- Lufax Holding Ltd. recently announced a series of leadership changes, including the immediate resignation of its Chief Risk Officer and the appointments of a new Co-CEO and Chief Marketing Officer.

- This abrupt turnover in several top executive roles highlights a potential shift in the company’s operational direction and risk management approach.

- We’ll analyze how this wave of executive appointments and departures may reshape Lufax Holding’s investment narrative and leadership stability.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Lufax Holding's Investment Narrative?

For anyone considering Lufax Holding, the story has shifted quickly in recent weeks. A series of rapid executive changes, most notably an abrupt Chief Risk Officer resignation and simultaneous leadership appointments, has unsettled investors, as seen in the 10% share drop following the announcements. These moves put a sharper focus on the near-term risks: the company’s ability to stabilize leadership, rebuild confidence, and maintain momentum toward a return to profitability. Previously, catalysts centered around earnings recovery, management stability, and progress on compliance with reporting requirements. Now, the uncertainty introduced by new executives and the recent management churn may weigh more heavily, potentially delaying or complicating efforts for a turnaround. The magnitude of the market reaction suggests these changes are material for the stock’s immediate outlook and underline just how critical leadership credibility is during a period of financial losses and ongoing audit challenges.

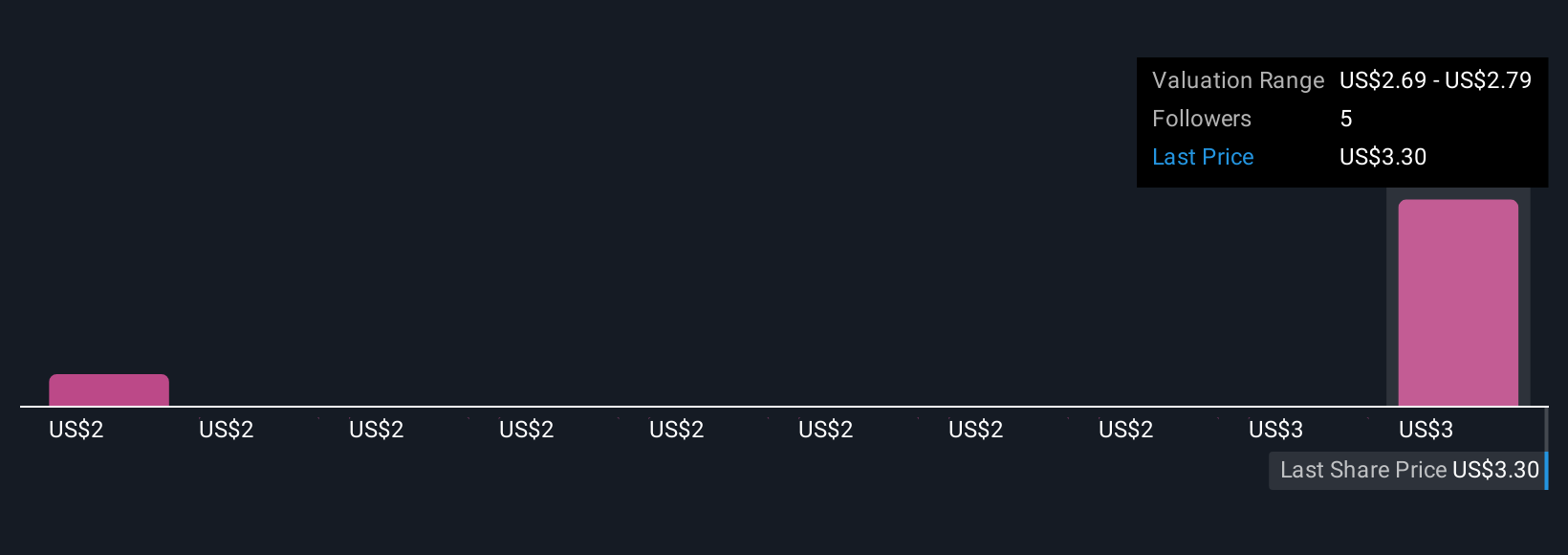

On the other hand, even well-timed turnarounds can get complicated when leadership turnover is high. The valuation report we've compiled suggests that Lufax Holding's current price could be quite moderate.Exploring Other Perspectives

Explore 2 other fair value estimates on Lufax Holding - why the stock might be worth 42% less than the current price!

Build Your Own Lufax Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lufax Holding research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Lufax Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lufax Holding's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com