- Marqeta, Inc. recently reported strong third quarter earnings, highlighting US$163.31 million in sales and a significant reduction in net loss, along with the announcement by Klarna of their partnership to roll out the Klarna Card across 15 new European markets using Marqeta’s platform.

- This expansion leverages Visa’s Flexible Credential technology, enabling customers to switch between pay-now and pay-later options through a single card and underlining Marqeta’s growing influence in embedded finance solutions for enterprise clients in multiple regions.

- We’ll explore how Marqeta’s expanded European partnership with Klarna could impact its investment narrative and future growth trajectory.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Marqeta Investment Narrative Recap

To own Marqeta, you need to believe in the sustained growth of embedded finance and open banking, anchored by Marqeta’s ability to secure and expand partnerships with major enterprises like Klarna. The Klarna expansion signals real traction in Europe, which may bolster Marqeta’s short-term growth outlook, but does not materially alter dependency risks related to its largest clients or address the pressure of intensifying competition among card issuance providers.

Among Marqeta’s recent updates, the Klarna partnership stands out as most relevant. Rolling out Klarna Card into 15 new European markets showcases the company’s role in supporting innovative, multi-market payment products and tapping into new revenue streams. This is a clear reminder for investors tracking growth catalysts tied to international expansion and adoption of its platform by global fintechs.

By contrast, investors should also be aware of the company’s continued reliance on a few major clients and the revenue risks if any...

Read the full narrative on Marqeta (it's free!)

Marqeta's narrative projects $900.6 million revenue and $47.9 million earnings by 2028. This requires 17.6% yearly revenue growth and a $112.6 million increase in earnings from -$64.7 million today.

Uncover how Marqeta's forecasts yield a $6.18 fair value, a 25% upside to its current price.

Exploring Other Perspectives

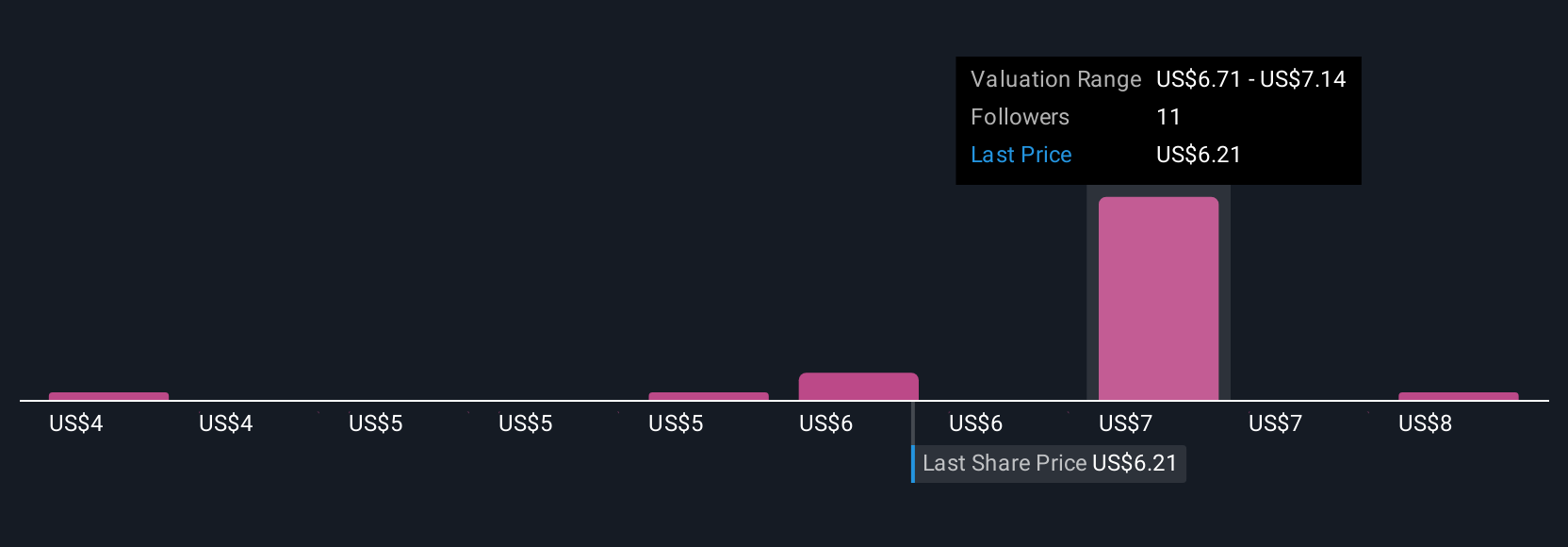

Simply Wall St Community members have set fair value estimates for Marqeta between US$3.70 and US$8.00, based on six independent analyses. Rapid expansion into new regions may fuel optimism, but dependence on a small group of key customers remains central to the Marqeta discussion, explore a range of viewpoints to weigh growth opportunities against concentration risk.

Explore 6 other fair value estimates on Marqeta - why the stock might be worth as much as 61% more than the current price!

Build Your Own Marqeta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Marqeta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marqeta's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com