- Earlier this month, Novanta Inc. announced it had priced a public offering of 11 million 6.50% tangible equity units at US$50.00 each, aiming to raise net proceeds of approximately US$533 million after expenses.

- A unique aspect of this capital raise is Novanta's intent to simultaneously fund potential acquisitions and repay about US$317 million of debt, strengthening both its balance sheet and growth capacity.

- We'll explore how this substantial fundraising and commitment to acquisitions could alter the company’s investment narrative and risk profile.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Novanta Investment Narrative Recap

If you’re considering Novanta as an investment, the core thesis rests on the company’s ability to expand its advanced automation and healthcare technology offerings in markets increasingly shaped by robotics and digitalization. The recent US$533 million equity-raising provides more resources for acquisitions and debt repayment, yet, since organic growth remains tepid and reliant on deal-making, this fundraising does not significantly shift the biggest near-term catalyst, meaningful M&A execution, or the main risk, integration success and exposure to weaker end-markets.

Of Novanta’s recent developments, the latest financial guidance stands out: the company reaffirmed mid-single digit organic revenue growth for 2026, underpinned by recent design wins and new product launches. While this outlook signals business momentum, actual improvements hinge on how effectively new investments and possible acquisitions boost performance, especially in light of recent operating margin pressures.

Yet, investors should be aware that, unlike the promise of new funding, the persistent risk from ongoing revenue declines in critical segments such as Precision Medicine could ...

Read the full narrative on Novanta (it's free!)

Novanta's narrative projects $1.1 billion revenue and $135.3 million earnings by 2028. This requires 5.8% yearly revenue growth and a $73.9 million earnings increase from $61.4 million.

Uncover how Novanta's forecasts yield a $154.00 fair value, a 53% upside to its current price.

Exploring Other Perspectives

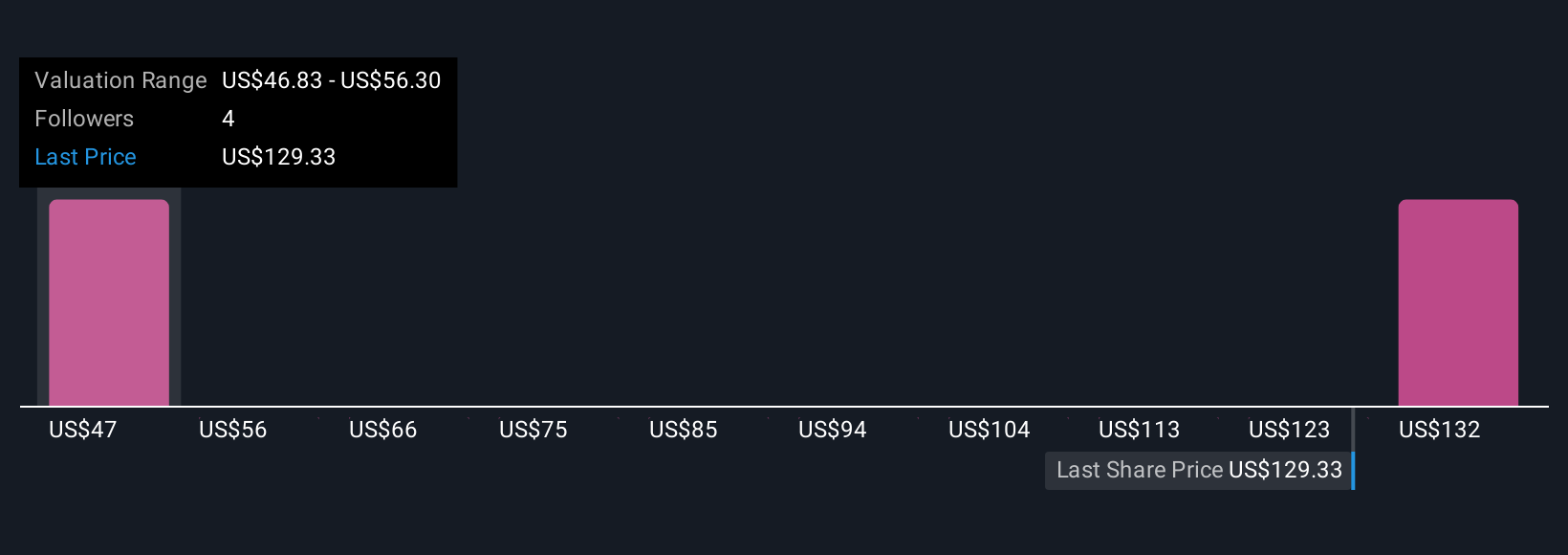

Simply Wall St Community members offered fair value estimates for Novanta ranging from US$46.10 to US$154 across three analyses. While opinions differ, many recognize that future growth may depend heavily on successful acquisitions after this major fundraising.

Explore 3 other fair value estimates on Novanta - why the stock might be worth less than half the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com