CNH Industrial (NYSE:CNH) has just grabbed headlines with the launch of its New Holland PowerStar Electro Command, a flagship tractor aimed squarely at North America’s hard-working farms. The headline feature is an advanced 16x16 semi-powershift transmission designed to boost both efficiency and operator comfort during long days of frequent load changes. For investors, this kind of product innovation in a core market is always worth a second look, especially because it signals the company’s intent to stay competitive and relevant in a changing agricultural landscape.

That focus on innovation may help explain some of the buzz around the stock this year. After a sharp drop in the past month and quarter, shares have rebounded, climbing nearly 12% since January and 23% over the past year. While some of last year’s momentum had faded, this recent announcement has helped renew interest. With net income up 18% over the last year, there are signs that operational improvements could be taking hold. It is the kind of move that raises questions about how well the market is capturing CNH Industrial’s growth and value story.

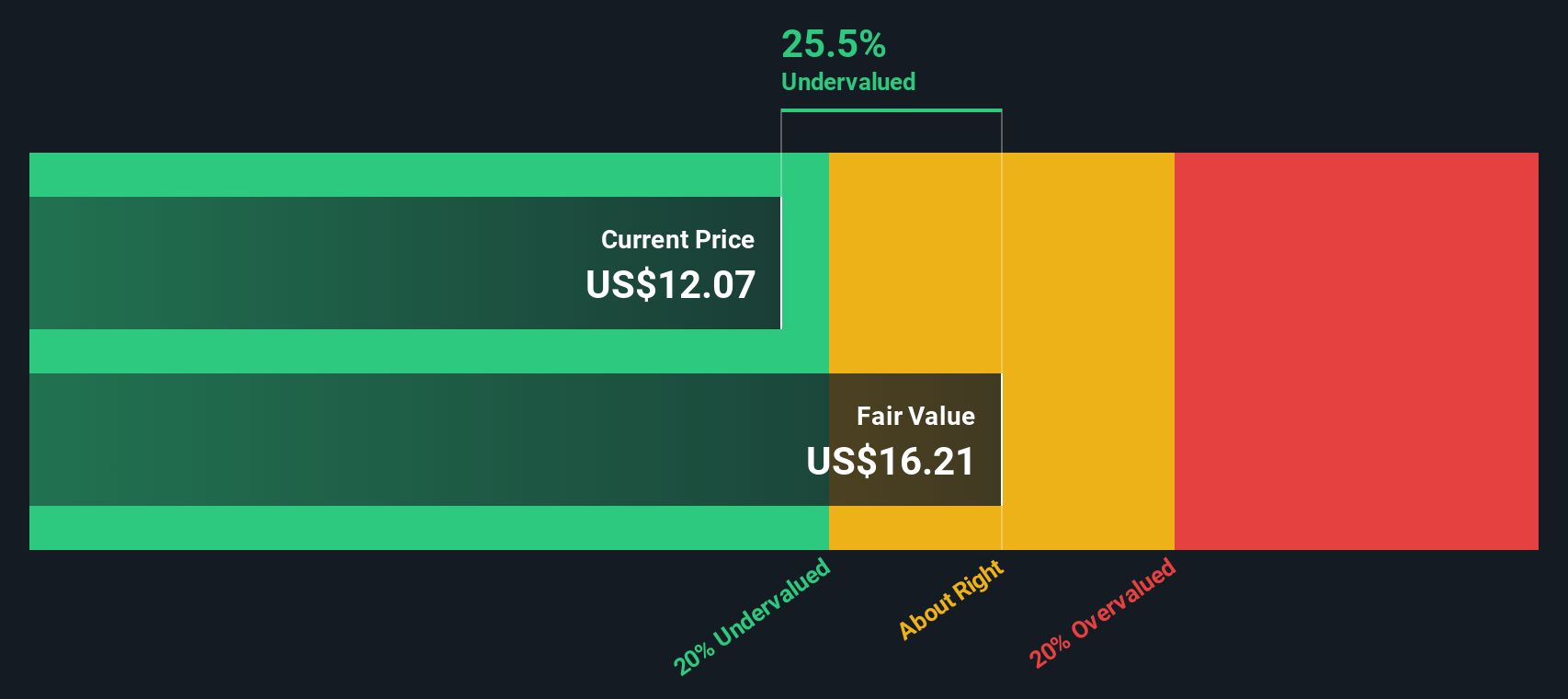

So is the market offering investors a rare chance to buy future growth at a discount, or has it already factored in CNH Industrial’s latest push for innovation?

Most Popular Narrative: 18.3% Undervalued

According to community narrative, CNH Industrial is trading well below its estimated fair value. Analyst expectations for future earnings growth and profitability are central to this positive valuation outlook.

The integration of advanced connectivity and precision technologies (for example, the Starlink partnership, FieldOps platform, and in-house tech stack) positions CNH to capture greater recurring, higher-margin revenue streams from software, data, and tech-enabled services. This supports net margin and long-term earnings growth.

Could the future of tractors and harvesters rest on a digital backbone? This narrative promises a surge in value through innovation that few expect. Want to uncover the core assumptions powering this bullish outlook, from revenue prospects to margin leapfrogs? Prepare for surprises in how the specialists reach their standout conclusion.

Result: Fair Value of $15.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent global cost pressures and heavy exposure to the North American market could undermine earnings growth, which may challenge the bullish outlook for CNH Industrial.

Find out about the key risks to this CNH Industrial narrative.Another View: What Does the SWS DCF Model Say?

Interestingly, our DCF model offers a second perspective and also points to CNH Industrial as undervalued, which is similar to the first method’s result. Does this consensus mean the market really is overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CNH Industrial Narrative

If you see things differently or want to dig into the numbers your own way, shaping your personal take is simple and quick. It only takes a few minutes – just do it your way.

A great starting point for your CNH Industrial research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great investors always keep their eyes open for the next big opportunity. Broaden your watchlist and move ahead of the pack with handpicked themes driving today’s market. Don’t let these compelling trends pass you by—get in while the story is just beginning.

- Uncover strong, high-yield payouts when you check out stocks offering yields above 3% with our dividend stocks with yields > 3%. Let your portfolio benefit from steady income growth.

- Zero in on potential market leaders as you target cutting-edge advances in healthcare by browsing healthcare AI stocks. This gives you access to innovation at the intersection of medicine and technology.

- Seize undervalued opportunities before the crowd by tapping into our research on companies trading below their intrinsic value with undervalued stocks based on cash flows. This can help you spot tomorrow’s bargains today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com