If you have been watching Hilton Worldwide Holdings (HLT), last week might have caught your eye. The company posted its second-quarter 2025 results, coming in ahead of earnings and revenue estimates. Not only did Hilton prove its ability to navigate softer international travel and a pullback in government spending, but it also continued pushing forward with global expansion. The company added 221 new hotels and unveiled luxury properties in cities like Paris and Vienna.

These updates have pushed Hilton’s stock up 3.1% over the past week and about 29% higher over the last year, as part of a five-year climb that totals an increase of 207%. The bigger picture also includes rising earnings per share and recent insider buying, both of which point to mounting confidence in Hilton’s growth potential. While the company did slightly trim its full-year guidance, its ability to consistently deliver results and rapidly expand its portfolio appears to be keeping the stock’s momentum strong for now.

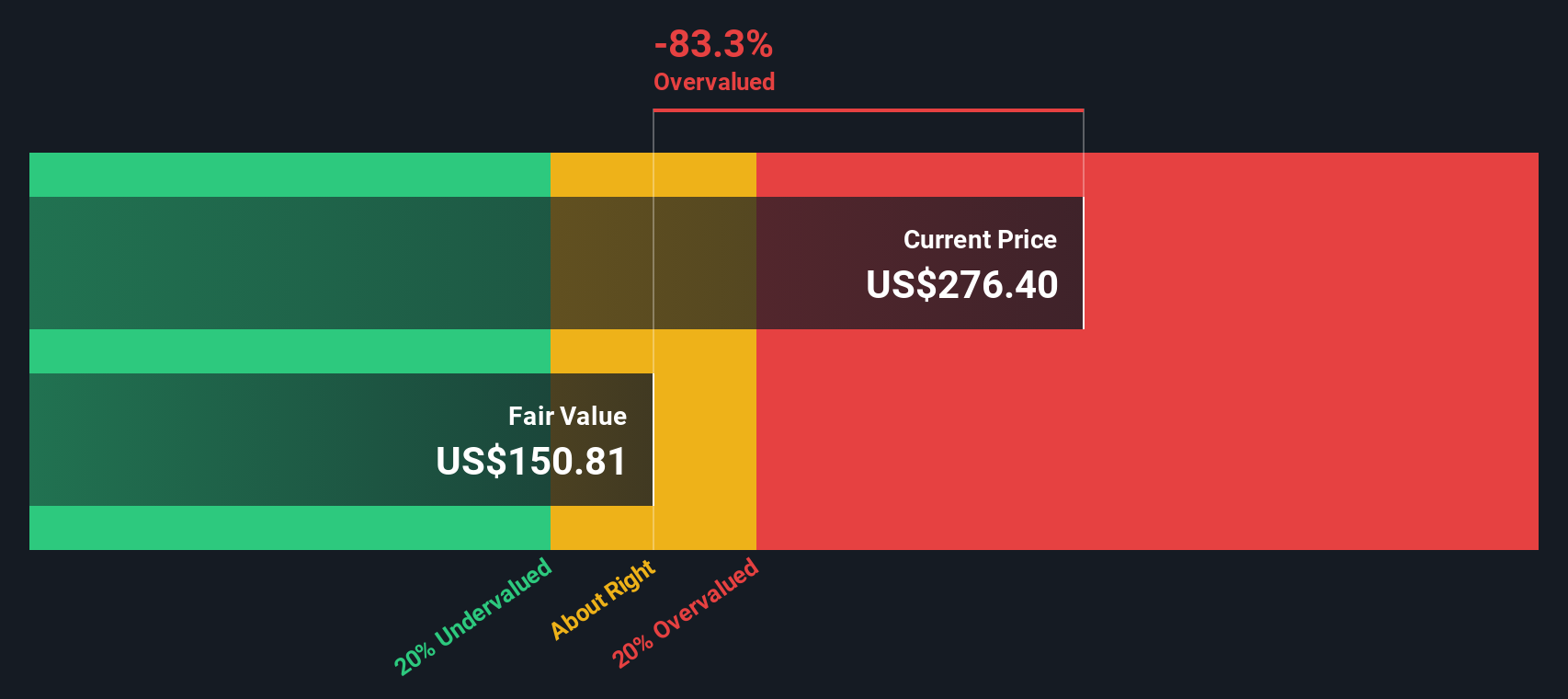

Given such performance, the question is front and center: is Hilton Worldwide Holdings still undervalued at current levels, or are investors already pricing in the company’s future growth?

Most Popular Narrative: 1.5% Overvalued

According to community narrative, Hilton Worldwide Holdings is considered slightly overvalued relative to its fair value estimate derived from analyst consensus.

"The rapid expansion of Hilton's development pipeline, including opening 221 hotels in the quarter and a record 510,000 rooms in progress, with strategic focus on emerging markets (Asia-Pacific, Africa, India), positions Hilton to capture rising demand from growing middle-class travelers worldwide. This supports long-term revenue and earnings growth."

Curious how bullish industry growth projections and Hilton's aggressive international expansion are shaping this price target? The real story lies in the bold revenue expectations, future profit margins, and a premium valuation multiple that outpaces the sector average. Want to see what makes this stock's narrative stand out? Explore the key drivers matching up to its fair value.

Result: Fair Value of $273.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent economic headwinds in China and muted RevPAR growth in key regions could limit Hilton’s ability to meet ambitious projections.

Find out about the key risks to this Hilton Worldwide Holdings narrative.Another View: Discounted Cash Flow Perspective

Looking through the lens of our DCF model, Hilton appears overvalued as well, reflecting signals similar to the price target method. However, how robust are these assumptions about future growth? Could the cash flow story be missing some key factors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hilton Worldwide Holdings Narrative

If you want to dig deeper or believe a different angle tells the true story, you can put your own narrative together in just a few minutes. So why not do it your way?

A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Missing out on tomorrow’s leaders is never enjoyable, especially when smarter stock opportunities are just a click away. Fuel your next investing move by tapping into unique opportunities selected for different strategies and market conditions. Take action and help ensure your portfolio maintains every possible edge:

- Tap into steady returns by checking out high-income picks via dividend stocks with yields > 3%, and let yields above 3% contribute to reliable growth in your holdings.

- Discover the potential of game-changing medical breakthroughs by exploring healthcare AI stocks, a space where healthcare converges with innovative AI to drive the next leap in patient care.

- Be at the forefront of finance with cryptocurrency and blockchain stocks, which allows you to identify stocks benefitting from the ongoing growth in blockchain and cryptocurrency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com