- On October 24, 2025, Lufax Holding Ltd. announced the immediate resignation of Ms. Youn Jeong Lim as Chief Risk Officer due to personal work arrangements, appointing Mr. Jianbo Cheng as her replacement the same day.

- Mr. Cheng brings a distinguished background in risk management, with senior roles at major financial institutions such as JD.com and Ant Financial Services Group.

- We’ll explore how Mr. Cheng’s extensive risk expertise may influence Lufax’s investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Lufax Holding's Investment Narrative?

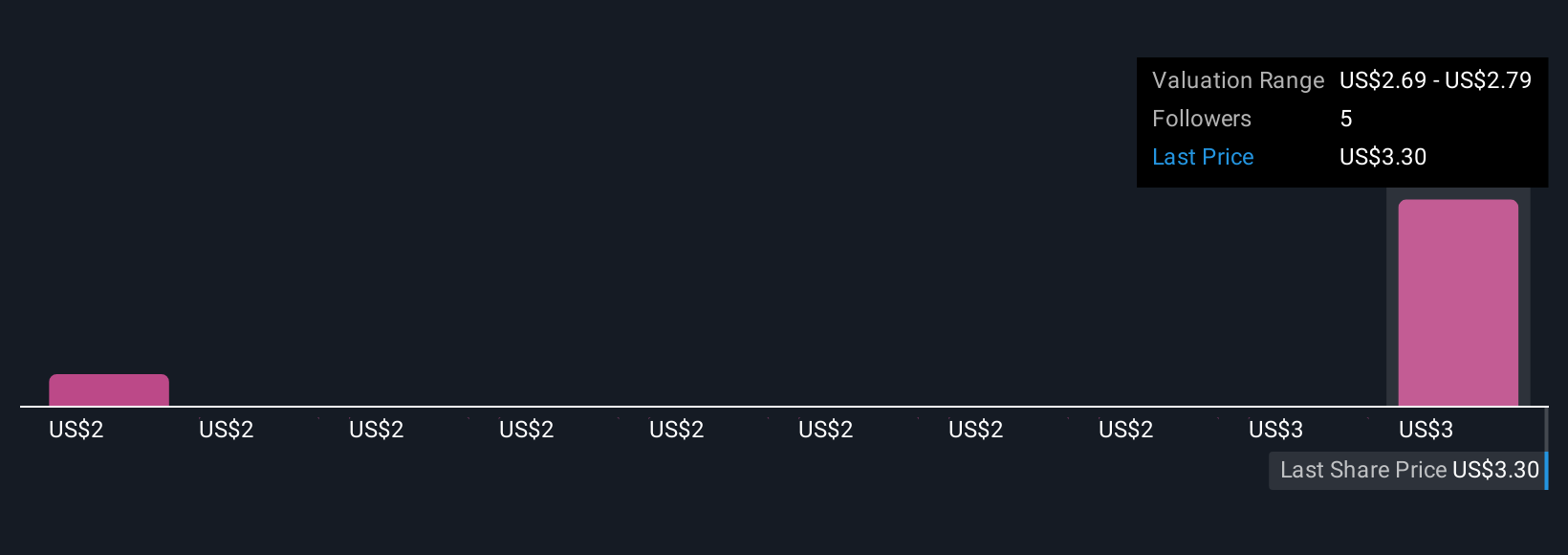

Lufax Holding continues to polarize investors who weigh its depressed share price against ongoing headwinds. As of late October, the big picture remains centered on the company's anticipated turnaround and potential buyout interest from majority shareholder Ping An. Near-term catalysts include upcoming collaborations with Ping An Consumer Finance and efforts to achieve profitability in the next three years, a goal analysts say outpaces the average market. The recent appointment of Mr. Jianbo Cheng as Chief Risk Officer, following Ms. Youn Jeong Lim’s resignation, arrives at a pivotal moment. While Mr. Cheng’s risk management depth should reassure stakeholders, given the scale of recent losses and an inexperienced board and management team, this change is not expected to materially shift the company’s immediate risk profile or near-term catalysts. Short-term price moves after the announcement suggest a muted market reaction, but board turnover and execution risk remain central issues.

However, board inexperience could still shape Lufax's risk outlook in unpredictable ways.

Exploring Other Perspectives

Explore 2 other fair value estimates on Lufax Holding - why the stock might be worth 45% less than the current price!

Build Your Own Lufax Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lufax Holding research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Lufax Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lufax Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com