- Primerica, Inc. has announced a share repurchase program authorized by its Board of Directors, allowing the company to buy back up to US$475 million of its shares through December 31, 2026.

- This buyback program gives Primerica added flexibility to return capital to shareholders and often reflects management's positive view on the company's future prospects.

- We'll explore how this substantial share buyback authorization could influence Primerica's investment narrative as outlined by analysts.

Find companies with promising cash flow potential yet trading below their fair value.

Primerica Investment Narrative Recap

To own Primerica stock, investors typically need to believe in the company’s ability to grow its core insurance and investment business through demographic tailwinds and sustained sales force expansion, despite recent headwinds. The new US$475 million share repurchase program adds capital flexibility, but does not materially address near-term risks such as pressure on new policy sales and ongoing cost increases, which remain the most important factors driving short-term performance.

Of the recent announcements, Primerica’s November 2025 quarterly earnings update is most relevant here, as it showed healthy year-over-year revenue and net income growth. However, despite improved top-line results, ongoing cost pressures and slower sales force productivity could impact whether this buyback meaningfully supports shareholder value, especially if top-line growth moderates as projected.

In contrast, investors should also watch for persistent cost of living challenges that may continue to unsettle...

Read the full narrative on Primerica (it's free!)

Primerica's outlook anticipates $3.7 billion in revenue and $775.3 million in earnings by 2028. This scenario assumes a 4.4% annual revenue growth rate and a $67.8 million increase in earnings from the current $707.5 million.

Uncover how Primerica's forecasts yield a $307.57 fair value, a 17% upside to its current price.

Exploring Other Perspectives

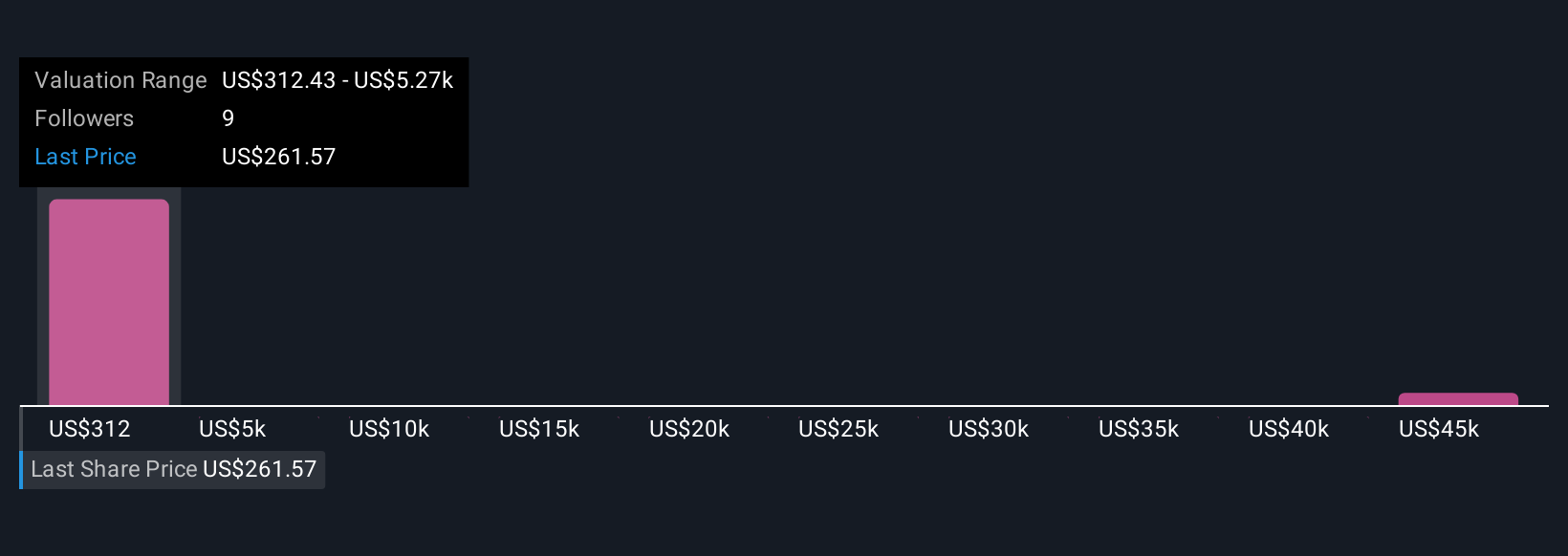

Fair value opinions from the Simply Wall St Community range widely from US$307 to US$49,917, based on three investor forecasts. Given this divergence, remember that ongoing cost and sales force risks may shape how future results meet or fall short of expectations, consider several viewpoints before deciding your own stance.

Explore 3 other fair value estimates on Primerica - why the stock might be worth just $307.57!

Build Your Own Primerica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primerica research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Primerica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primerica's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com