- On October 31, 2025, Lufax Holding Ltd. announced executive leadership changes, appointing Mr. Xiang Ji as Co-Chief Executive Officer and Mr. Tao Wu as Executive Deputy General Manager and Chief Marketing Officer, both bringing substantial cross-industry expertise to the company.

- The recruitment of leaders with deep experience in retail credit, insurance, and digital services may influence Lufax’s future strategic direction and market positioning.

- We will explore how the addition of seasoned leadership, particularly Mr. Ji’s extensive retail banking background, impacts Lufax’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Lufax Holding's Investment Narrative?

To be confident as a Lufax shareholder, you’d need to believe that the recent leadership changes and deep bench of experience can reverse the weak trends in revenue and profitability, despite the headwinds of shrinking top line and recent net losses. The appointment of Mr. Xiang Ji as Co-CEO, with his extensive background in retail credit and risk management, and Mr. Tao Wu as Executive Deputy GM, could influence the pace of any operational turnaround, especially since Lufax is forecast to become profitable over the next three years. However, the stock has seen a major price drop in the last month and lags its industry, underlining uncertainty about whether the new management can quickly impact the key catalysts: cost control, credit quality, and reaccelerating growth. At the same time, board independence remains limited, which may persist as a risk even as the executive team gains fresh expertise. While new leadership may inspire some optimism, the impact is likely to be gradual rather than immediately material to Lufax’s biggest risks and short-term catalysts.

But concerns about board independence could remain a meaningful issue for shareholders.

Exploring Other Perspectives

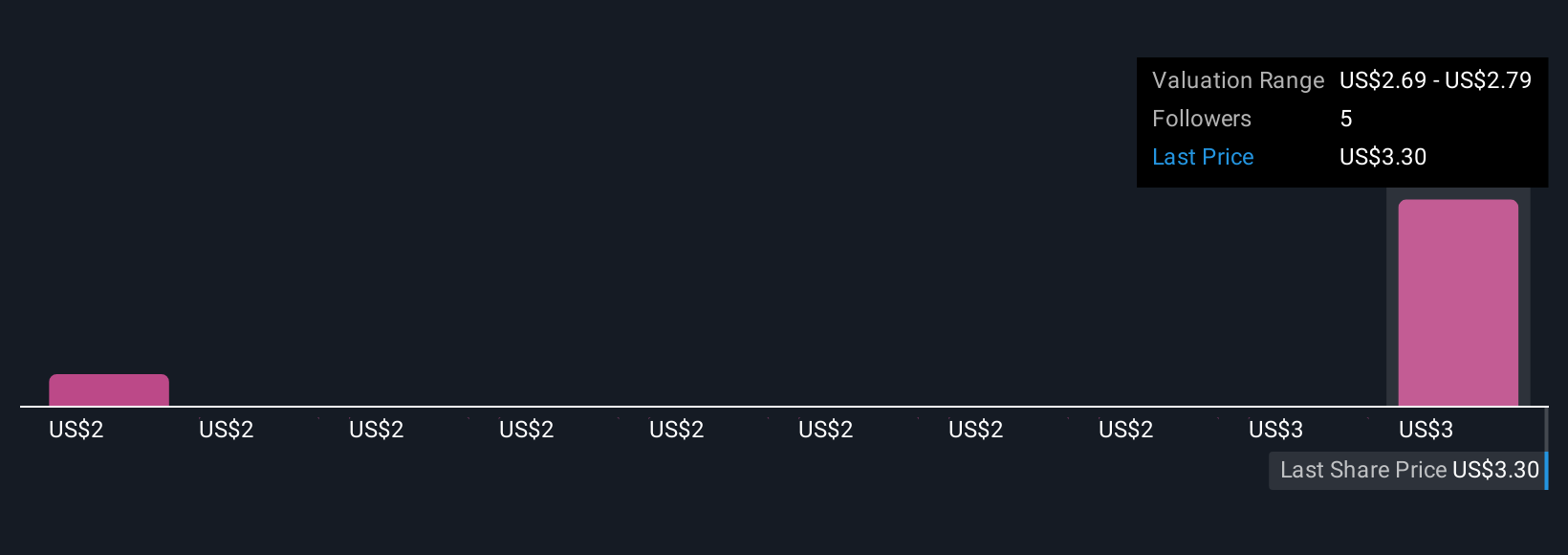

Explore 2 other fair value estimates on Lufax Holding - why the stock might be worth as much as $2.79!

Build Your Own Lufax Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lufax Holding research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Lufax Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lufax Holding's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com