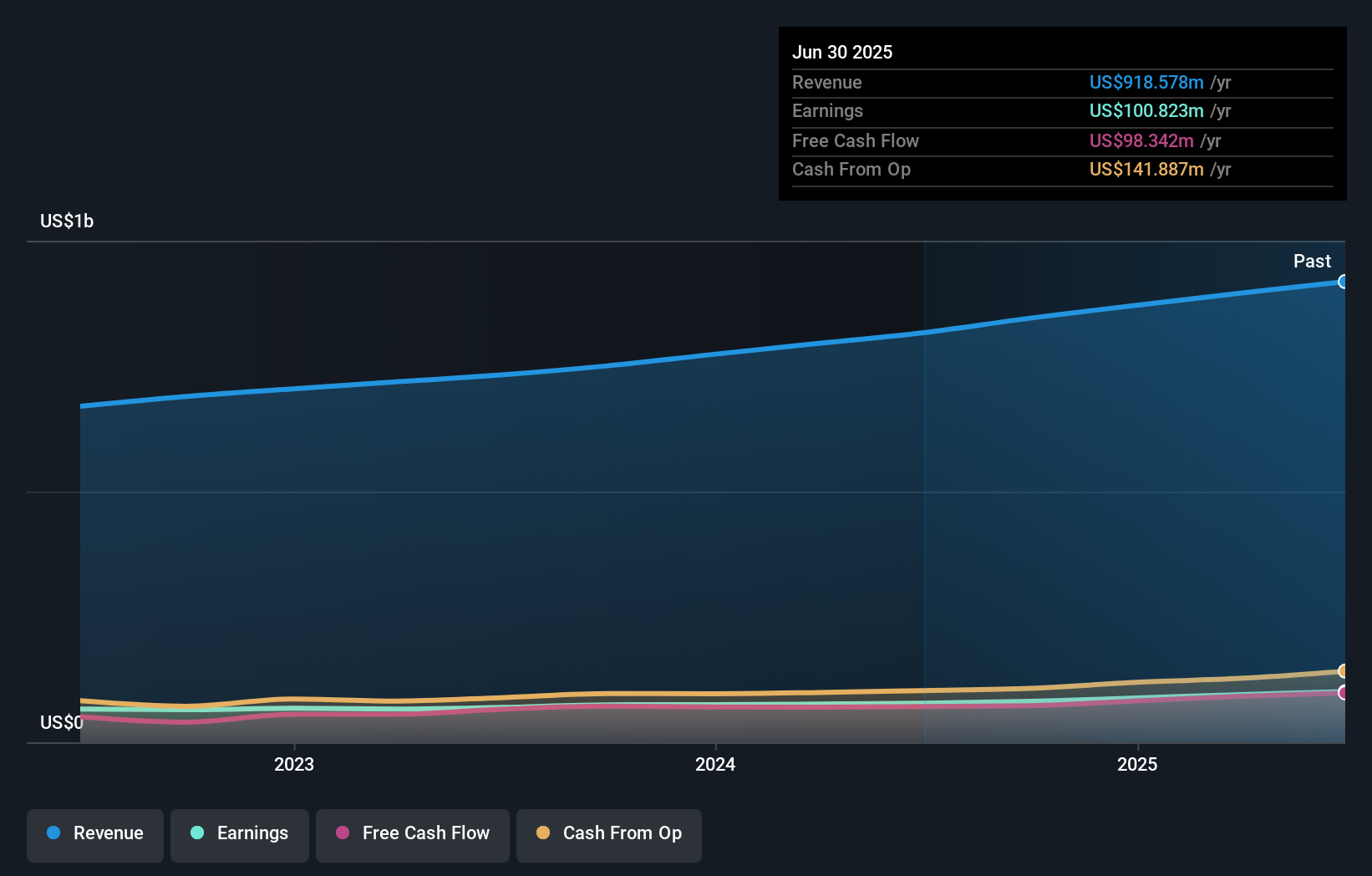

- CorVel Corporation recently reported strong quarterly earnings for the period ended September 30, 2025, highlighted by a 7% increase in sales to US$239.64 million and a 20% increase in earnings per share, along with the completion of an AI-focused acquisition and a new US$134 million shelf registration for an ESOP-related common stock offering.

- These developments illustrate CorVel’s commitment to driving operational efficiency and future growth by investing in artificial intelligence, technology-driven acquisitions, and workforce development initiatives such as CorVel University.

- We’ll explore how CorVel’s expanded AI capabilities are shaping its investment narrative amid strengthening financial and operational performance.

Find companies with promising cash flow potential yet trading below their fair value.

What Is CorVel's Investment Narrative?

For CorVel shareholders, the key narrative centers on disciplined execution and the ongoing integration of technology across healthcare claims management. The recent quarterly earnings and the completion of an AI-driven acquisition both showcase CorVel’s ambitions to ramp up productivity, augment product development, and address persistent industry talent gaps. An AI-focused expansion signals a willingness to invest in transformative technologies, which could support operational efficiency and future margins. Meanwhile, the fresh US$134 million shelf registration for an ESOP-related common stock offering, alongside continued share buybacks, underscores management’s confidence in aligning employee and shareholder interests. However, these moves arrive amid a significant year-to-date decline in the share price and ongoing questions around valuation, with the stock currently trading above some estimates of fair value. While recent announcements reinforce near-term catalysts around innovation, valuation remains a risk if earnings growth does not continue apace.

On the other hand, valuation questions linger for those watching recent price declines. CorVel's shares are on the way up, but they could be overextended by 26%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on CorVel - why the stock might be worth as much as $60.36!

Build Your Own CorVel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CorVel research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free CorVel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CorVel's overall financial health at a glance.

No Opportunity In CorVel?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com