Terex (TEX) grabbed the spotlight this week after it clinched improved credit terms with its lenders, trimming the cost of both its term and revolving loans. This results in lower interest expenses going forward. Combined with expectations that earnings could double in the next few years, this development has drawn attention from investors who are considering whether the market is overlooking something. The company’s refinancing comes at a time when analysts note that recent results and positive projections may not be fully reflected in the current share price.

Looking at the broader picture, Terex’s stock has seen a mixed performance. It has slipped around 7% over the past year, although momentum has quietly built since spring with a 9% gain in the past 3 months and a 16% rise since January. The company has reported annual revenue growth above 5% and strong net income gains, but there are ongoing questions about how much future profitability is already factored into the recent share price moves, particularly after years of outperformance. The refinancing news further shapes the ongoing discussion about risk and reward.

After this year’s subdued performance and recent signs of optimism, the question remains whether Terex is trading at a discount to its underlying growth prospects or if the market has already anticipated the next phase of performance.

Most Popular Narrative: 6.6% Undervalued

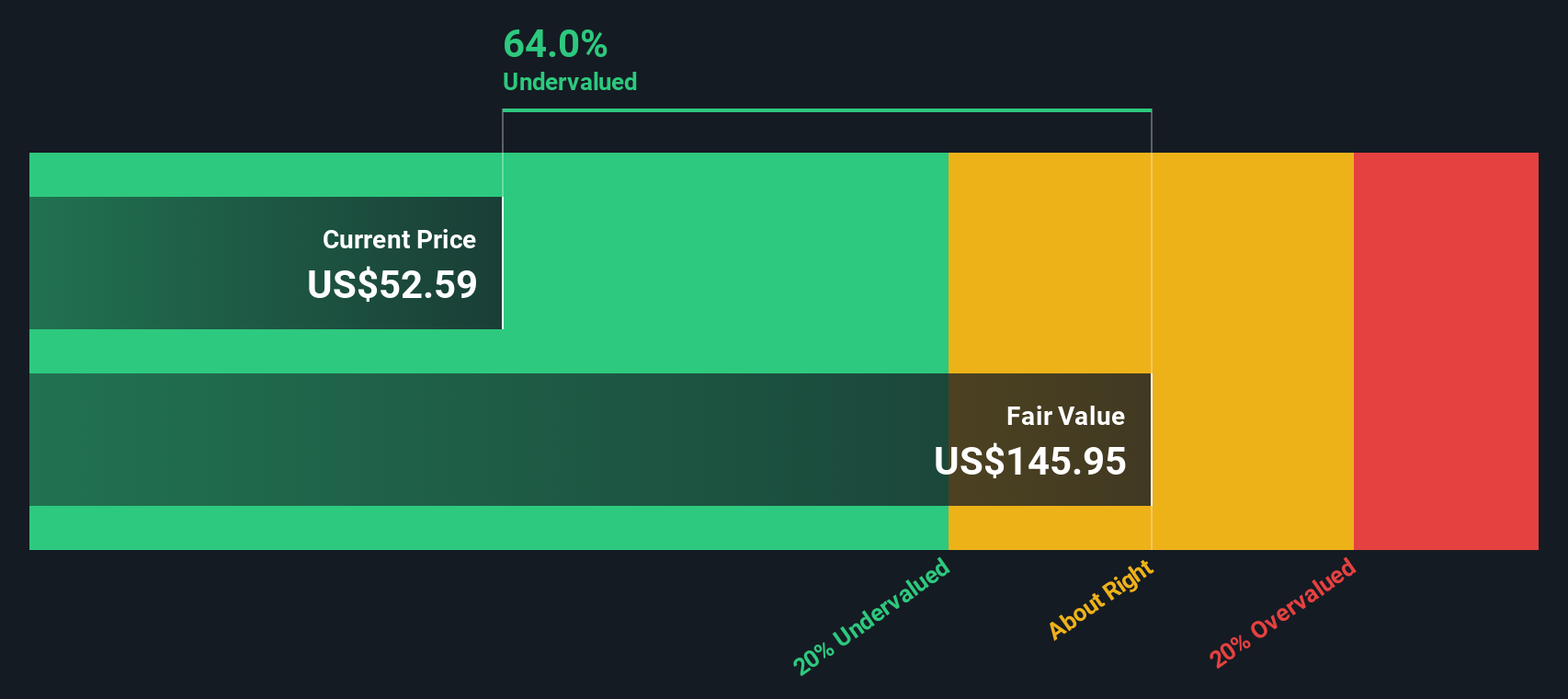

According to community narrative, Terex is currently regarded as undervalued relative to its fair value estimate. Analysts see modest upside potential based on forecasts for continued growth and improving margins.

The company's acceleration of electrified and digital product offerings (Environmental Solutions growth, expansion of 3rd Eye telematics and SaaS subscriptions) is unlocking higher-margin, recurring revenues and enabling Terex to benefit from stricter sustainability and efficiency regulations. This supports margin expansion and differentiated pricing for next-generation equipment.

Can Terex sustain this momentum and justify a higher price? There is one key strategic bet at the heart of this narrative. It draws on bold future profitability and a margin transformation story with industry-shifting scale. Curious how these assumptions stack up against consensus numbers and what exactly drives that future value? Find out which major numbers are moving this story forward and why the analysts are calling for upside.

Result: Fair Value of $55.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high interest rates or unpredictable tariff costs could quickly challenge the bullish outlook and stall Terex’s projected growth trajectory.

Find out about the key risks to this Terex narrative.Another View: Discounted Cash Flow Perspective

The SWS DCF model tells a different story and suggests that Terex’s shares could be trading well below their estimated intrinsic value. This raises a key question: is the market missing something that the numbers reveal?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Terex Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own view and narrative in just a few minutes. Go ahead and do it your way.

A great starting point for your Terex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity rarely waits. Take charge of your portfolio and explore stocks catching attention right now with the Simply Wall Street Screener. Let these powerful themes guide you to what could be your next winning move.

- Unlock the potential of innovative healthcare technology by tracking companies pushing the boundaries with healthcare AI stocks.

- Tap into the strong cash flow advantage of companies trading below their true value through our curated list of undervalued stocks based on cash flows.

- Capture attractive yields for your income goals by screening for dividend stocks with yields > 3% that have stood out for consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com