Most Popular Narrative: 15.5% Undervalued

According to community narrative, International Seaways is viewed as undervalued based on a blend of steady earnings growth, expanding margins, and supportive industry shifts expected to drive long-term value.

The company's strategy of renewing and modernizing its fleet, including the acquisition of newbuild eco-vessels and selling older tonnage, positions it to benefit from stricter environmental regulations. This approach may reduce operating costs and support sustained or improved net margins.

How is this narrative supporting such a bullish fair value? It comes down to significant assumptions about future earnings growth, stronger profitability, and where the multiple may settle in a few years. Interested in which profit drivers and market forecasts are fueling this optimistic case? Explore further and discover the factors behind this attention-grabbing valuation thesis.

Result: Fair Value of $53.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory shifts and declining global oil demand could undermine these bullish forecasts. This may create new challenges for International Seaways' growth trajectory.

Find out about the key risks to this International Seaways narrative.Another View: Discounted Cash Flow Signals Deeper Value

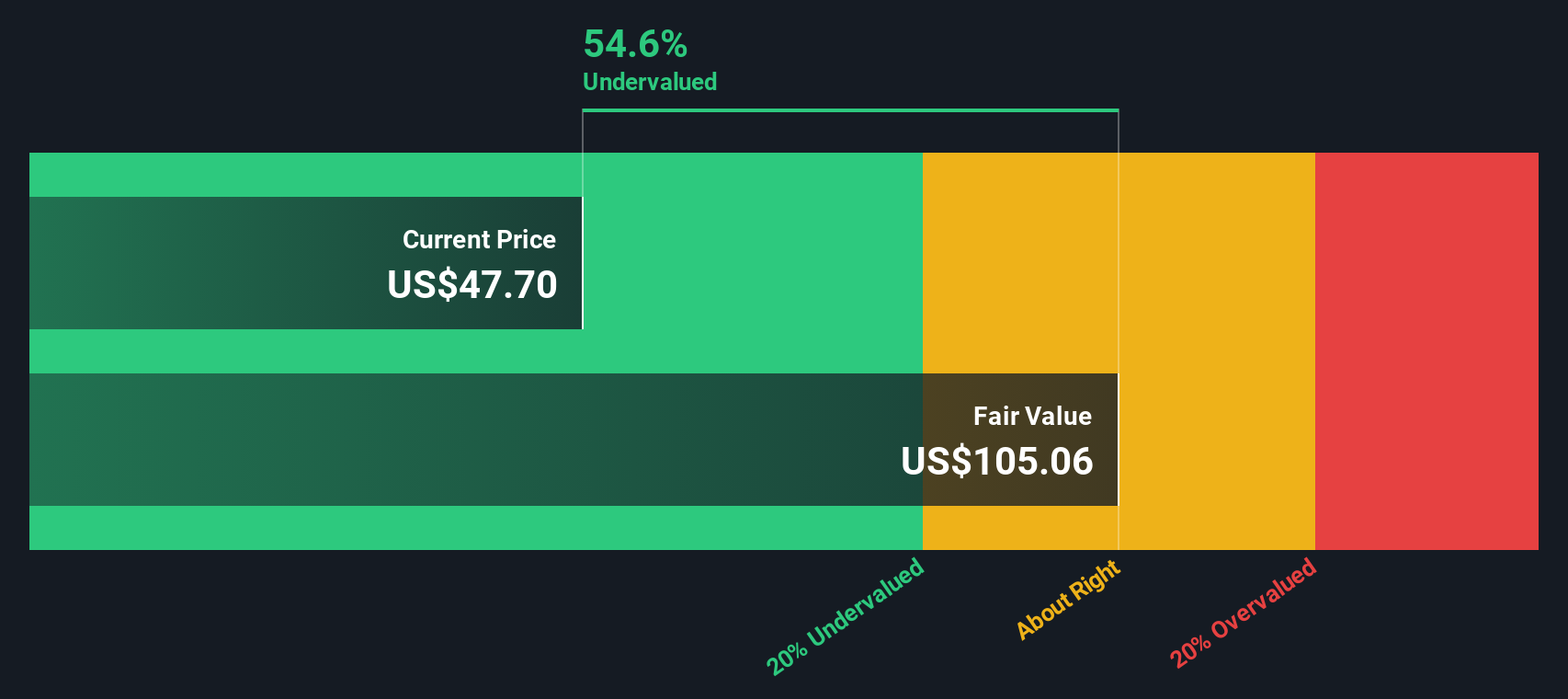

While the analyst consensus highlights potential upside, our DCF model takes a different approach and suggests International Seaways may actually be even more undervalued than many expect. Could the market be missing something significant in this case?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own International Seaways Narrative

If you have a different perspective or want to explore the numbers firsthand, you can build your own company thesis in just a few minutes. Do it your way

A great starting point for your International Seaways research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more ways to strengthen your portfolio?

Smart investors don’t stop at just one opportunity. Expand your horizons and gain an edge by effortlessly finding stocks with impressive growth stories, innovative technology, or strong financial fundamentals. Let the Simply Wall Street Screener guide you toward fresh ideas that others might be missing.

- Discover potential market gems with strong financials and growth momentum using our penny stocks with strong financials.

- Explore tomorrow’s breakthroughs by tracking companies advancing artificial intelligence in medicine and healthcare through our healthcare AI stocks.

- Focus on opportunities offering reliable income with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com