Anyone who denies the meteoric ascent of Palantir Technologies Inc. (NASDAQ:PLTR) is simply choosing to ignore the charts. Since making its public market debut in October 2020, the big-data analytics specialist — which serves multiple government and defense-related agencies — has made its mark. At the same time, PLTR stock isn't invincible, losing more than 9% during Tuesday's tech sector selloff. It raises the question: where will PLTR head next?

When looking at the big picture, it's difficult not to lend enormous credence to the bullish side of the spectrum. Since the start of this year, PLTR stock has gained over 106%. Over the past 52 weeks, it has returned a remarkable 379%. By practically every commonly monitored technical gauge, the long-term price discovery process appears robust.

However, Tuesday's fallout threw a potential monkey wrench into the otherwise impressive machinery. While PLTR stock remains above key technical benchmarks, the huge red candlestick sent the price action below the 20-day exponential moving average. Furthermore, it should be noted that since April of this year, volume has declined while the price has moved up.

Generally, technical analysts prefer volume to confirm price action. In this case, volume is contradicting the price, which could be a bearish signal.

Nevertheless, the bulls will likely believe that it's too early to panic. Earlier this month, Palantir demonstrated its resilience amid a difficult macro environment with a strong second-quarter earnings print. The company posted revenue of $1.004 billion, beating the consensus estimate of $939.71 million. On the bottom line, Palantir reported adjusted earnings of 16 cents per share, above Wall Street's target of 14 cents per share.

With the Q2 performance, Palantir has now met or exceeded analyst estimates on the top and bottom lines in eight consecutive quarters, according to data from Benzinga Pro.

"This was a phenomenal quarter. We continue to see the astonishing impact of AI leverage. Our Rule of 40 score was 94%, once again obliterating the metric, " said Alex Karp, co-founder and CEO of Palantir.

While the tech specialist has dazzled analysts, the valuation may be a sticking point for investors moving forward. Right now, PLTR stock trades at a whopping 250-times forward earnings. Around this point last year, this metric stood at 88.5 times. True, an elevated ratio doesn't necessarily spell doom. However, as was witnessed on Tuesday, jittery investors may be more willing to dump names that are perceived to be excessively priced.

The Direxion ETFs: With both sides laying claim to exciting narratives, financial services provider Direxion offers traders a chance to exercise their speculative theses. For the optimists, the Direxion Daily PLTR Bull 2X Shares (NASDAQ:PLTU) seeks the daily investment results of 200% of the performance of PLTR stock. On the pessimistic end, the Direxion Daily PLTR Bear 1X Shares (NASDAQ:PLTD) seeks 100% of the inverse performance of the namesake equity.

While these products have garnered popularity in recent years, a key driver of Direxion ETFs is flexibility. Usually, traders interested in leveraged or short positions must engage the options market. However, financial derivatives carry complexities that may not be suitable for everyone. In contrast, Direxion ETFs can be bought and sold much like any other publicly traded security, thus easing the learning curve.

Nevertheless, traders interested in these funds must recognize their unique risks. First, leveraged and inverse ETFs typically incur greater volatility than funds tracking benchmark indices, such as the Nasdaq Composite index. Second, Direxion ETFs are designed for exposure lasting no longer than one day. Holding these ETFs longer than recommended may expose traders to value decay due to the daily compounding effect.

