Marqeta (MQ) stock has seen notable shifts lately, with a 7% rise over the past month despite a recent decline. Investors are watching for signals in payment technology to determine whether this momentum could continue.

See our latest analysis for Marqeta.

After a stellar run earlier this year, Marqeta’s 7% share price gain in the past month stands out, especially after a tougher stretch that saw a 19.6% drop over the last three months. Overall, momentum is picking up again; despite short-term swings, its 30.8% year-to-date share price return and 25.1% total shareholder return over the past year highlight renewed investor confidence in Marqeta’s growth story.

If this payment tech momentum has you curious about what else could be next in the sector, it's worth taking a look at the See the full list for free.

But with shares still trading about 27% below analyst targets and the company posting robust revenue and income growth, the key question is whether Marqeta is truly undervalued or if the market has already factored in future gains.

Most Popular Narrative: 21.1% Undervalued

Marqeta’s most widely followed narrative points to a fair value about a fifth above the current share price, suggesting analysts see much more upside if key growth factors materialize.

The completed TransactPay acquisition gives Marqeta full program management and EMI capabilities in Europe. This enables entry into larger enterprise opportunities, uniformity of service across North America and Europe, and easier multi-market expansion for clients. This unlocks new revenue streams, increases take rates, and improves earnings scalability.

Want to know what’s fueling this bullish outlook? The core of the narrative is bold global expansion bets and a dramatic target for future profitability. The analysts’ valuation leans hard on aggressive assumptions about scale, margins, and Marqeta’s place in tomorrow’s payments world. Get the full inside scoop and see which precise financial levers could drive shares higher.

Result: Fair Value of $6.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on major clients or sudden shifts in digital payment trends could quickly change Marqeta’s growth outlook and valuation prospects.

Find out about the key risks to this Marqeta narrative.

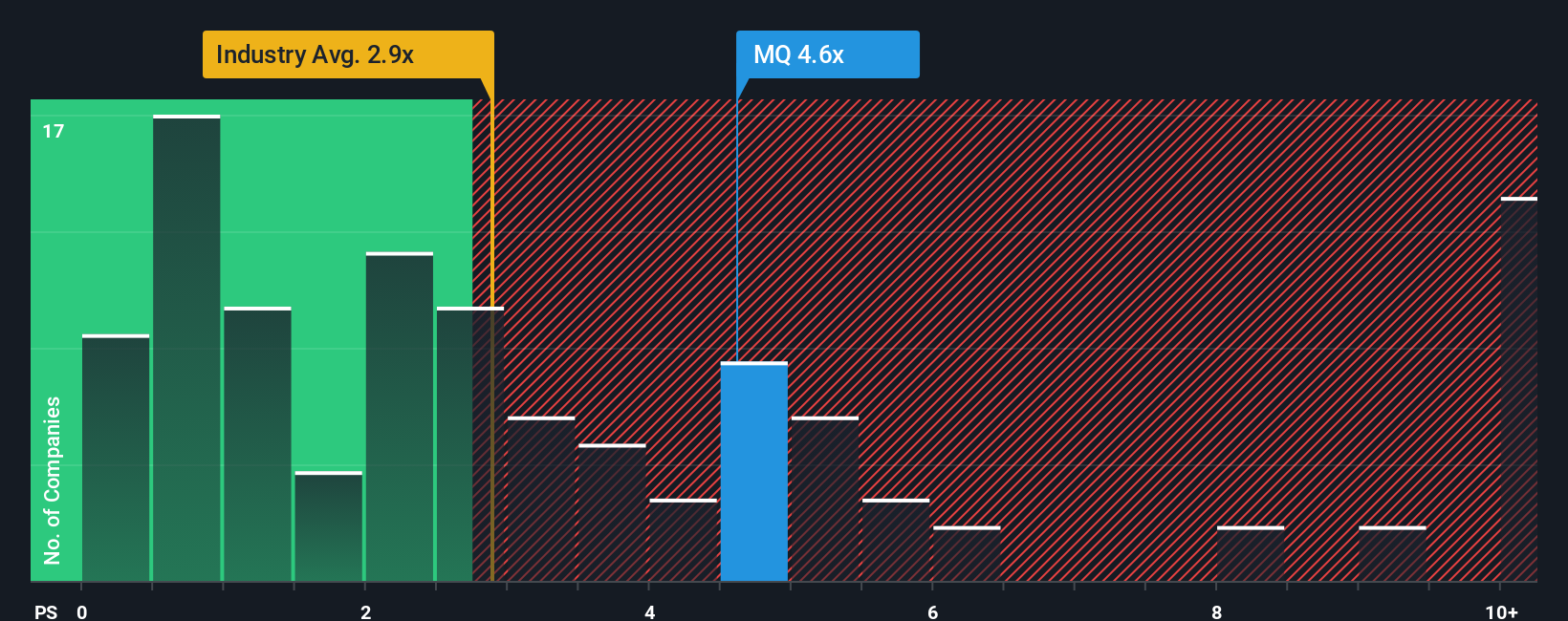

Another View: Multiples Raise a Red Flag

Looking from a different angle, Marqeta's shares look expensive when you stack its price-to-sales ratio of 3.6x against peers at 0.7x and the US industry average at 2.4x. Even compared to its fair ratio of 2.6x, the premium is striking. Does this gap signal extra risk for investors, or might growth justify the higher mark?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you want to test the numbers for yourself or take a deeper dive into Marqeta’s story, you can create your own take in just a few minutes. Do it your way

A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their options, so don’t miss your chance to get ahead. The market’s next opportunity could be just a click away with these handpicked strategies:

- Maximize your returns by focusing on income stability and reliability. Check out these 16 dividend stocks with yields > 3% for stocks that continually reward shareholders.

- Benefit from exciting growth potential by reviewing these 906 undervalued stocks based on cash flows and targeting opportunities where the market may have overlooked strong fundamentals.

- Capitalize on breakthrough medical innovation by browsing these 31 healthcare AI stocks, connecting you with companies poised to transform healthcare using artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com