- International Seaways recently announced a fixed-income offering, initiating investor meetings for a planned five-year US dollar-denominated senior unsecured bond to refinance the Ocean Yield sale-and-leaseback agreement and for general corporate purposes.

- This move highlights the company’s continued focus on financial flexibility and proactive capital management in a shifting capital markets landscape.

- We'll explore how this planned bond issue may affect International Seaways' investment narrative, particularly regarding its approach to refinancing and liquidity.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

International Seaways Investment Narrative Recap

Investors considering International Seaways typically focus on the company’s ability to manage volatile tanker markets, maintain modern fleet standards, and preserve financial flexibility amid shifting energy and regulatory trends. The newly announced senior unsecured bond offering is intended to refinance existing obligations and support ongoing liquidity; while positive for financial flexibility, it does not materially impact the immediate catalysts, such as trade route expansion, or the most significant near-term risk, which remains market earnings volatility tied to spot exposure and regulatory changes.

Among recent announcements, International Seaways’ August 2025 earnings update stands out; the company reported softer year-on-year revenue and earnings but continued its regular and supplemental dividend payments. This earnings update is particularly relevant to the bond issue, as it underscores the company’s focus on supporting liquidity and investor returns amid market uncertainty, further reinforcing the importance of catalysts tied to trade flows and regulatory developments.

Yet, in contrast to these steps for stability, investors should be aware of the structural risk that comes with heavy spot market reliance during periods of weakened tanker demand and...

Read the full narrative on International Seaways (it's free!)

International Seaways' narrative projects $848.0 million revenue and $288.7 million earnings by 2028. This requires 2.0% yearly revenue growth and a $50.1 million earnings increase from $238.6 million.

Uncover how International Seaways' forecasts yield a $53.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

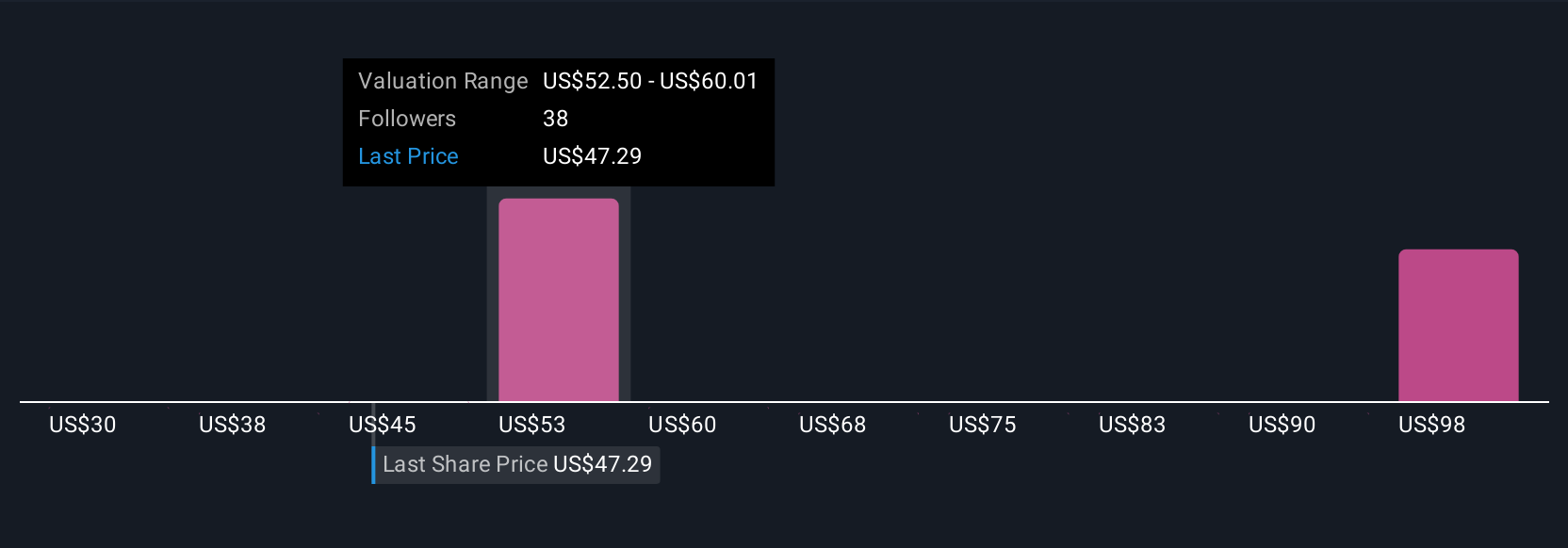

Six different fair value estimates from the Simply Wall St Community span a wide range, from US$30 to US$104.75 per share. You may want to consider how near-term regulatory risks could influence future earnings and valuations compared with your own outlook.

Explore 6 other fair value estimates on International Seaways - why the stock might be worth 36% less than the current price!

Build Your Own International Seaways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Seaways research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Seaways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Seaways' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com