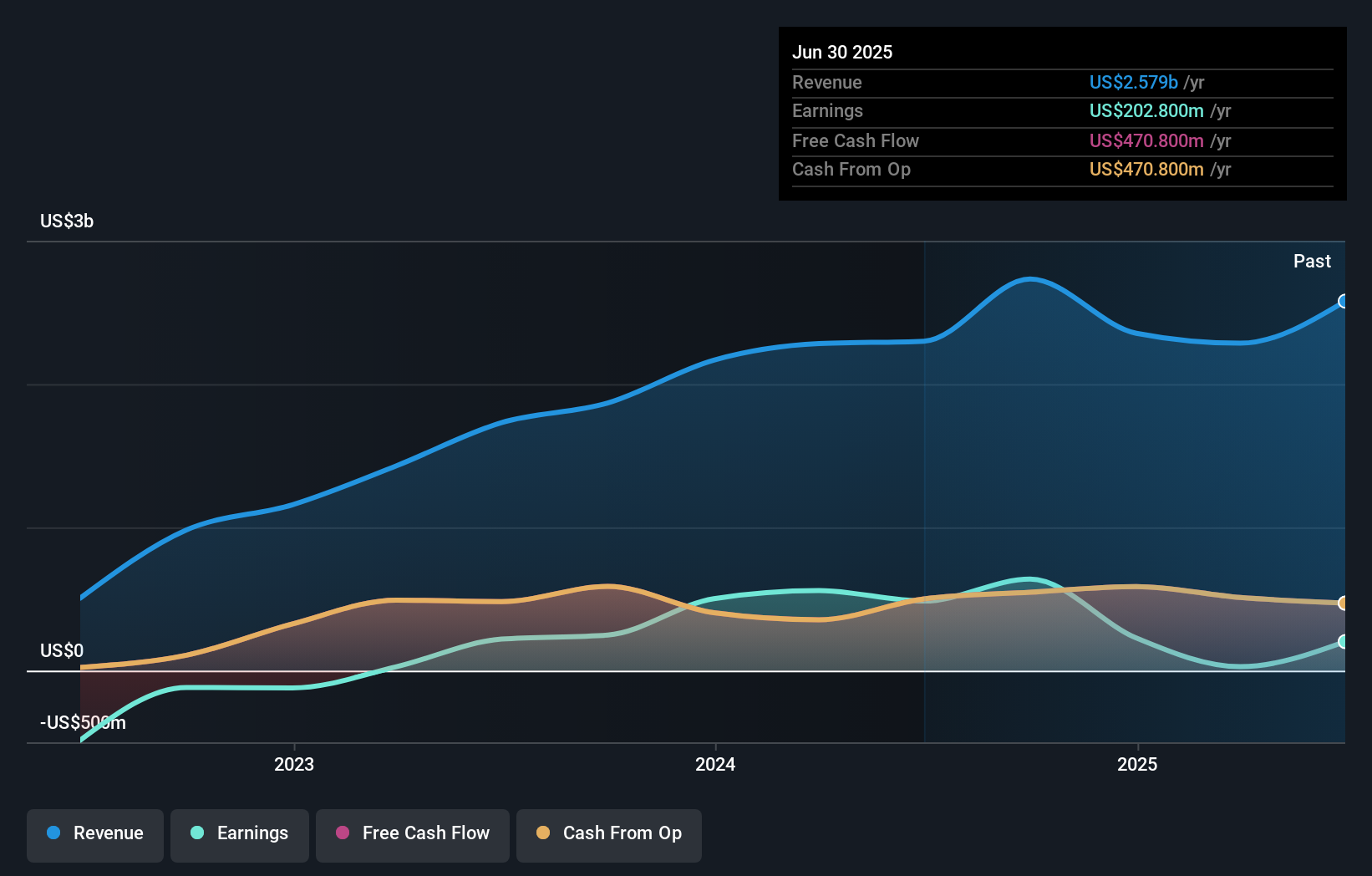

To be a shareholder in White Mountains Insurance Group today, you’d likely need confidence in the company’s ability to generate long-term value through disciplined capital allocation and active portfolio management. The recent launch of a US$300 million modified Dutch auction tender offer, following the US$1.75 billion Bamboo platform sale, marks a period of significant corporate activity and raises the question of how this capital return effort may affect near-term catalysts. While these actions highlight management’s willingness to pursue shareholder-friendly moves, they introduce some uncertainties around future earnings visibility and the direction of excess capital deployment. These shifts arrive as profit margins have compressed and executive leadership is undergoing transition, creating new dynamics that could influence how quickly the company can stabilize declining net income. While existing risks around margin pressure and expensive valuation remain, the tender and asset sale could reshape the catalysts and risks investors must weigh going forward.

But with profit margins well below last year, investors need to understand the implications for returns. White Mountains Insurance Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on White Mountains Insurance Group - why the stock might be worth as much as $1581!

Build Your Own White Mountains Insurance Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your White Mountains Insurance Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free White Mountains Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate White Mountains Insurance Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com