- Brookfield Business Partners has announced plans to simplify its dual-entity structure by reorganizing into a single publicly traded Canadian corporation, BBU Inc.

- This streamlined approach is intended to enhance both organizational efficiency and the potential for improved alignment with shareholders.

- We’ll examine how Brookfield’s shift to a unified corporate structure shapes its investment narrative and potential for future value creation.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Brookfield Business' Investment Narrative?

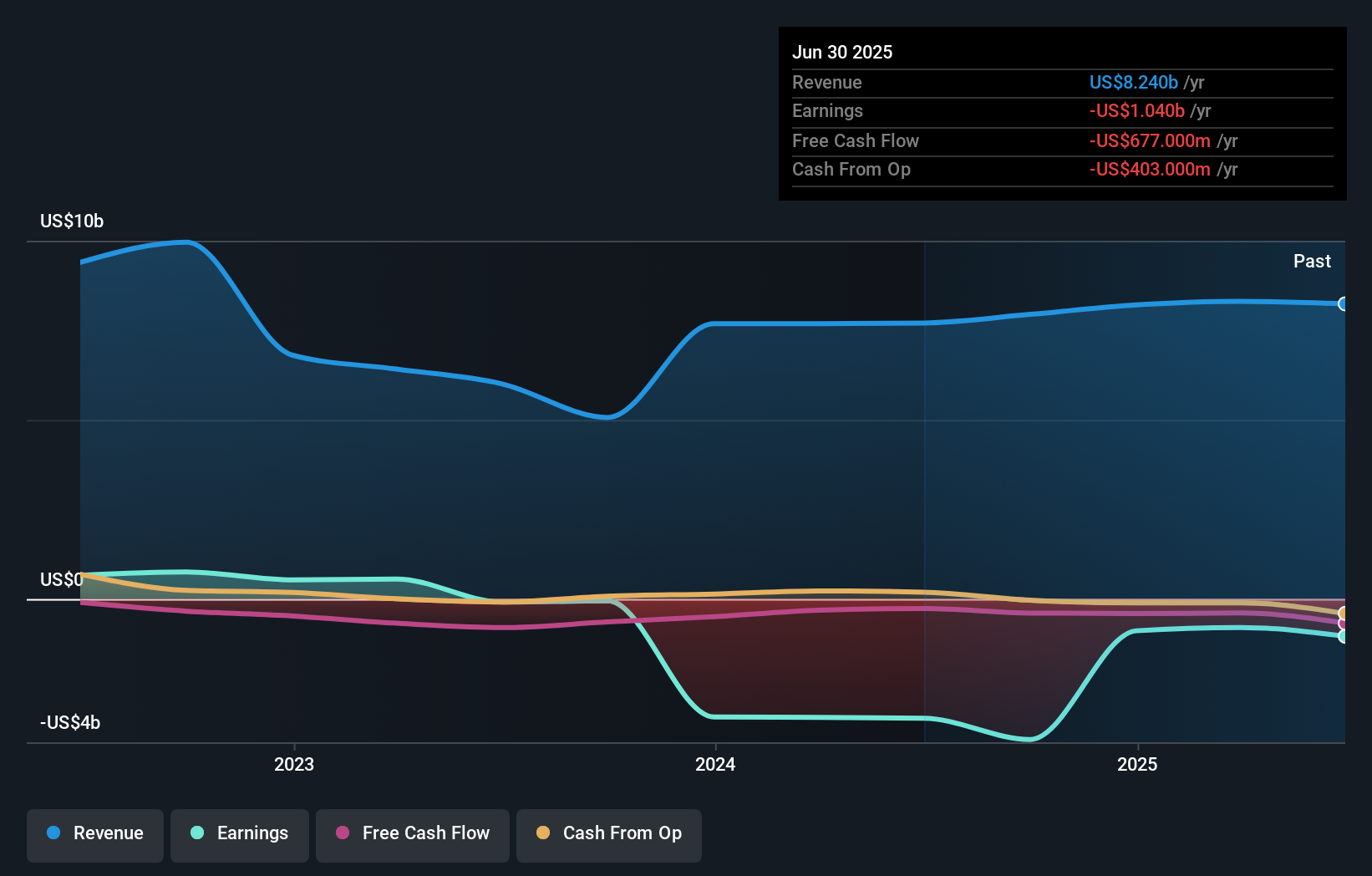

To own shares in Brookfield Business, you need confidence in its ability to create value by managing and growing a diverse portfolio, despite recent periods of net losses and headwinds in portions of its operations. The company’s move to unify under BBU Inc. could be a meaningful development, potentially leading to operational simplicity and better alignment with public markets. This structural change follows a period of weaker earnings, with Q2 results showing a net loss of US$120 million and sales down year over year, both reminders of key risks related to performance volatility. The news might shift short-term catalysts by sharpening the market’s focus on efficiency gains and capital allocation, but whether that materially offsets the fundamental earnings risk remains uncertain after a sharp run-up in share price.

But, efficiency improvements aside, recurring operating losses are an ongoing risk shareholders should not ignore. Brookfield Business' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business - why the stock might be worth as much as $0.846!

Build Your Own Brookfield Business Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Brookfield Business research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com