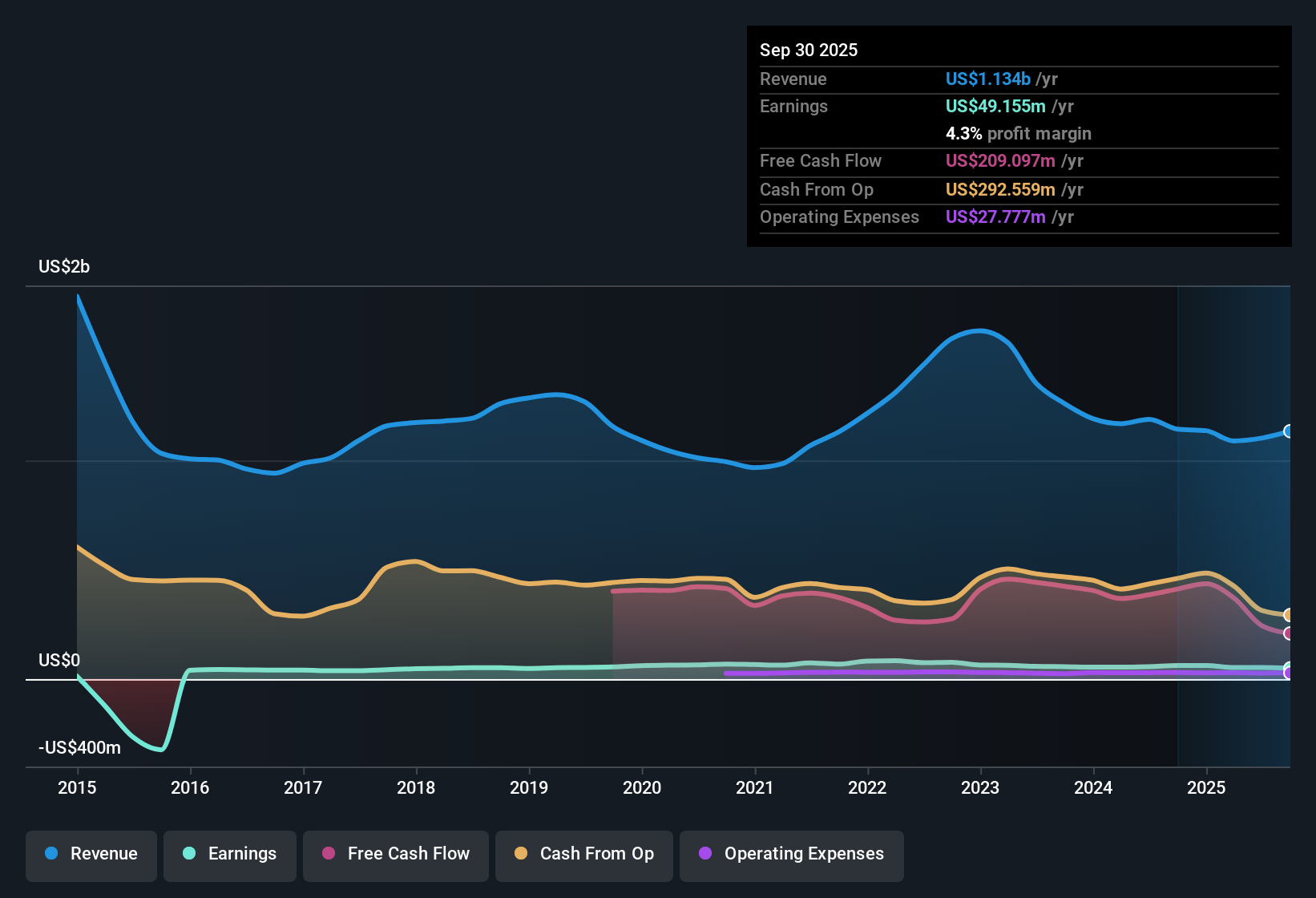

Westlake Chemical Partners (WLKP) posted a net profit margin of 4.8%, matching last year’s figure, while the company’s earnings have slipped by 6.7% annually over the past five years. Although revenue is forecast to grow at 7.7% each year, which trails the US market’s 10.3% pace, the shares currently trade at $18.86, notably below the fair value estimate of $49.88. With a Price-to-Earnings ratio of 12.6x, lower than both the industry and peer averages, and ongoing profit declines, investors are left to consider the value story alongside the company’s persistent financial risks.

See our full analysis for Westlake Chemical Partners.The next section takes a closer look at how these results stack up against the narratives shaping opinions on Westlake Chemical Partners, highlighting where the numbers align with expectations and where they prompt new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stay Steady Despite Lackluster Growth

- Westlake Chemical Partners maintained a net profit margin of 4.8% for the latest period, unchanged from the previous year, even as annual earnings have slipped by 6.7% per year over the last five years.

- What is notable is that, while the business has steadily prioritized distribution stability and a fee-based earnings structure, the persistently flat margin contrasts with ongoing profit declines.

- This operational consistency supports the narrative that WLKP’s "boring" model is attractive to income-focused investors who value reliability over rapid growth.

- At the same time, the trend stresses that margin resilience alone does not offset shrinking earnings for those seeking longer-term appreciation.

Revenue Growth Lags Market, But Income Remains the Focus

- Revenue is projected to rise by 7.7% annually, below the US average of 10.3%, which positions the company as more of a stable, income-oriented asset rather than a growth vehicle.

- Investors who prioritize reliable distributions over high growth may find this slower topline expansion justified, since WLKP’s fee-based model and distribution track record remain key selling points in the absence of "fast grower" credentials.

- This revenue outlook echoes the view that consistent cash generation can still appeal to portfolios focused on steady yield, especially in volatile markets.

- The tension emerges for those weighing sector-wide headwinds and limited upside against the stock’s defensiveness and distribution reliability.

Valuation Gap Signals Discount, Not Without Risks

- WLKP changes hands at a Price-to-Earnings ratio of 12.6x, well below the US Chemicals industry average of 25.3x and its peer group’s 17.8x, while its share price of $18.86 trades at a significant discount to the DCF fair value of $49.88.

- Despite this valuation gap, the stock’s ongoing profit declines and risks to financial stability signal that low multiples alone are not a free pass. Monitoring the company’s balance sheet and dividend coverage is crucial for value-focused investors.

- Bulls may point to this wide discount as a potential opportunity, but without evidence of a turnaround or margin improvement, skeptics highlight the dangers of chasing value too soon.

- The absence of negative news and controversy reinforces WLKP’s status as a defensive holding, yet sustained trading below intrinsic value can also reflect ongoing doubts about growth prospects.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Westlake Chemical Partners's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite its margin resilience, Westlake Chemical Partners faces persistent profit declines and slower revenue growth. This puts its long-term appeal in question for investors seeking financial strength.

If you’re looking for companies with sturdier finances and stronger balance sheets, consider searching with our solid balance sheet and fundamentals stocks screener (1983 results) to find investments better positioned to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com