- SiriusPoint Ltd. reported third-quarter results showing revenue of US$755.9 million and net income of US$90.8 million, with year-over-year increases in key financial metrics, while also reaffirming its 2025 net interest income guidance between US$265 million and US$275 million and announcing a preference share dividend.

- These developments highlight not only a strong earnings rebound but also management's confidence in the company's outlook, reinforcing stability for shareholders through consistent guidance and dividend commitments.

- With management reaffirming its 2025 earnings guidance, we'll examine how this confidence may influence SiriusPoint’s investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SiriusPoint Investment Narrative Recap

To be a SiriusPoint shareholder today, one needs to believe in the company’s ability to drive profitable growth by expanding specialty and MGA relationships while maintaining disciplined underwriting and strong investment income. The latest Q3 results and reaffirmed 2025 guidance provide reassurance to the company’s outlook, but they do not fundamentally alter the main short-term catalyst: scaling new MGA platforms and specialty business. The primary near-term risk, underperformance or slow “seasoning” of these new partnerships, remains unchanged.

Among the recent news, SiriusPoint’s announcement of a US$0.50 per share preferred dividend stands out as a sign of balance sheet stability. While consistent dividends signal confidence in the company’s cash flow, their relevance ties back to the core catalyst: whether SiriusPoint can deliver on its premium and earnings growth targets through quality MGA partnerships.

Yet, against these positives, investors should not lose sight of the real risk if newly added MGAs struggle to meet expectations, especially since...

Read the full narrative on SiriusPoint (it's free!)

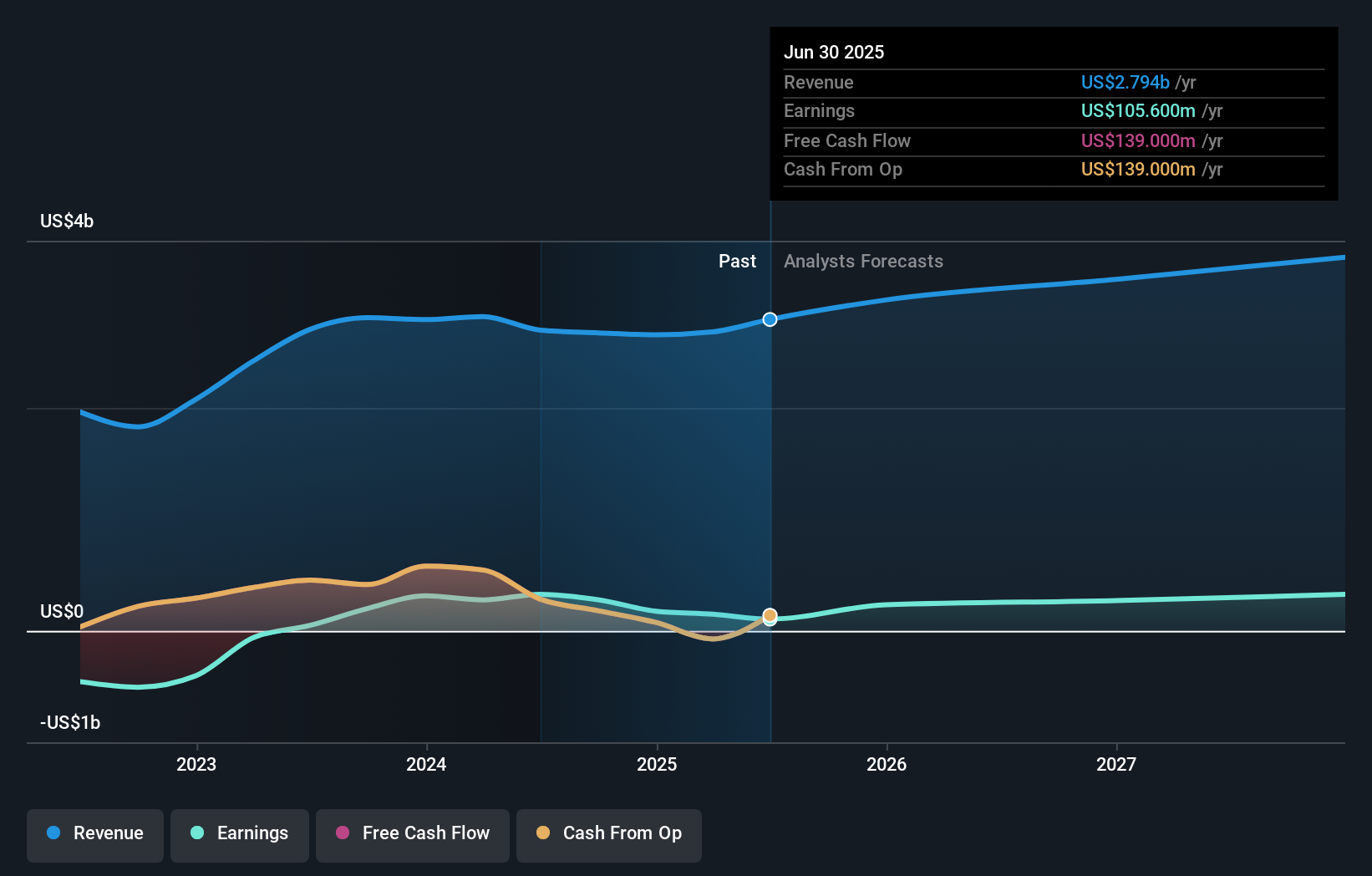

SiriusPoint's narrative projects $3.5 billion in revenue and $402.8 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $297.2 million earnings increase from $105.6 million currently.

Uncover how SiriusPoint's forecasts yield a $27.50 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Two community fair value estimates for SiriusPoint range from US$21.42 to US$27.50 per share. Many readers focus on the importance of freshly onboarded MGA partnerships, a risk that could shape future results, so explore differing views as you form your own expectations.

Explore 2 other fair value estimates on SiriusPoint - why the stock might be worth as much as 39% more than the current price!

Build Your Own SiriusPoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiriusPoint research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SiriusPoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiriusPoint's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com