Unum Group (UNM) just posted its Q2 2025 results, and the market was expecting a little more. The numbers missed Wall Street’s estimates, which is not a welcome surprise. However, management countered by signaling plans to ramp up share buybacks, now targeting the higher end of their $500 million to $1 billion goal for the year. Meanwhile, a prominent analyst adjusted their price target for the stock, reflecting caution but not panic. For investors tracking signals, these updates may bring mixed feelings, especially for those who value predictability in their portfolios.

Looking over the past year, Unum Group’s share price is still up over 30% even after this latest decline. The recent quarter did impact the stock, which is down 13% for the month and 14% over the past three months. This breaks the momentum seen earlier. In the broader context, the company’s three- and five-year returns remain notable, indicating long-term resilience despite short-term fluctuations. These mixed signals may encourage investors to reconsider whether the current valuation fully reflects the company’s performance.

With management increasing its buyback activity while the market lowers its expectations, there is debate as to whether this setback may signal an entry point, or if Wall Street is already incorporating potential future growth into the current price.

Most Popular Narrative: 24.9% Undervalued

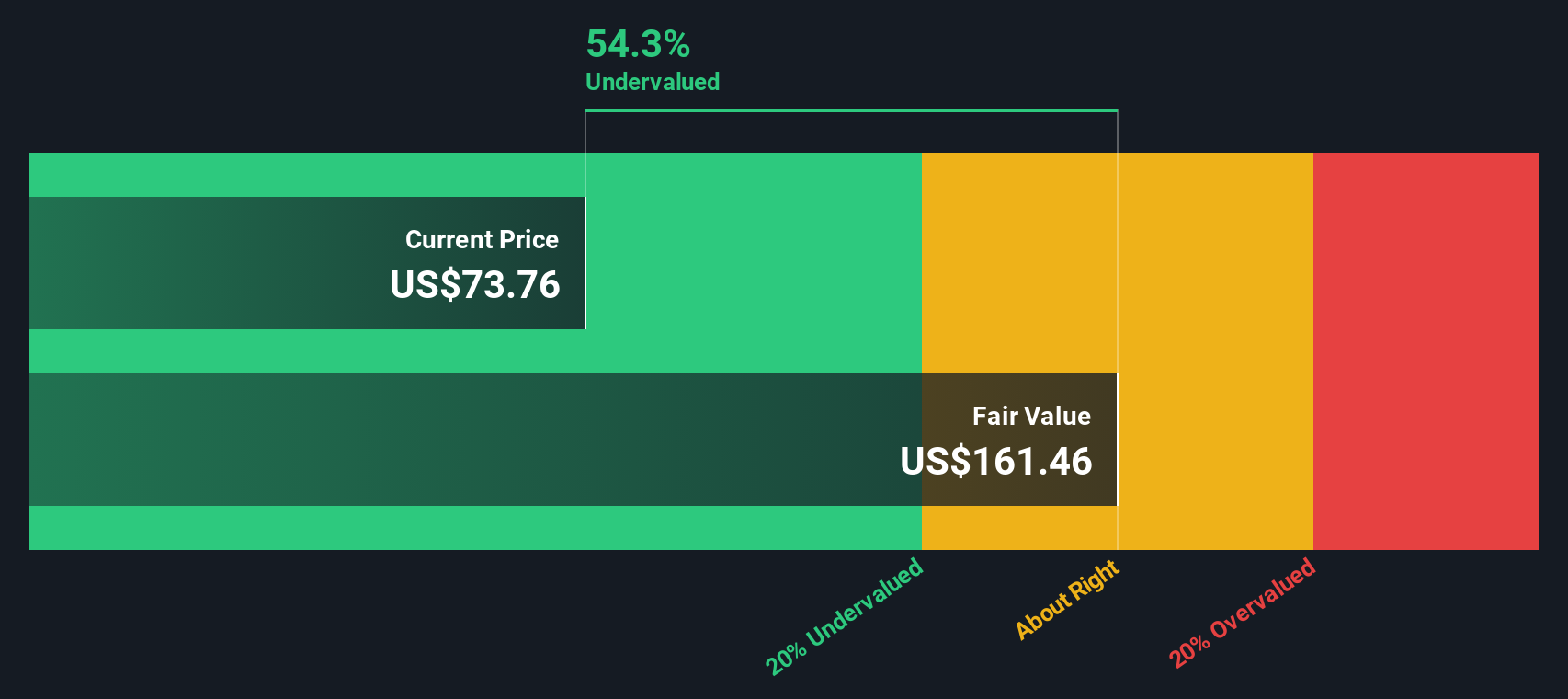

According to the community narrative, Unum Group is currently considered undervalued, with a fair value target well above its present share price. Analysts are pointing to several strategic drivers and market trends that they believe will support continued growth and solidify the fundamental case for further upside.

“Unum's ongoing investment in digital capabilities, exemplified by integration of platforms like HR Connect and recent tech acquisitions, has boosted customer persistency and improved client retention. This has supported stable premium growth and expanded net margins over time. The expanding focus among employers on employee and voluntary benefits, along with increasing awareness of supplemental products due to a competitive labor market, is allowing Unum to cross-sell more solutions and penetrate new market segments. These factors support premium and recurring revenue growth.”

How is this potential really calculated? The heart of this bullish thesis relies on a bold set of future financial targets and a profit multiple that stands out compared to industry norms. Want to discover exactly which assumptions could send Unum’s stock significantly higher? The real story behind this valuation involves big numbers, margin moves, and a valuation model you will not want to miss.

Result: Fair Value of $93.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent elevated benefit ratios or ongoing headwinds in the long-term care segment could quickly dampen this optimistic outlook for Unum Group.

Find out about the key risks to this Unum Group narrative.Another View: Discounted Cash Flow Model

While the first valuation focused on future earnings, our DCF model offers a different perspective. It suggests Unum Group remains undervalued and reinforces the bullish narrative, but it uses a distinct set of assumptions. Which model do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Unum Group Narrative

Keep in mind, if you see things differently or want to investigate the numbers yourself, you can bring your own view to life in just a few minutes. do it your way.

A good starting point is our analysis highlighting 6 key rewards investors are optimistic about regarding Unum Group.

Looking for More Smart Investment Ideas?

Expand your investing toolkit by tapping into powerful new opportunities with the Simply Wall Street Screener. Hundreds of unique companies await, and the right move today could put you ahead of the curve. Don’t miss out on sectors poised for breakthroughs, steady returns, and tomorrow’s top performers.

- Accelerate your growth potential by finding standout AI penny stocks in artificial intelligence, automation, and next-generation data analytics.

- Secure steady income streams by exploring top picks among dividend stocks with yields > 3%, where reliable yields and dividend consistency set these stocks apart.

- Ride the momentum of cutting-edge healthcare by identifying high-potential healthcare AI stocks companies innovating in medical diagnostics, patient care, and bioinformatics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com