- NewMarket Corporation recently reported third-quarter 2025 earnings, with sales of US$690.31 million and net income of US$100.27 million, both lower than the prior year, alongside a 9% increase in its quarterly dividend to US$3.00 per share.

- The company’s decision to boost dividends despite softer financial results highlights management’s focus on returning value to shareholders and signals confidence in ongoing cash flows.

- We’ll explore how the substantial dividend increase shapes NewMarket’s investment story in the face of recent earnings pressure.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is NewMarket's Investment Narrative?

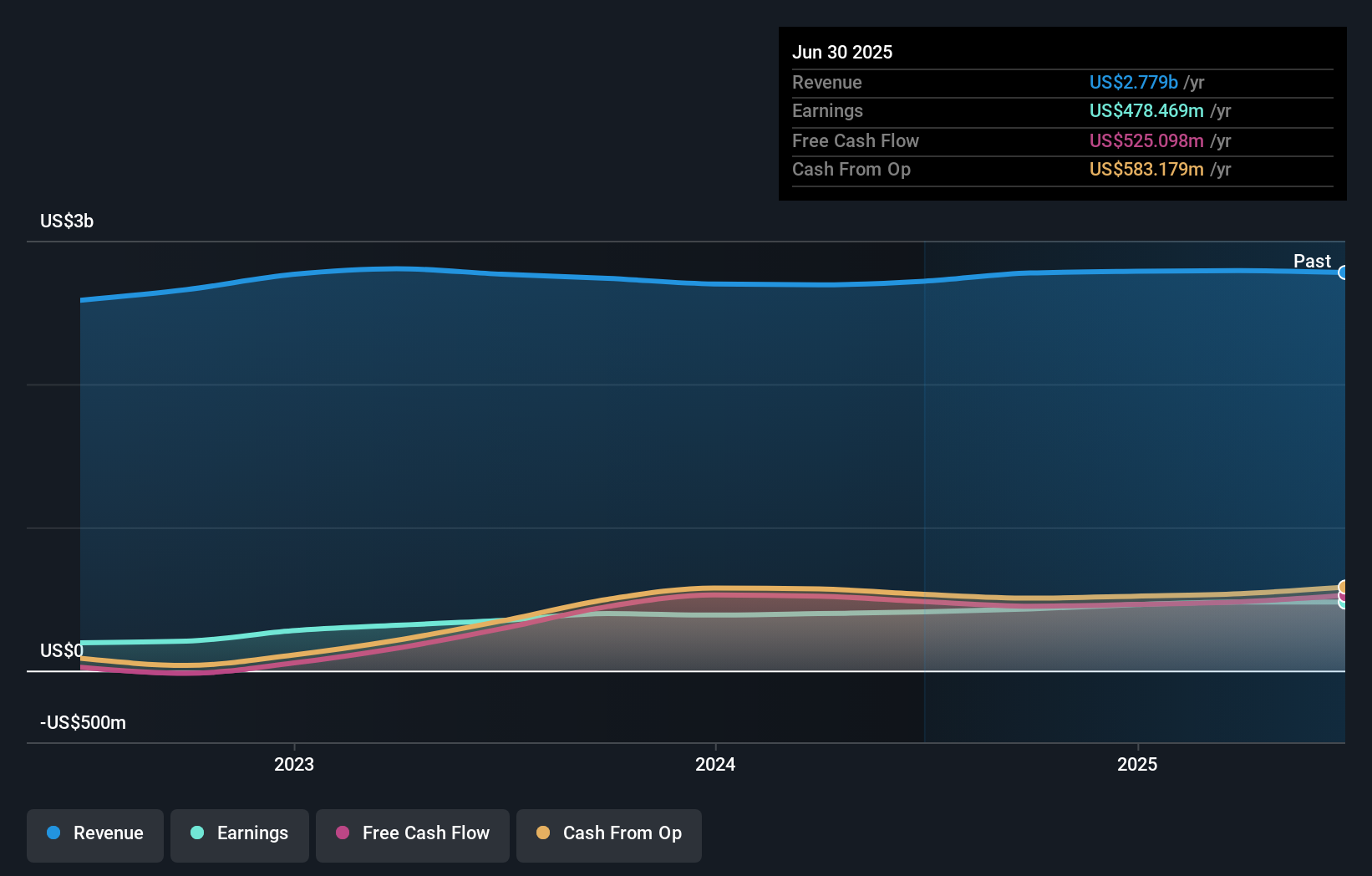

Investors who see opportunity in NewMarket today are likely focused on the company’s solid long-term profitability, deep industry experience, and shareholder returns, but recent results add new wrinkles to the story. The third-quarter pullback in both revenue and net income highlights current headwinds such as soft market demand and higher costs. However, management’s choice to raise the dividend by 9 percent, along with ongoing share buybacks, points to continued confidence in the company’s underlying cash flow and balance sheet strength, even during a softer period. In the near term, this move might help stabilize sentiment, but the ability to maintain these payouts could become a catalyst or a risk, depending on whether earnings recover or further declines materialize. For now, the overall risk-reward profile hasn’t fundamentally shifted, though some investors may be watching for any signs of sustained margin pressure.

Yet, despite the dividend increase, ongoing margin pressure is something investors should keep in mind.

Exploring Other Perspectives

Explore 2 other fair value estimates on NewMarket - why the stock might be worth over 2x more than the current price!

Build Your Own NewMarket Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewMarket research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NewMarket research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewMarket's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com