BorgWarner (NYSE:BWA) has caught the eye of many investors lately, thanks to a flurry of upward earnings estimate revisions and renewed focus from analysts as a value play in the auto technology sector. The company’s leadership is openly discussing acquisition plans, signaling confidence in BorgWarner’s financial position and strategy. Together, these moves have pushed the stock upward and raised the stakes for those deciding whether to act now or wait for further clarity.

These signals come at a time when BorgWarner shares have climbed 38% since the start of the year and are up 29% from a year ago. The market appears to be rewarding the company for its disciplined approach to growth and its position within the clean and efficient vehicle technology space. While the past month’s nearly 20% gain suggests that momentum is currently strong, it also raises questions about how much future upside the market has already recognized.

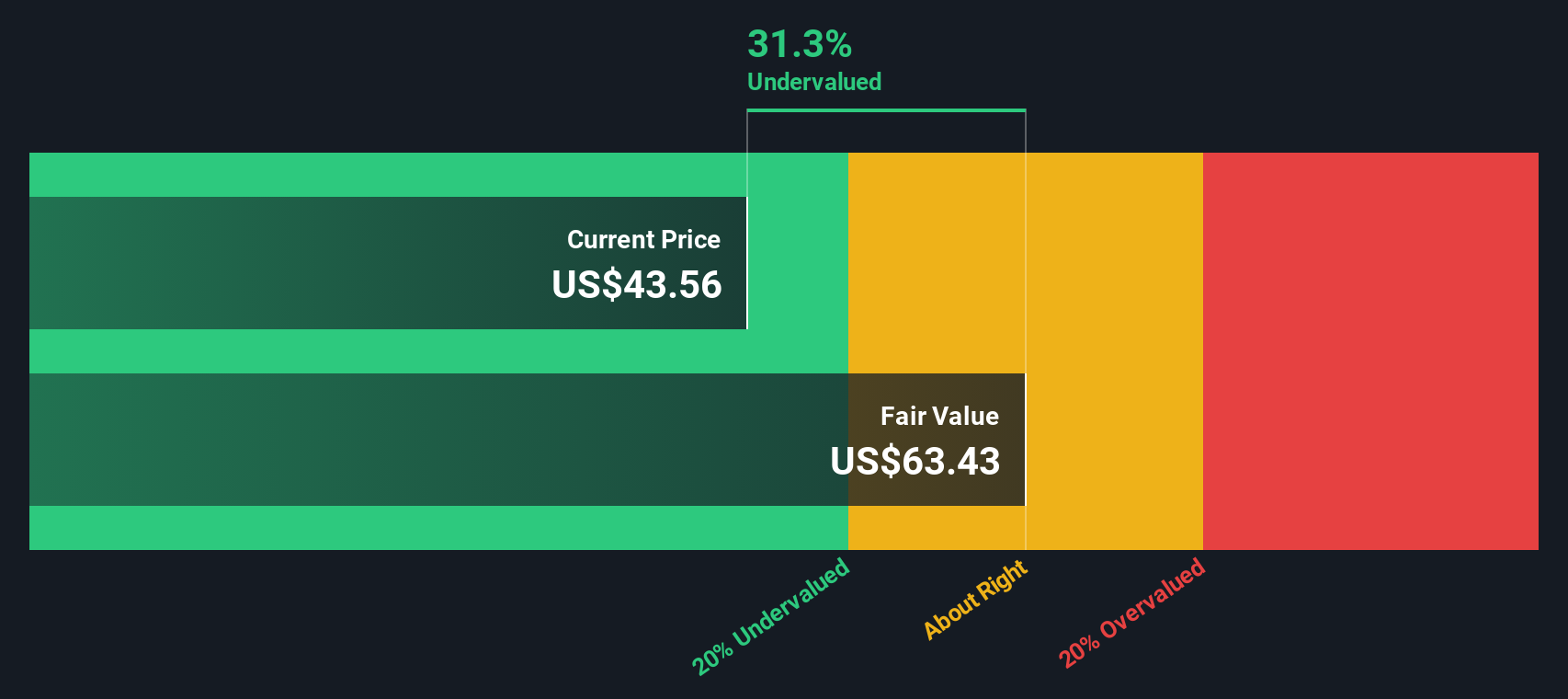

Given this setup, investors have reason to wonder whether after this run up BorgWarner is trading at a discount or if the market has already priced in all the good news.

Most Popular Narrative: Fairly Valued

According to community narrative, BorgWarner is considered fairly valued at current prices, with the consensus view suggesting the market price closely matches underlying business assumptions and long-term projections.

“Ongoing operational restructuring and cost controls, alongside battery business consolidation measures, are yielding improvements in adjusted operating margins and free cash flow, indicating enhanced profitability and the potential for structurally higher net margins as the company pivots to electrified products.”

Curious how this “fair value” is calculated? Analysts are banking on a dramatic transformation involving bold forecasts for margins and future profits. What hidden assumptions set this valuation apart from both the bulls and the bears? The figures behind the consensus might surprise you; your next investing insight could be just beneath the surface.

Result: Fair Value of $42.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as ongoing supply volatility and heavy reliance on combustion products could quickly shift market expectations and challenge this valuation narrative.

Find out about the key risks to this BorgWarner narrative.Another View: Discounted Cash Flow Analysis

While the community consensus sees BorgWarner as fairly valued based on market expectations, our DCF model presents a very different picture. It suggests the company could be significantly undervalued. Do these conflicting signals reveal a hidden opportunity, or are they simply the result of differing assumptions about the future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BorgWarner Narrative

If you think there’s more to uncover, or want to craft your own perspective from the data, you can put together your own BorgWarner narrative in just a few minutes and do it your way.

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep fresh opportunities on their radar. Broaden your horizons with some of the fastest-growing, high-potential themes on Simply Wall Street. Don’t let great investment potential pass you by. These tailored stock ideas could help you stay ahead of the curve.

- Accelerate your income strategy and spot top picks among dividend stocks with yields > 3% for consistent yields higher than 3%.

- Tap into the next big wave with forward-thinking AI penny stocks making headlines for breakthroughs in artificial intelligence.

- Zero in on competitive prices and uncover undervalued stocks based on cash flows that trade well below their fair value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com