- Freedom Capital Markets recently initiated coverage on Minerals Technologies, assigning the company its first-ever rating and expressing a positive outlook.

- This marks a significant development, as a new analyst's entry often signals increased visibility and interest from the broader investment community.

- We'll look at how Freedom Capital Markets' new coverage may influence Minerals Technologies' prospects and overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Minerals Technologies Investment Narrative Recap

To be optimistic about Minerals Technologies, you’d need to believe in the company’s ability to grow its specialty minerals and sustainability-driven segments faster than the drag from mature paper and construction markets. Freedom Capital Markets’ initiation of coverage adds visibility, but this alone doesn't materially shift short-term catalysts such as successful expansion into new product lines; the most immediate risk remains lingering weakness in North American and European paper demand, which continues to pressure results.

One recent development that stands out is the significant investment in cat litter production facilities across the US, Canada, and China. This expansion is relevant considering the heightened competition and persistent margin pressures in the pet care segment, making capacity upgrades an important catalyst as Minerals Technologies looks to recover sales volumes and defend market share.

By contrast, there’s ongoing risk from margin pressure if the company can’t offset competitive pricing or pass through rising costs in…

Read the full narrative on Minerals Technologies (it's free!)

Minerals Technologies' narrative projects $2.3 billion revenue and $818.2 million earnings by 2028. This requires 3.3% yearly revenue growth and a dramatic $816.1 million increase in earnings from $2.1 million currently.

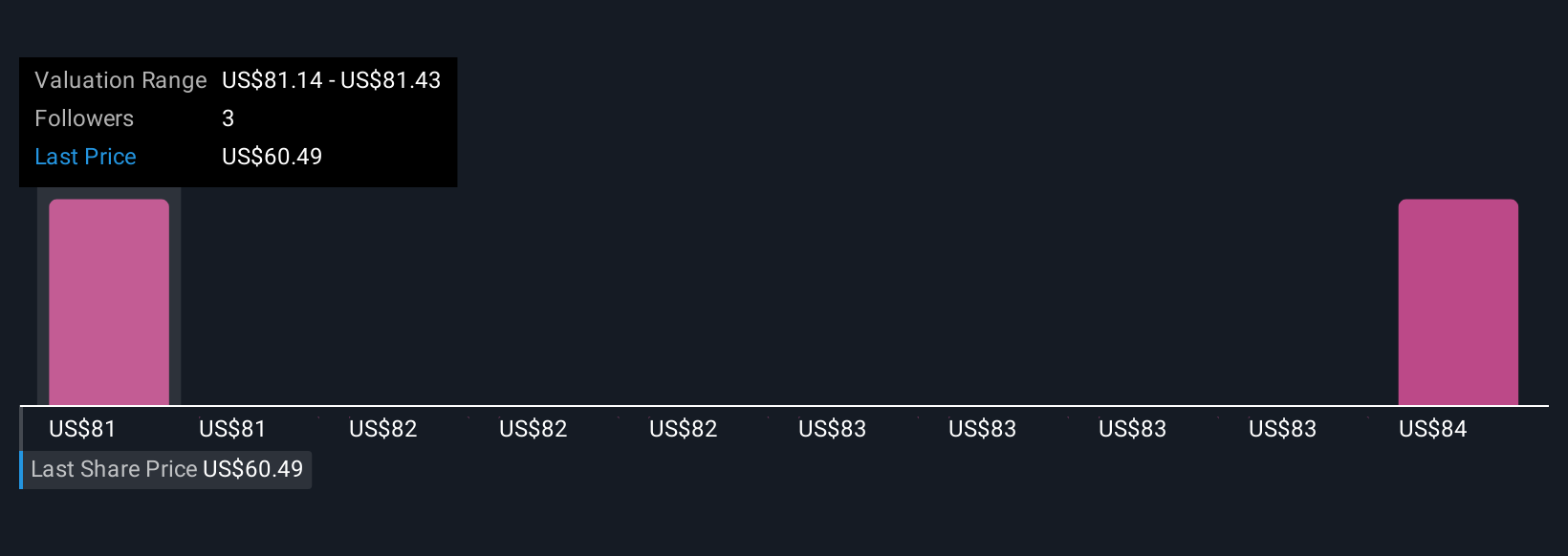

Uncover how Minerals Technologies' forecasts yield a $84.00 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Two different Simply Wall St Community fair value estimates for MTX range from US$84 to US$152, reflecting wide divergence in retail investor outlooks. With recent analyst coverage and continued pressure from legacy business segments, it's clear that broad opinion on the company's future is far from settled, consider reviewing several perspectives before deciding where you stand.

Explore 2 other fair value estimates on Minerals Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Minerals Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Minerals Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Minerals Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Minerals Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com