- Brookfield Business Corporation reported third quarter 2025 earnings, showing sales of US$1.68 billion and a net loss of US$500 million, both weaker than the prior year period, and reaffirmed a quarterly dividend of US$0.0625 per share payable December 31, 2025.

- The company’s announcement highlighted growing losses alongside continued shareholder payouts, which may raise questions about its ongoing capital allocation priorities.

- We’ll assess how Brookfield Business Corporation’s widening net losses amid continued dividend payments could reshape its investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Brookfield Business' Investment Narrative?

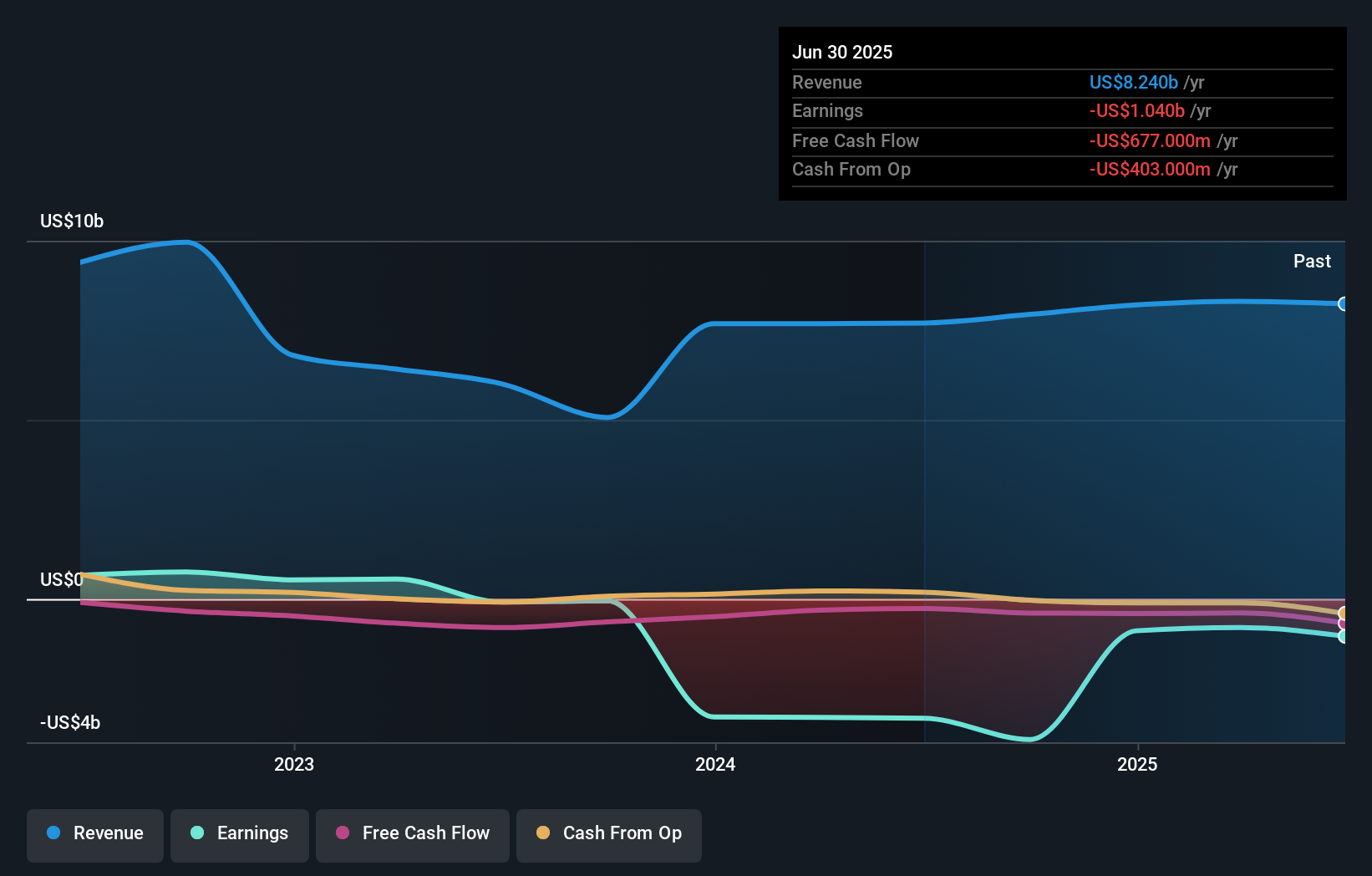

To be a shareholder in Brookfield Business Corporation, you need to believe in the company’s ability to manage through periods of operational and financial challenge, given its ongoing net losses and shrinking sales. The most recent earnings report put a spotlight on widening quarterly losses of US$500 million and declining revenue, while management remains committed to shareholder returns through consistent dividend payments. This combination of rising losses and maintained capital returns now brings greater attention to the company’s cash management and balance sheet strength as immediate risks. Previously, key short term catalysts might have included successful asset sales, further share buybacks, or improved operating results. This latest update arguably shifts the narrative: concerns around capital allocation and sustainability of dividends have become more pressing in the near term. Investors weighing this news should consider whether the business can balance these competing demands without stretching its financial resilience.

But with losses growing and dividends maintained, capital allocation risk cannot be ignored.

Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business - why the stock might be worth less than half the current price!

Build Your Own Brookfield Business Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Brookfield Business research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com