- On November 20, 2025, Element Solutions Inc. announced that its board declared a quarterly cash dividend of US$0.08 per share and that it reached an agreement in principle for a US$450 million add-on to its existing senior secured term loan B due 2030, with both actions set to impact qualified shareholders and the company's long-term capital structure.

- The combination of ongoing dividends and expanded debt financing highlights management's confidence in balancing shareholder returns with growth initiatives, which may be of particular interest to those tracking the company's ability to allocate capital effectively.

- We'll explore how Element Solutions' recent US$450 million term loan agreement shapes its investment narrative and future capital strategy.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Element Solutions Investment Narrative Recap

To be a shareholder in Element Solutions, you need to believe in its potential to benefit from growing demand in advanced electronics, specialty chemicals, and automotive technology, while accepting exposure to economic cycles and competitive pressures. The recent US$450 million add-on to its term loan and continued dividend payments may not meaningfully change the near-term catalysts driving growth, such as product innovation and expansion in high-performance computing, but these financing moves do highlight management’s focus on capital allocation and future scalability. The biggest risk remains the company’s reliance on cyclical end-markets, which can lead to unpredictable earnings if demand in electronics or automotive stalls.

Among recent announcements, the company’s steady quarterly dividend of US$0.08 stands out for income-focused investors, reinforcing Element Solutions’ commitment to shareholder returns even during periods where earnings show some volatility. This ongoing payout is relevant in the context of earnings trends reported in the latest quarters, as it aligns with management's approach to balancing growth opportunities and capital returns, both of which remain core themes for investors assessing short-term momentum or risks.

However, for those seeking a fuller picture, it's important to recognize the heightened exposure to cyclical swings in electronics and automotive demand, especially if...

Read the full narrative on Element Solutions (it's free!)

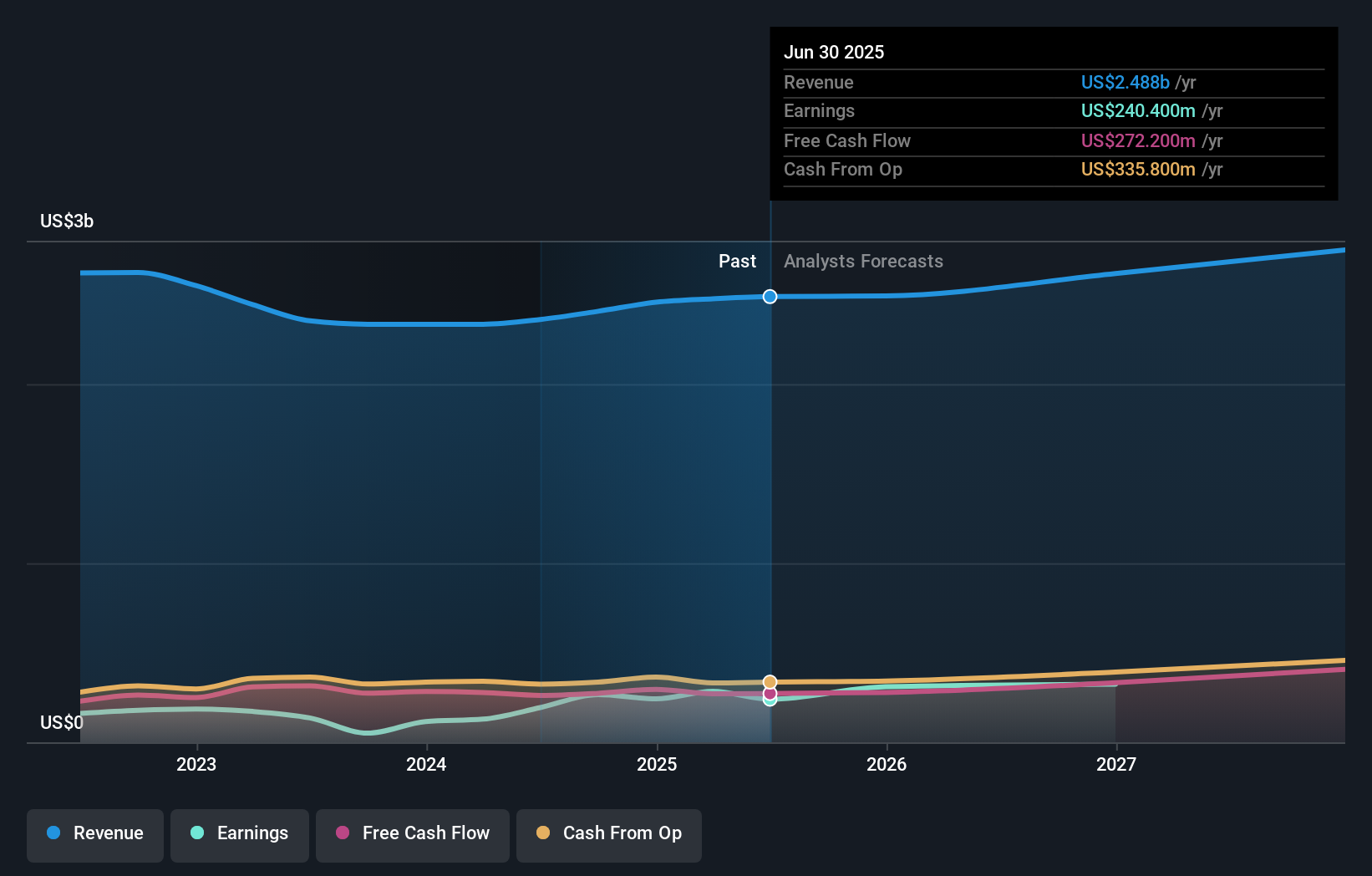

Element Solutions is projected to achieve $2.8 billion in revenue and $438.6 million in earnings by 2028. This outlook is based on a forecast annual revenue growth rate of 3.9% and an earnings increase of $198.2 million from current earnings of $240.4 million.

Uncover how Element Solutions' forecasts yield a $32.10 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span US$32.10 to US$46.93 across 2 analyses, highlighting the variety you can expect. Given the company’s sensitivity to cyclical end-markets, your outlook on sector growth could materially influence how you interpret these numbers.

Explore 2 other fair value estimates on Element Solutions - why the stock might be worth as much as 92% more than the current price!

Build Your Own Element Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Element Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Element Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Element Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com