Roper Technologies (ROP) just wrapped up its second quarter with better-than-expected earnings and revenue, fueled by standout gains from its Application Software arm and the smart integration of recent acquisitions. The company also raised its outlook for both earnings per share and revenue growth in 2025, which reflects confidence from management in continued operational strength. If you are holding or watching Roper, these updates might prompt you to consider whether this is a turning point for the stock, especially as the company raises guidance even as the broader tech sector experiences mixed investor sentiment.

Looking at the bigger picture, Roper’s stock has lagged modestly over the last year, dipping around 1% despite being up 4% year to date. Although the stock has declined roughly 5% since last quarter’s report, long-term holders have still seen a gain of 33% over three years and almost 30% in the past five years. This performance suggests that while recent momentum has slowed, investors have historically been rewarded for patience, particularly following periods of market softness or skepticism.

With expectations reset and results surpassing analyst estimates, the question now is whether Roper is undervalued with potential for further gains, or if the current price already reflects these improvements and future growth prospects.

Most Popular Narrative: 15.6% Undervalued

According to community narrative, Roper Technologies is seen as undervalued by analysts, with a fair value notably higher than today’s price. This perspective is driven by optimistic projections for recurring revenue and margin expansion in vertical SaaS segments.

Penetration of under-digitized, data-rich sectors such as faith-based organizations, healthcare, legal, and government contracting remains nascent. In some cases, such as Subsplash, only 50% of large total addressable markets (TAMs) are currently served, indicating substantial runway for recurring revenue and market share gains as digital transformation accelerates within these verticals.

What’s fueling this bullish outlook? Analysts are betting on sector-specific software that transforms overlooked markets, eyeing bigger margins and greater cash flow stability. Want to know the exact growth drivers behind the valuation call? The numbers and underlying assumptions might shift your view on Roper’s upside.

Result: Fair Value of $635.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on acquisitions and potential market saturation in niche sectors could dampen Roper’s growth trajectory, even with bullish projections.

Find out about the key risks to this Roper Technologies narrative.Another View: A Look at Market Comparisons

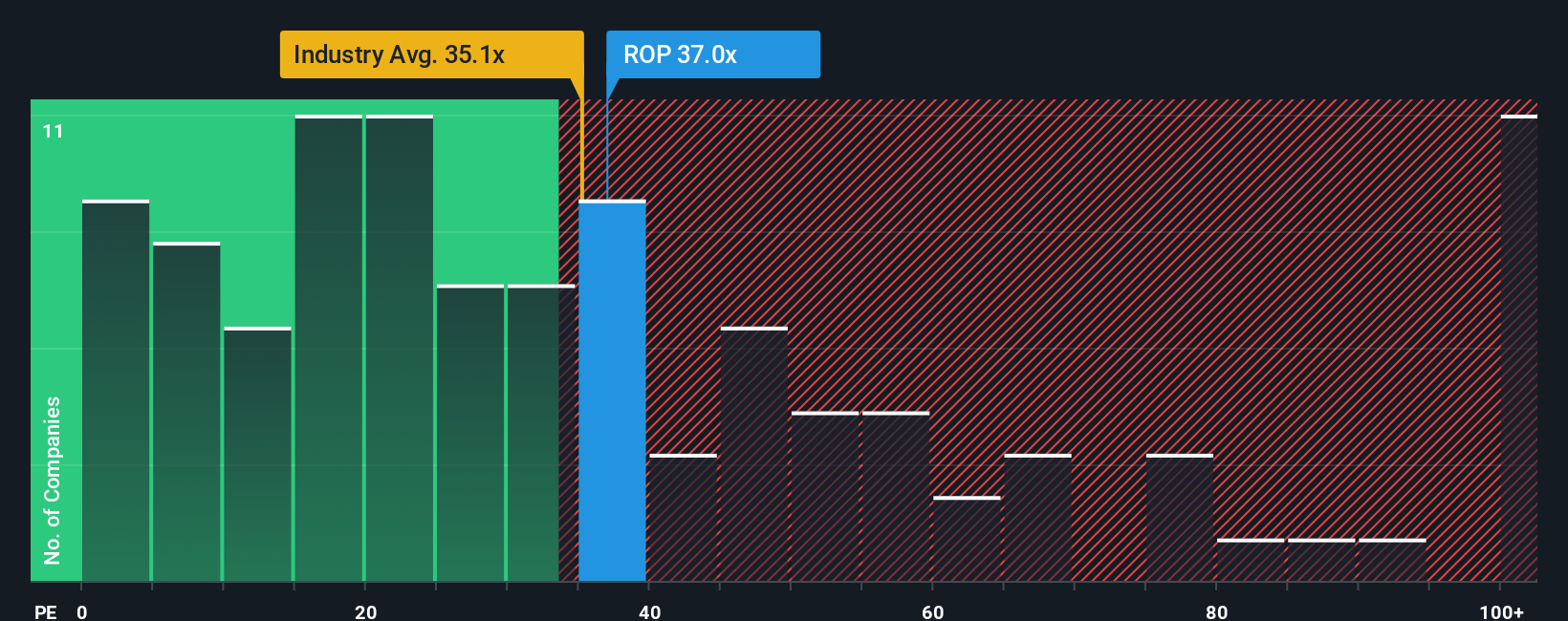

While our first approach highlights Roper Technologies as undervalued, a broader industry lens tells a different story. By comparing its valuation to peers across the software sector, the stock actually appears a bit expensive. This premium may signal genuine quality, or the market could be pricing in more growth than is likely.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roper Technologies Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily analyze the data and craft your own narrative in just a few minutes. Simply do it your way.

A great starting point for your Roper Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Why focus on just one opportunity when there are many ways to build a smarter portfolio? Explore emerging sectors and investment strategies where new prospects may be found. Take action to discover what the market can offer right now:

- Explore the future of medicine by evaluating breakthrough companies in artificial intelligence-powered healthcare through healthcare AI stocks.

- Enhance your search for stocks with consistent yields by reviewing reliable dividend-paying companies offering more than 3% annual returns with dividend stocks with yields > 3%.

- Track opportunities in cryptocurrency and blockchain innovation using cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com