Hyatt Hotels (NYSE:H) has just caught the eye of investors, with shares leaping more than 5% after Federal Reserve Chair Jerome Powell signaled that interest rate cuts may be on the horizon. In an environment where borrowing costs play a big role in capital-heavy businesses like hospitality, even a hint at cheaper financing can shift the outlook for companies such as Hyatt. The immediate rally suggests markets see fresh possibilities for both growth and profitability if consumers are encouraged to travel and spend more freely.

Looking at the bigger picture, Hyatt’s stock has been anything but predictable over the past year. While the company has delivered double-digit annual growth in both revenue and net income, its stock is down 2% since last August and remains negative for the year. However, the recent 9% climb over the past three months hints at a possible turning point, particularly as macro policy changes come into focus. Earlier in the year, Hyatt’s performance lagged, but this move shows how quickly sentiment can swing for a travel-facing company tied to economic cycles.

This uptick raises a classic investing question: Is this the start of an undervalued recovery, or is the market quickly pricing in all the potential upside that future rate cuts might bring?

Most Popular Narrative: 6.7% Undervalued

According to community narrative, Hyatt Hotels is viewed as undervalued based on bullish expectations for earnings growth and strategic business changes.

The sale of Playa's real estate, along with other owned properties, is anticipated to reduce Hyatt's ownership of hotels. This aligns with its asset-light strategy and could improve net margins by lowering capital expenditure and maintenance costs. The introduction and expected expansion of the Hyatt Select brand, targeting upper mid-scale markets, signals revenue growth potential through increased market penetration in secondary and tertiary markets within the U.S.

Curious about why some analysts think Hyatt’s future could defy expectations? Their valuation hinges on transformative moves and ambitious targets that might surprise even bullish investors. Can Hyatt's bold strategy and its profit forecasts really justify such a premium? The numbers behind this consensus price might just change your view of the entire sector.

Result: Fair Value of $154.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in booking behavior and ongoing acquisition uncertainties could quickly challenge optimism about Hyatt’s future earnings potential.

Find out about the key risks to this Hyatt Hotels narrative.Another View: Testing the Valuation With Our DCF

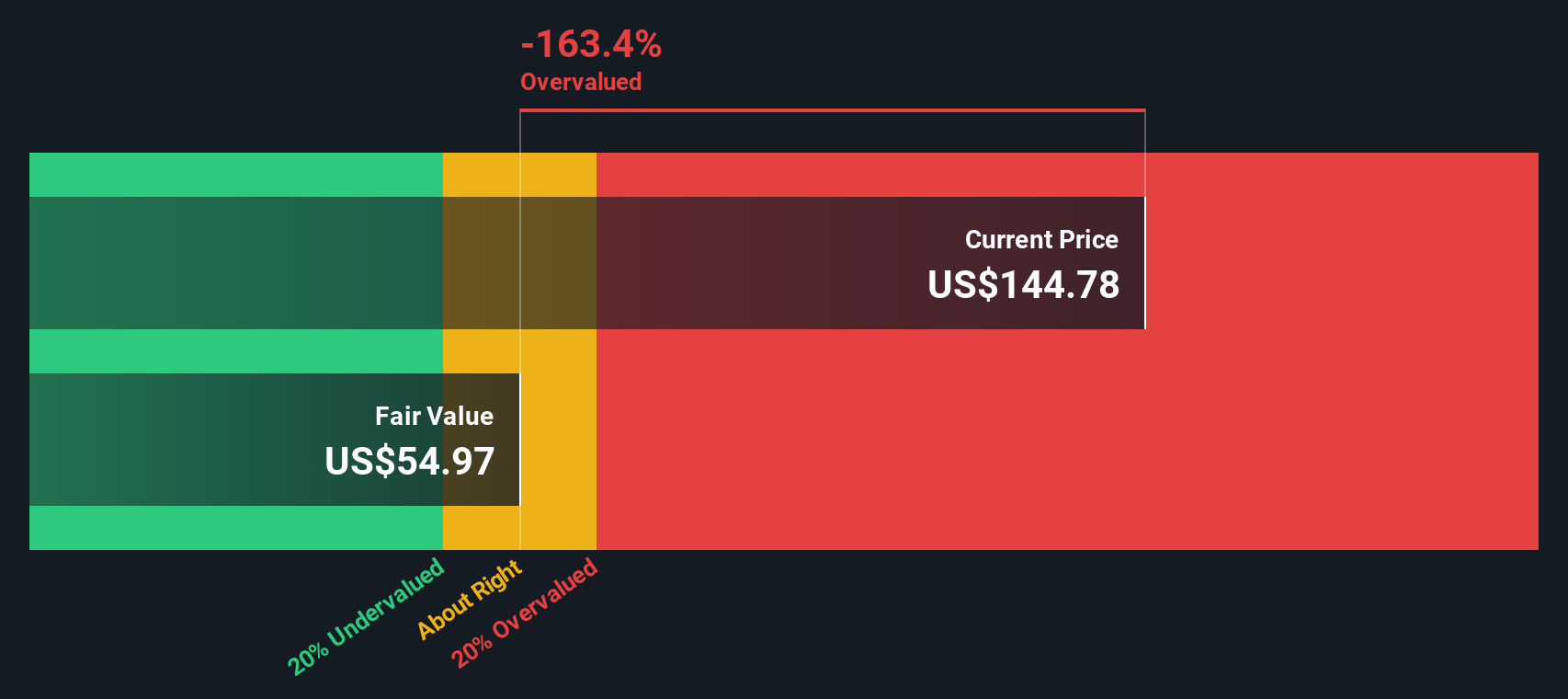

While the market tends to focus on price tags and industry comparisons, our DCF model paints a different picture for Hyatt. This model suggests the shares may not be as cheap as they first appeared. Which perspective provides a clearer understanding of Hyatt's true value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hyatt Hotels Narrative

If you want to dig deeper or think a different story is emerging in the numbers, you can quickly assemble your own take on Hyatt. Just give it a try and do it your way.

A great starting point for your Hyatt Hotels research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t miss your chance to find tomorrow’s leaders before everyone else. Use the Simply Wall Street Screener to capture unique ideas and build a portfolio ready for what’s next. Here are some standout strategies to kickstart your search:

- Uncover steady income potential by checking out dividend stocks with yields > 3% with strong yields that can boost your returns, regardless of market conditions.

- Capitalize on innovation by scanning the latest AI penny stocks and companies driving the AI revolution forward.

- Strengthen your holdings with undervalued stocks based on cash flows so you never overlook a stock trading below what may be its true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com