If you’re watching Greenbrier Companies (NYSE:GBX), you know the company has been busy. Management recently announced the closure of a European facility, a move set to save $10 million each year. In addition, they have secured $850 million in extended credit facilities. These are significant changes to the business, and investors may be wondering just how much of an impact these operational and financial steps could have on the company’s long-term growth outlook.

Looking at the stock, Greenbrier has drawn attention in the past year, rising about 3% even as it traded through some rough patches. Recent momentum in short-term performance, combined with these savings initiatives, adds a new dimension to the story. Recent earnings exceeded expectations, and upward estimate revisions suggest that analysts are becoming more favorable toward management’s approach, at least at this stage.

After a year marked by gradual gains, the question remains whether these operational moves are giving the stock more potential, or if the market has already factored future growth into today’s price.

Most Popular Narrative: 11% Undervalued

According to community narrative, Greenbrier Companies is viewed as trading below its estimated fair value. The narrative attributes this valuation to ongoing strategic efforts and market positioning that may deliver long-term benefits despite near-term industry challenges.

Strength in the leasing market, with recurring revenue growing by 39% over the last two years. Strong lease renewal rates and limited equipment supply are likely to contribute to stable, and possibly increasing, revenue. Greenbrier's robust global railcar backlog, valued at $2.6 billion, provides significant revenue visibility and is expected to support steady production rates, which could positively impact future revenue streams.

Curious about the big story beneath Greenbrier’s price tag? This narrative hinges on game-changing growth assumptions, including future earnings and margin shifts that could surprise even seasoned investors. Gain insight into what these projections could mean for its next move.

Result: Fair Value of $53.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, fluctuating trade policies or slower demand for new railcars could present challenges for Greenbrier’s margin and revenue outlook in the coming years. Find out about the key risks to this Greenbrier Companies narrative.Another View: DCF Model Questions Fair Value

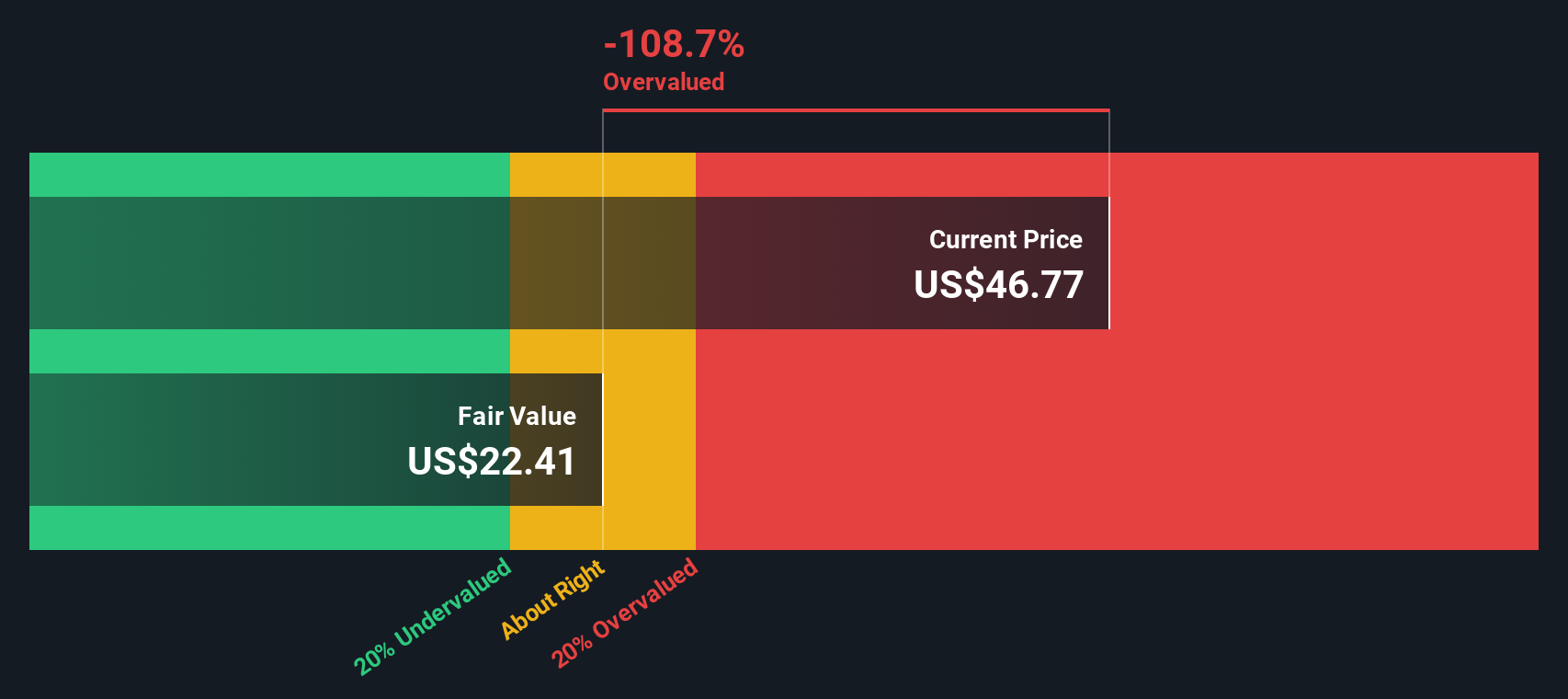

While analyst price targets suggest Greenbrier Companies is undervalued, our SWS DCF model provides a much more conservative perspective and indicates the shares may be overvalued. How should investors reconcile these different views on the company’s future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Greenbrier Companies Narrative

If you see the story differently or want to dig into the data on your own terms, you can create a fresh narrative in just a few minutes. So why not do it your way?

A great starting point for your Greenbrier Companies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Imagine expanding your portfolio with stocks that truly stand out. Take action now to seize unique market opportunities and stay ahead of the curve. Make smarter choices by considering companies with strong financial health, promising industry trends, and powerful future potential, so you never miss what’s next.

- Unlock reliable returns when you seek out income opportunities in dividend stocks with yields > 3%, designed for investors focused on steady yields above 3%.

- Accelerate your growth strategy by targeting healthcare AI stocks, which are harnessing artificial intelligence to transform the future of healthcare.

- Stay ahead of tech innovation and potential breakthroughs by tracking quantum computing stocks shaping the quantum computing space and presenting cutting-edge possibilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com