- In the past, M/I Homes completed the repurchase of 1,384,305 shares for US$170 million as part of a previously announced buyback plan and authorized a new share repurchase program of up to US$250 million with no set expiration.

- This sequence of buyback activities signals the company's active approach to managing its capital structure and suggests an emphasis on enhancing shareholder value.

- We'll explore how M/I Homes' expanded share repurchase effort may influence its investment outlook and shareholder returns expectations.

Find companies with promising cash flow potential yet trading below their fair value.

M/I Homes Investment Narrative Recap

To be a shareholder in M/I Homes right now, you need to believe in a housing market recovery centered on pent-up demographic demand and the company’s ability to capitalize on long-term growth in key regions. The newly expanded US$250 million share repurchase program is a positive signal for capital management, but does not materially change the main short-term catalyst, buyer demand stabilization as interest rates remain elevated, or the principal risk, which is margin pressure from continued reliance on mortgage incentives and spec inventory.

Among recent updates, the company’s buyback completion and its immediate move to authorize another repurchase plan stand out. While this initiative may attract some investor attention, its near-term impact could be muted if rising rates and softening new contract activity persist as ongoing risks for revenue and backlog conversion.

Yet, in contrast to capital actions, investors should be mindful of the risk tied to elevated inventory levels and potential price discounting if demand fails to rebound...

Read the full narrative on M/I Homes (it's free!)

M/I Homes' narrative projects $4.9 billion revenue and $470.5 million earnings by 2028. This requires 2.8% yearly revenue growth and a $40.9 million decrease in earnings from $511.4 million currently.

Uncover how M/I Homes' forecasts yield a $162.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

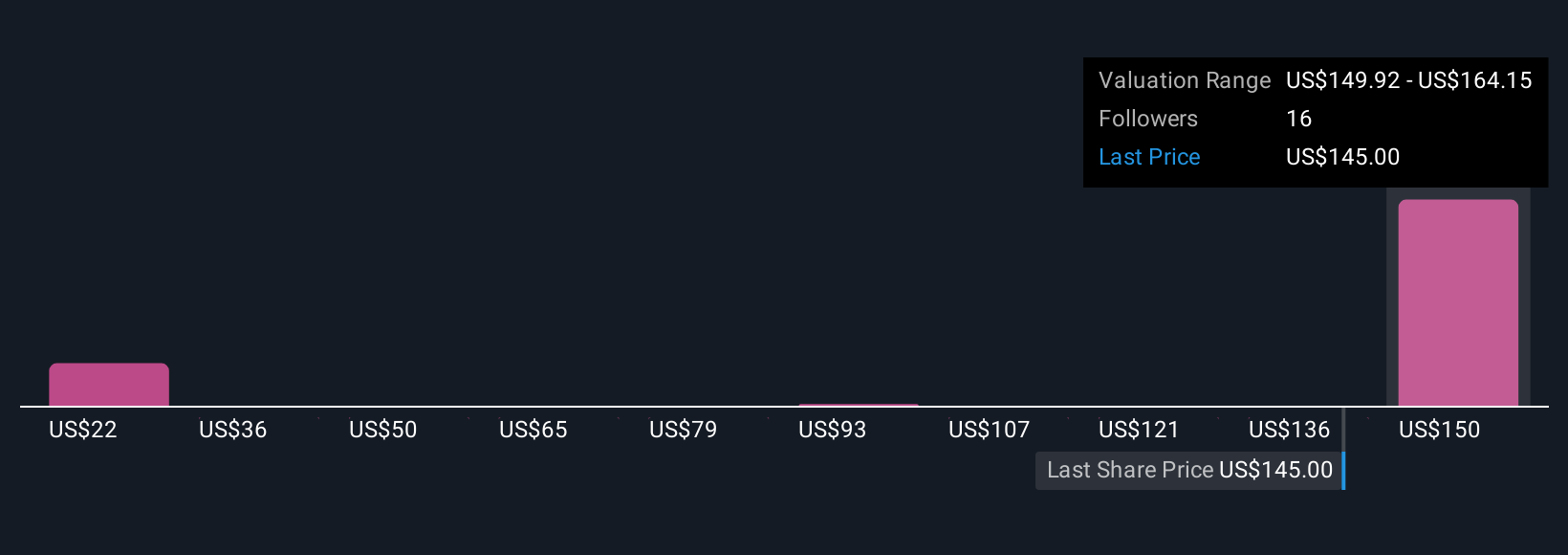

The Simply Wall St Community’s three fair value estimates for M/I Homes range widely from US$38.13 to US$164.15. While opinions are divided, current concerns about margin compression from inventory and incentives could weigh heavily on future expectations.

Explore 3 other fair value estimates on M/I Homes - why the stock might be worth as much as 26% more than the current price!

Build Your Own M/I Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your M/I Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free M/I Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate M/I Homes' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com