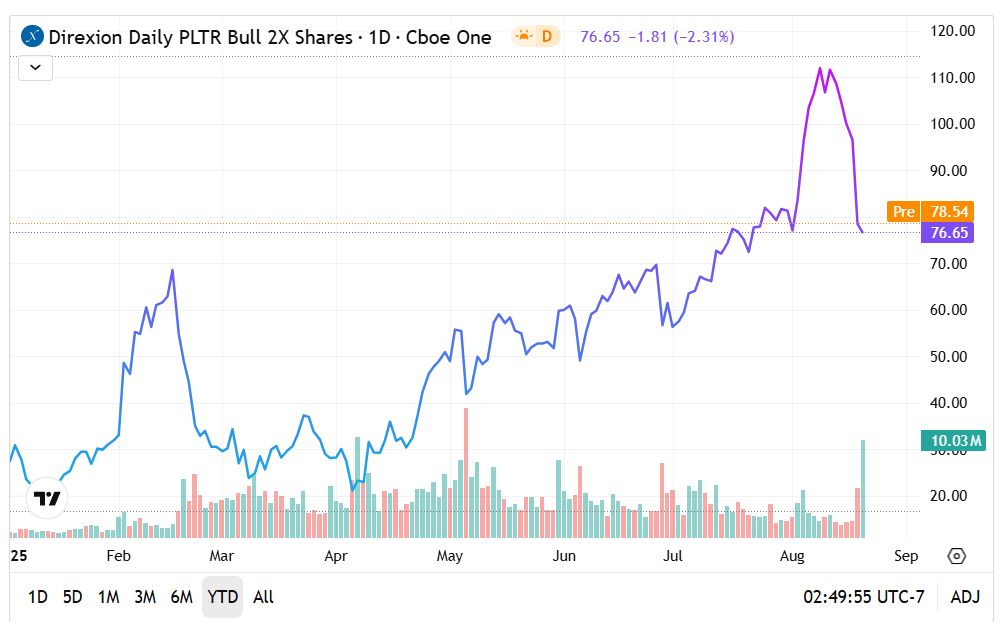

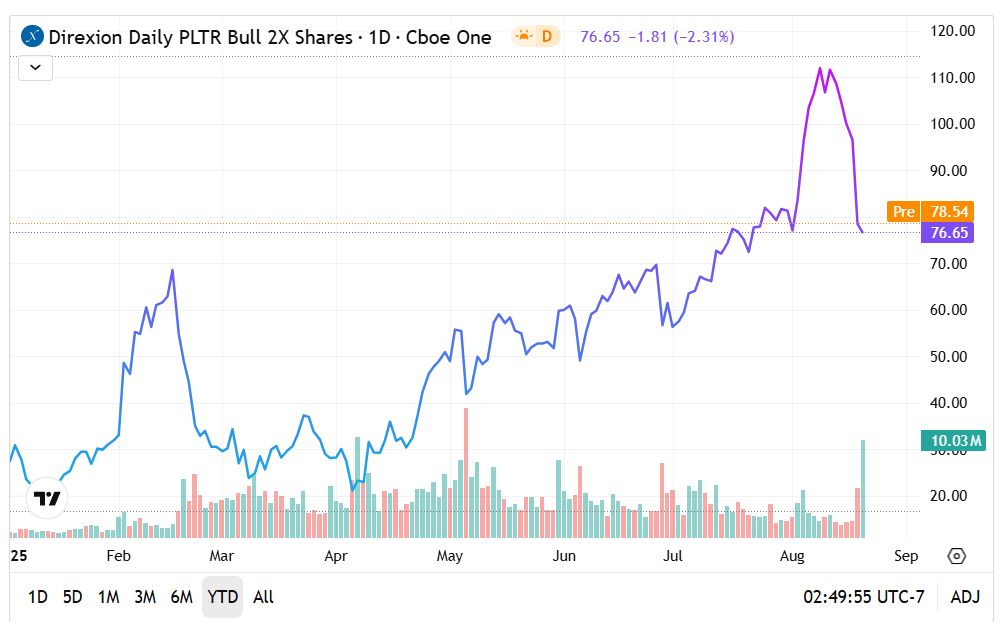

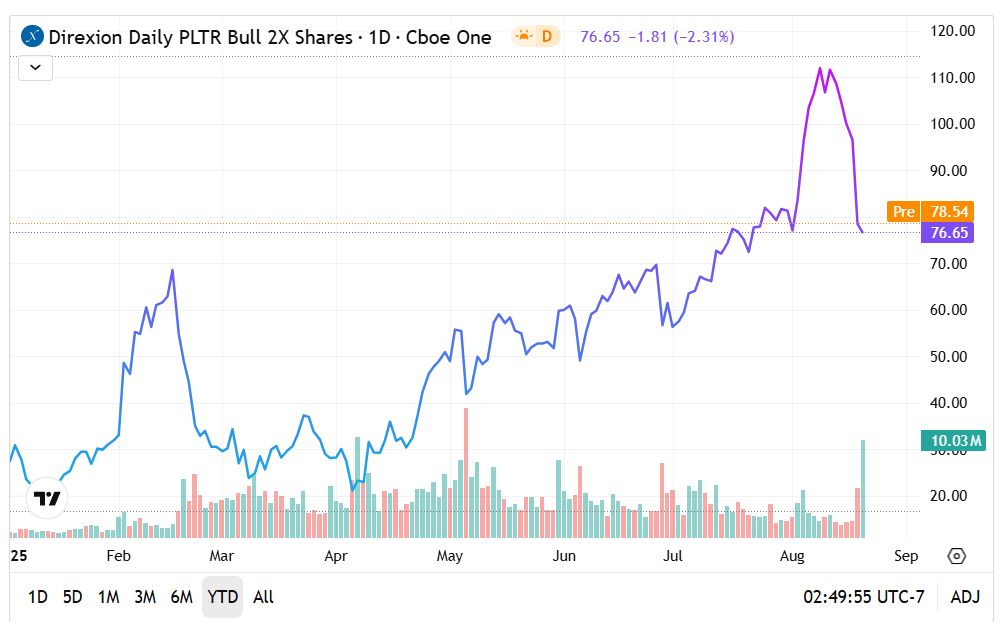

The PLTU ETF: Since the start of the year, the Direxion Daily PLTR Bull 2X Shares has gained over 175%, magnifying the heightened interest toward PLTR stock.

- While the PLTU ETF has enjoyed a strong run since April, the latest bout of red ink has brought the price action right on top of the 50-day moving average.

- Adding to concerns, distributive volume has skyrocketed in the past two sessions, implying severe investor anxiety.

The PLTD ETF: To no surprise, the Direxion Daily PLTR Bear 1X Shares hasn't fared well this year, losing more than 65% since the January opener.

- Throughout most of this year, the PLTD ETF's price action has been below the 20-day EMA. Right now, it's sandwiched between the shorter-term average below and the 50 DMA above.

- What may please the bears is that accumulative volume for the inverse fund has surged dramatically higher over the past several sessions, indicating renewed sentiment.

Featured image by Pete Linforth on Pixabay.