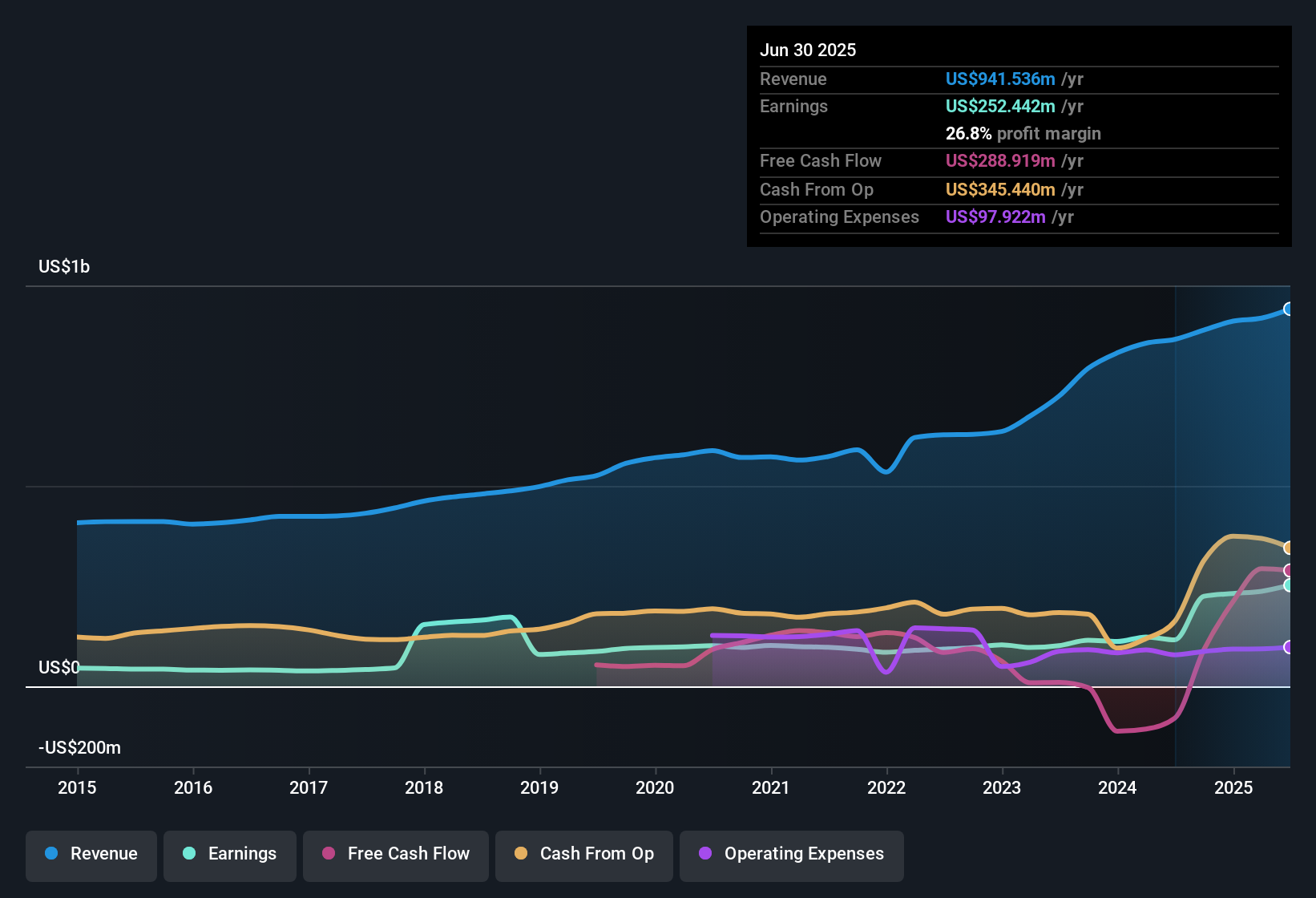

McGrath RentCorp (MGRC) posted a net profit margin of 15.6%, below the previous year’s 25.3%, and faced negative earnings growth over the past twelve months. Over a longer horizon, earnings have advanced at an impressive 20.3% annual rate over the last five years. Analysts now forecast earnings to grow 9.27% per year, with revenue growth projected at 4.6% per year. Both metrics trail the US market averages. With margins squeezed but a steady growth profile ahead, investors will weigh the mix of slower near-term results and the company’s favorable valuation as they interpret this earnings release.

See our full analysis for McGrath RentCorp.Next up, we’ll see how these latest earnings numbers compare to the broader stories and community narratives that have been shaping investor expectations for McGrath RentCorp.

See what the community is saying about McGrath RentCorp

Recurring Rental Growth Faces Utilization Headwinds

- Mobile Modular fleet utilization dropped to 73.7%, down from 78.4%. Portable Storage also slipped to 61.1% from 66.1%, signaling weaker segment demand over the past period.

- Analysts' consensus view highlights recurring rental revenues supported by robust demand and market expansion. However, these positives are now contrasted with lower fleet utilization, which could pressure both short- and long-term revenue if these trends persist.

- Investments in fleet and technology are aimed at unlocking margin improvements and new revenue streams, but near-term demand in key segments is no longer as resilient.

- Consensus stakeholders are watching to see whether growing backlogs and infrastructure tailwinds can offset softness in utilization rates and stabilize topline growth.

Curious how the numbers cross paths with analysts' consensus expectations? Bulls and bears are both tracking these utilization trends closely. 📊 Read the full McGrath RentCorp Consensus Narrative.

Profit Margins Contract More Than Expected

- The company's net profit margin fell sharply to 15.6% from 25.3% a year ago. This pace of contraction exceeds what ongoing investments or moderate cost escalation alone would explain.

- Analysts' consensus view spotlights operational efficiency investments intended to protect margins. However, rapidly rising SG&A and higher fixed costs may permanently compress EBITDA margins if topline growth does not accelerate.

- Ongoing digital infrastructure spending and strategic hiring appear to be outpacing revenue gains, establishing a higher cost base.

- This margin erosion underscores the consensus caution that profit durability may depend more on expense discipline than on topline recovery alone.

Valuation Remains Attractive Versus Peers

- McGrath RentCorp's share price trades at $114.50, below both the DCF fair value of $115.27 and the current analyst price target of $145.00. Its price-to-earnings ratio of 12.0x is less than both industry (22.0x) and projected future multiples.

- Analysts' consensus narrative emphasizes that despite slowing growth and shrinking profit margins, the current valuation multiples and a 14% gap between share price and target price make the stock potentially undervalued relative to peers.

- For the current valuation to be justified, investors must believe in future earnings stabilizing near $89.9 million, even as analyst estimates project a steeper decline ahead.

- Although analyst models predict a challenging profit outlook, the present valuation suggests that the market has already priced in much of the expected downside. This leaves open the possibility for upside if execution improves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for McGrath RentCorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on the data? Put your viewpoint into action and share your narrative in just a few minutes by using Do it your way.

A great starting point for your McGrath RentCorp research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite historical growth, McGrath RentCorp now faces compressing profit margins, slowing top-line momentum, and utilization headwinds. These challenges could threaten future earnings stability.

If you want steadier growth potential, consider stable growth stocks screener (2098 results) to find companies proving they can maintain reliable results through shifting economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com