If you’ve been eyeing Boyd Gaming (BYD) lately, the company’s latest move is worth a closer look. Boyd finalized the sale of its 5% equity stake in FanDuel to Flutter Entertainment for $1.76 billion, which is no small transaction. This major step not only unlocks significant capital but also positions Boyd to trim debt and pursue new strategic growth plans. In addition, management increased share repurchases and reaffirmed the dividend. This signals an ongoing commitment to shareholder returns even as the company navigates operational challenges such as flood-related closures and some softness in certain segments.

These maneuvers come after a strong run for Boyd Gaming’s stock. Shares have returned 44% over the past year, outpacing many peers. The momentum has continued, with a 19% gain year-to-date and a 14% increase in the past three months. The larger backdrop includes annual revenue contraction but essentially flat net income, presenting a mixed picture regarding efficiency and growth. Still, management’s assertive use of capital may indicate that they see value ahead, despite some sector headwinds.

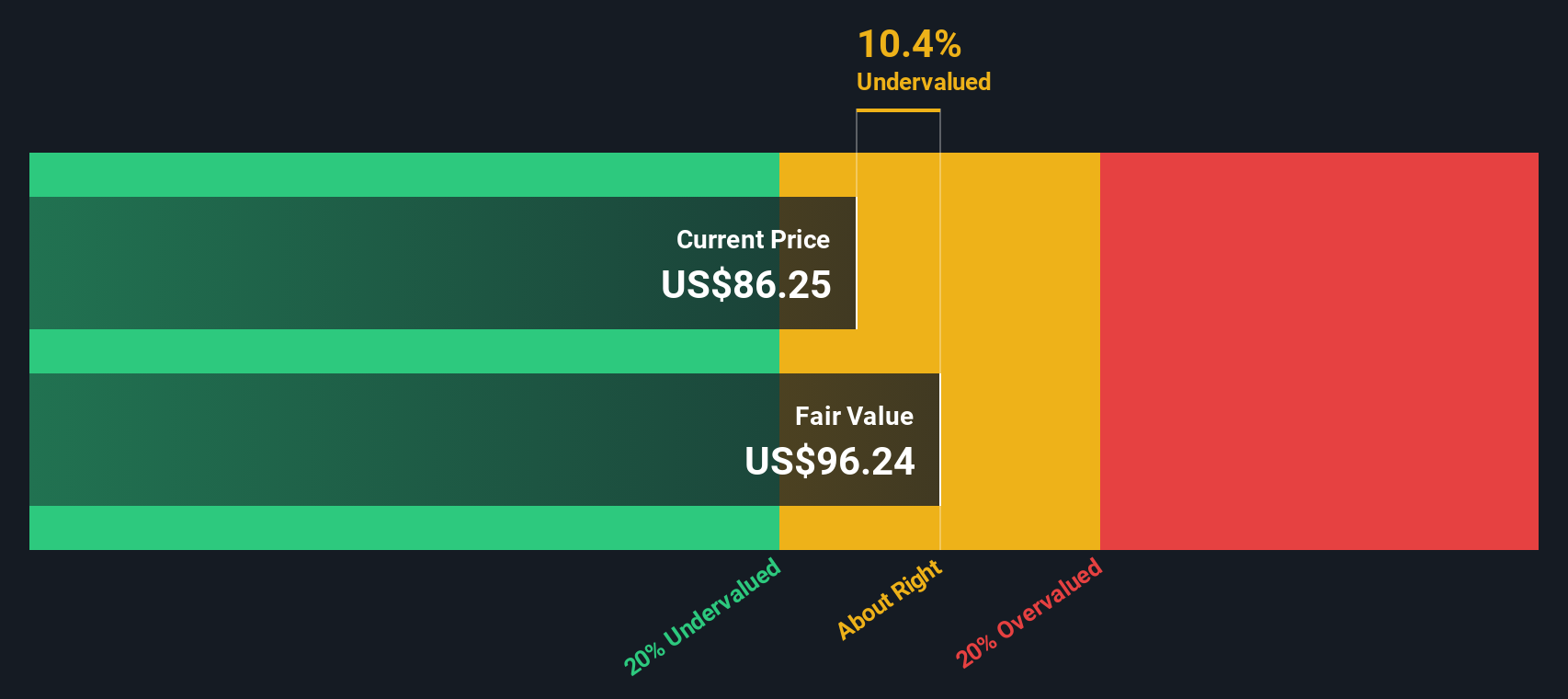

With all of this activity, the question remains whether Boyd Gaming is undervalued with more potential, or if the market has already priced in future growth to the share price.

Most Popular Narrative: 4.7% Undervalued

According to the community narrative, Boyd Gaming is currently considered undervalued by around 4.7%. This is based on projected improvements in profit margins and a tighter share count, balanced against anticipated revenue declines over the coming years.

Boyd Gaming's ongoing expansion activities, including the Sky River project and its phases, are expected to enhance gaming capacity and diversify offerings. These developments could potentially lead to future revenue growth. The company's investment in upgrading existing properties, such as the Suncoast renovation and new amenities at various hotels, is anticipated to enhance customer experience and could drive higher revenues and improved net margins.

Want to know what powers this valuation call? The narrative hinges on ambitious upgrades and behind-the-scenes financial shifts that could significantly impact Boyd Gaming. What projections are integrated into this outlook, and which milestones could influence the market view? Explore the full analysis to see what numbers are fueling these expectations.

Result: Fair Value of $89.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, competitive pressures at key properties and ongoing economic uncertainties could undermine Boyd Gaming’s profit outlook if conditions do not improve.

Find out about the key risks to this Boyd Gaming narrative.Another View: Discounted Cash Flow Perspective

Looking at Boyd Gaming through our DCF model shows a similar story and supports the previous assessment of value. This approach weighs future cash flows and adds another angle on what the market might be missing. Could this reinforce the current sentiment, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boyd Gaming Narrative

If you would rather dig into the numbers yourself and reach your own conclusions, you can develop a personalized story in just a few minutes. So why not do it your way?

A great starting point for your Boyd Gaming research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not limit your portfolio to a single story when fresh opportunities are just a click away. The Simply Wall Street Screener arms you with curated lists built to meet your exact strategy. Move ahead of the curve and find companies that match your ambitions with these powerful starting points:

- Supercharge your holdings with passive income potential by checking out dividend stocks with yields > 3%. Grow your returns with stocks boasting healthy dividend yields above 3%.

- Get ahead in the artificial intelligence race by scouting AI penny stocks. See which innovative companies are reshaping industries through advanced AI technology.

- Strengthen your portfolio’s defensive core by uncovering healthcare AI stocks. Pick from health-tech leaders using AI to transform patient care and medical diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com