Oscar Health Inc (NYSE:OSCR) shares are extending gains on Thursday, building on Wednesday’s rally. The stock surged Wednesday after the company reaffirmed its fiscal year 2025 sales guidance at the Wells Fargo Healthcare Conference.

What To Know: Oscar anticipates full-year revenue to be in the range of $12 billion to $12.2 billion, a figure that surpasses the consensus Wall Street estimate of $11.32 billion.

This positive outlook has bolstered investor confidence, which was already lifted by a strong second quarter that saw revenue climb to $2.86 billion, up from $2.2 billion in the same period last year.

Despite a reported second-quarter loss of 89 cents per share, the market has responded favorably to the reaffirmed guidance and growth strategies. Year-to-date, Oscar Health’s stock has gained 34%.

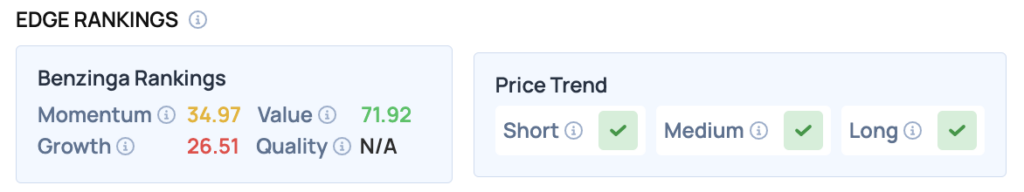

Benzinga Edge Rankings: Highlighting the stock’s financial appeal, Benzinga Edge rankings show OSCR with a strong value score of 71.92.

Price Action: According to data from Benzinga Pro, OSCR shares are trading higher by 3.70% to $18.34 Thursday morning. The stock has a 52-week high of $23.79 and a 52-week low of $11.20.

Read Also: C3.AI Stock Is Tumbling Thursday: What’s Going On?

How To Buy OSCR Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oscar Health’s case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock