If you've been following Expedia Group (EXPE), you may have noticed its recent surge has caught quite a few eyes on Wall Street. The main spark behind this move appears to be fresh analyst upgrades to the company’s earnings projections for fiscal 2025. That, combined with a growing buzz among momentum investors, is shining a spotlight on Expedia’s current run and raising questions about where the stock might be headed next.

What’s fueling the optimism? In addition to upward earnings revisions, Expedia’s stock has been on a roll, up nearly 16% so far this year and boasting a sharp 57% gain from a year ago. Momentum has really ramped up since spring, with shares advancing almost 30% in the past three months. These moves come on the heels of Expedia consistently posting strong financials, including annual revenue and net income growth, and building a reputation as a favorite among momentum-driven strategies.

With that kind of track record this year, is Expedia Group still trading at a discount to its long-term potential, or have recent rallies already factored in the company’s future growth?

Most Popular Narrative: 3.4% Undervalued

According to community narrative, analysts see Expedia Group as slightly undervalued, citing its expanding global reach and technology-driven strategy. Their valuation reflects optimism tempered with realism about the company's growth prospects and competitive landscape.

Ongoing shift in consumer preference toward digital and mobile channels, paired with increased adoption of AI-powered search and personalization on Expedia's platforms, is driving higher conversion rates and improved retention, which should support sustained revenue growth and margin expansion.

The secret behind this undervaluation? Analysts are focused on significant changes in how and where travelers book trips, with technology being a key factor. Whether Expedia's growth narrative can meet these ambitious expectations or whether there is more to the underlying numbers remains to be seen. A thorough analysis of the narrative will be necessary to understand the full story behind these expectations for the future.

Result: Fair Value of $222.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in the U.S. travel market and tough competition from alternative platforms could challenge the upbeat projections for Expedia’s growth.

Find out about the key risks to this Expedia Group narrative.Another View: Discounted Cash Flow Perspective

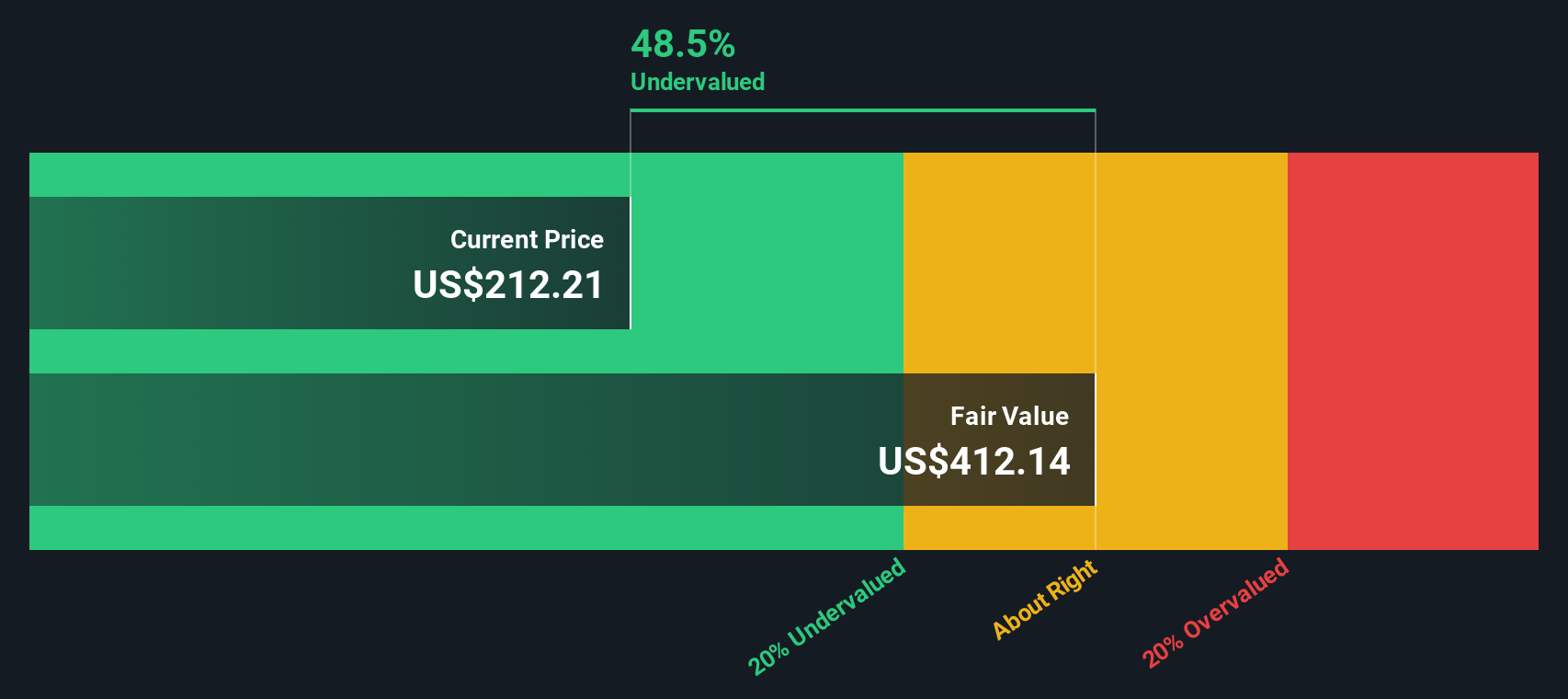

Taking a different approach, our DCF model suggests Expedia Group is more undervalued than the community narrative indicates. This perspective challenges the idea that the market has fully priced in the company’s future growth. Which lens offers the clearer picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Expedia Group Narrative

If you want to dig into the numbers and draw your own conclusions, you can generate a personal take on Expedia’s story in just a few minutes. Alternatively, you can simply do it your way.

A great starting point for your Expedia Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means spotting trends before the crowd. Why settle for the ordinary when you can target investments aligned with powerful themes and market moves? Don’t let opportunity slip by. Use Simply Wall Street’s tailored screens to find stocks that match your strategy and spark your portfolio’s growth.

- Uncover reliable income by checking out companies paying dividend stocks with yields > 3%. These combine attractive yields with solid business fundamentals.

- Accelerate your returns by selecting AI penny stocks. These are shaping the future with artificial intelligence breakthroughs and industry-disrupting innovation.

- Strengthen your portfolio with undervalued stocks based on cash flows. These show strong cash flow potential and may be trading below their fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com