- On November 5, 2025, RenaissanceRe Holdings announced a share repurchase program authorizing up to US$750 million in buybacks, alongside affirming its quarterly dividend of US$0.40 per share to be paid on December 31, 2025.

- This combination of direct capital return through buybacks and sustained dividend payments often signals management confidence in operational performance and a focus on shareholder value.

- Now, we'll explore how the sizeable buyback authorization could influence RenaissanceRe's investment narrative and its future risk-return profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

RenaissanceRe Holdings Investment Narrative Recap

To be a shareholder in RenaissanceRe Holdings, you need to believe that the company will successfully navigate the inherent volatility of the reinsurance market, particularly given its growing property catastrophe exposure and evolving competitive dynamics. The recent US$750 million buyback program and ongoing dividends support a near-term investment narrative of management’s alignment with shareholder interests, but do not materially change the central catalyst of capitalizing on reinsurance demand, nor do they fully address the company’s biggest risk, earnings volatility from severe natural catastrophes. Among recent announcements, the affirmation and continuity of quarterly dividends, with the latest payout of US$0.40 per share scheduled for December 31, 2025, stands out. This sustained dividend history, despite some near-term earnings pressure and natural catastrophe risk, highlights RenaissanceRe’s focus on steady capital return even amidst sector uncertainties and competitive headwinds. In contrast, investors should be aware that exposure to large catastrophic events remains a material risk if...

Read the full narrative on RenaissanceRe Holdings (it's free!)

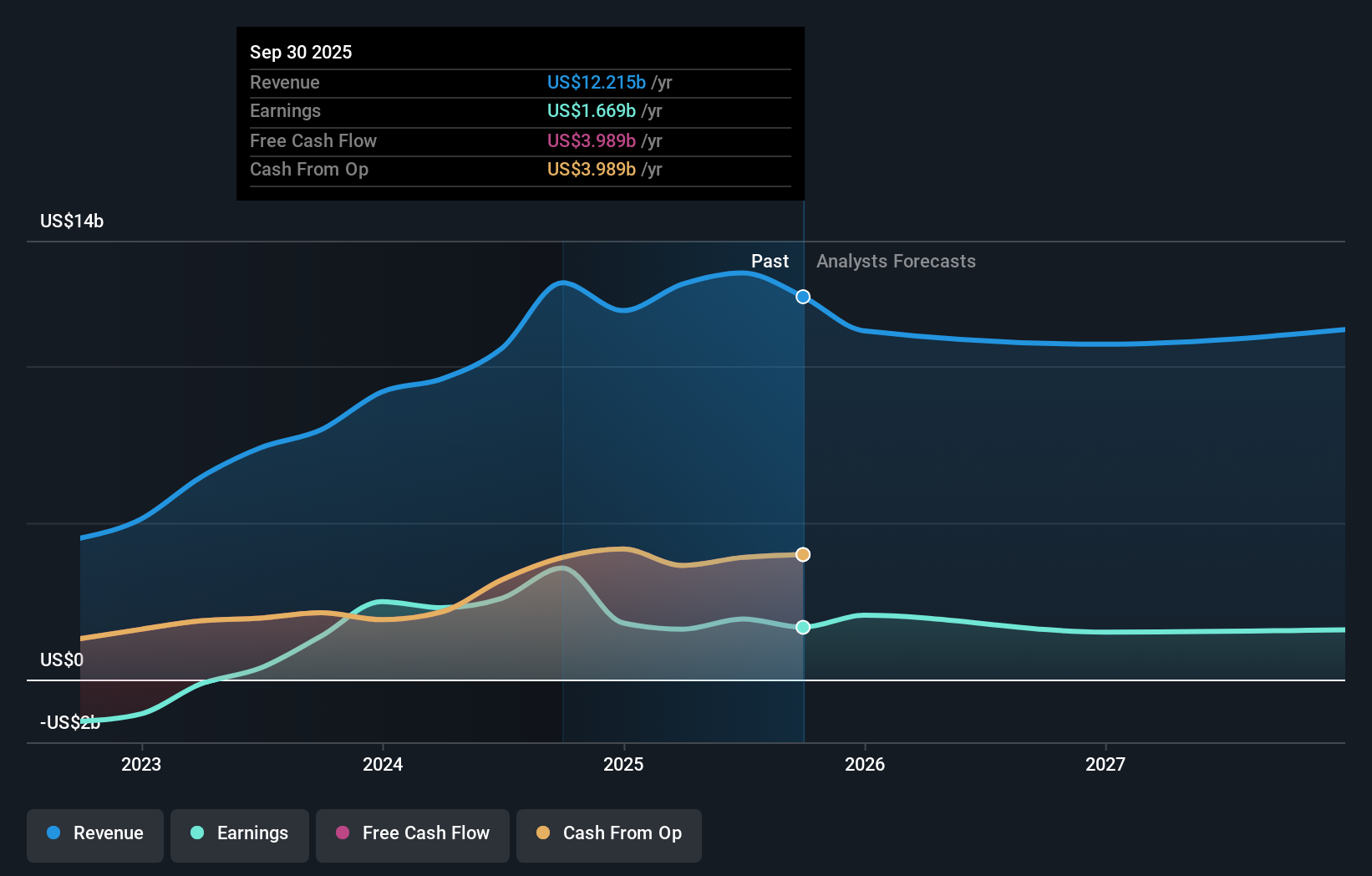

RenaissanceRe Holdings is projected to have $10.4 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a yearly revenue decline of 7.2% and a $0.4 billion decrease in earnings from the current level of $1.9 billion.

Uncover how RenaissanceRe Holdings' forecasts yield a $283.43 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community span from US$283 to over US$844 per share. With ongoing exposure to large insured losses, your own perspective on risk and upside may differ widely from these views.

Explore 3 other fair value estimates on RenaissanceRe Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own RenaissanceRe Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RenaissanceRe Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RenaissanceRe Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RenaissanceRe Holdings' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com