- Olin Corporation recently announced a quarterly dividend of US$0.20 per share payable on December 12, 2025, with an ex-date and record date of November 28, 2025, and formed a strategic partnership with Braskem to supply ethylene dichloride as Braskem transforms its Brazilian vinyl assets.

- This agreement enables Olin to reallocate ethylene dichloride supply toward structurally higher-value, growth-oriented partnerships, reinforcing its global vinyls strategy and integrated chlor-alkali and vinyls platform.

- Next, we'll explore how Olin's Braskem alliance and shift of EDC supply shape its long-term investment outlook and competitiveness.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Olin Investment Narrative Recap

To be a shareholder in Olin today, you need to believe in the long-term earnings power of its integrated chemical platform and the ability to reposition supply into more profitable and sustainable partnerships, despite severe pricing pressure in global EDC markets and persistent overcapacity. The recent Braskem alliance is a positive step for Olin’s vinyls strategy, but its impact on the most important near-term catalyst, industry-wide cost rationalization, remains modest, and it does not meaningfully address the biggest risk of prolonged low EDC prices.

Among recent announcements, the winding down of the Blue Water Alliance joint venture stands out. This move freed up EDC volumes, allowing Olin to pursue the higher-value Braskem partnership and focus more intently on long-term, growth-oriented contracts rather than short-term commodity exposures, which speaks directly to the catalysts discussed above. Contrast this more optimistic setup with...

Read the full narrative on Olin (it's free!)

Olin's outlook projects $7.4 billion in revenue and $375.3 million in earnings by 2028. This requires a 3.6% annual revenue growth rate and an earnings increase of $389.4 million from the current earnings of -$14.1 million.

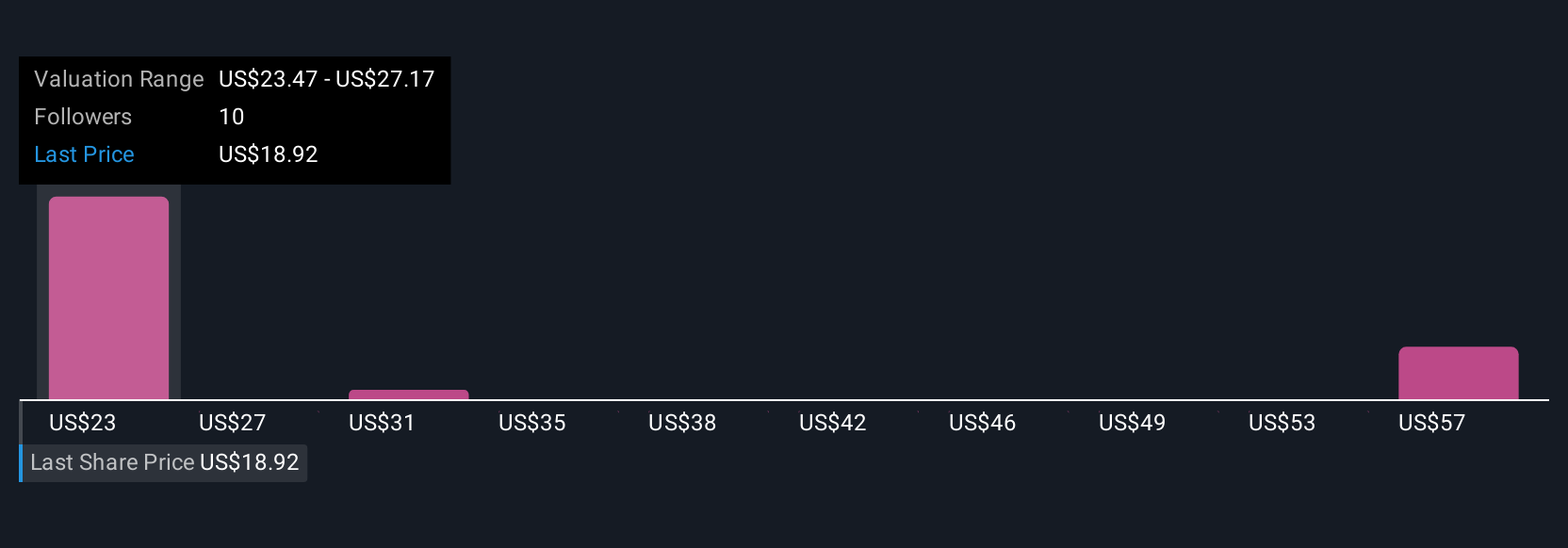

Uncover how Olin's forecasts yield a $24.73 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Five community fair value estimates on Simply Wall St for Olin range from US$24.73 to US$105.17, revealing a broad spectrum of opinions on the stock. While some expect upside if cost-cutting succeeds, others flag the risk that prolonged low EDC prices could limit recovery, making it worthwhile to explore several different viewpoints.

Explore 5 other fair value estimates on Olin - why the stock might be worth over 5x more than the current price!

Build Your Own Olin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olin research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Olin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olin's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com