Olin (OLN) just unveiled a long-term supply agreement with Braskem, aimed at supporting Braskem’s transformation of its Brazilian chlor-alkali and vinyl assets. This move directs Olin’s ethylene dichloride expertise toward international growth opportunities.

See our latest analysis for Olin.

Olin’s new partnership with Braskem follows a recent dividend affirmation and the dissolution of its Blue Water Alliance joint venture, signaling a sharp pivot toward growth markets. Despite these strategic moves, momentum remains weak with a year-to-date share price return of -39.98% and a one-year total shareholder return of -50.12%. This underscores ongoing challenges for the stock’s long-term performance.

If you’re interested in looking beyond Olin’s story, this could be the perfect chance to discover fast growing stocks with high insider ownership.

With shares trading near a 20 percent discount to consensus analyst targets after steep declines, investors are left wondering if Olin is now undervalued or if the market is fairly pricing in its future growth potential.

Most Popular Narrative: 18.7% Undervalued

With Olin’s narrative-derived fair value at $24.73, above its recent close of $20.12, analyst consensus points toward a potential upside. The stage is set for a deeper look at their conviction.

Structural cost reduction initiatives (Beyond250 and Epoxy cost optimization) are expected to deliver significant operational savings, yielding an estimated $70 to $90 million run-rate benefit by the end of 2025 and additional structural cost reductions from the Stade, Germany facility in 2026; this should improve net margins and boost earnings quality.

Curious what assumptions are driving this optimistic valuation? The analysts’ growth playbook relies on substantial operational transformation and unique future profit estimates. Find out how the numbers add up and what could fuel the next price surge.

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global oversupply and intensifying competition from low-cost producers could limit Olin's ability to improve margins or sustain earnings growth.

Find out about the key risks to this Olin narrative.

Another View: Trading at a Premium?

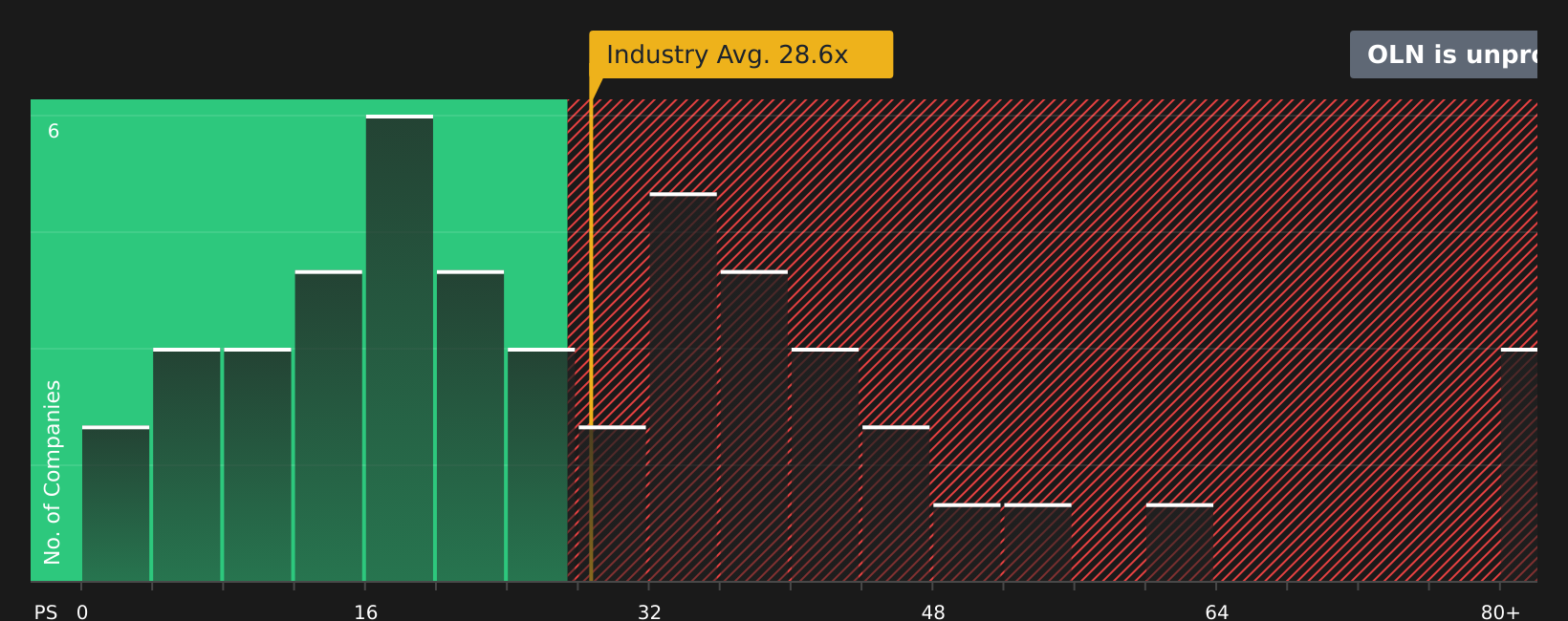

While one method suggests Olin is deeply undervalued, looking at its price-to-earnings ratio tells a different story. Olin trades at 42.8 times earnings, which is much higher than both its peers (22.6x) and the US Chemicals industry (22.9x). Its current ratio is also above the market's fair ratio of 38.4x, signaling valuation risk if sentiment shifts. Is the market being too optimistic, or is there more upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Olin Narrative

If you see things differently or want a hands-on approach, it takes just a few minutes to dive in and craft your own view. Do it your way.

A great starting point for your Olin research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip away. The Simply Wall Street Screener can help you target specific strategies and find stocks with real growth or yield potential. Give yourself the edge—your next big winner could be just a click away.

- Grow your wealth by tapping into the world of these 886 undervalued stocks based on cash flows and spot stocks trading below their intrinsic value.

- Capitalize on trends by checking out these 25 AI penny stocks shaping the future of artificial intelligence and automation.

- Boost your passive income with these 16 dividend stocks with yields > 3% offering reliable yields above 3 percent for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com