Modine Manufacturing (MOD) just opened a new 100,000 square foot manufacturing facility in Chennai, India, marking a significant step to meet Asia-Pacific’s demand for advanced data center cooling. This is more than a typical ribbon cutting. Modine is now producing Airedale by Modine equipment locally, including its new AireWall ONE fan wall, to serve a region experiencing substantial growth from AI and digital infrastructure investments. The move allows Modine to stay closely aligned with rising demand and ambitious APAC tech projects. The company is adding its new Chennai plant to recent U.S. expansion efforts, strengthening its commitment to global scale.

Investors have paid close attention. Over the past month, Modine’s stock is up 35%, outpacing its broader industry and indicating shifting sentiment around its prospects. The company has already exceeded both earnings and revenue estimates for the past year. This latest initiative is a clear indication that Modine aims to secure and potentially expand its role in the data center trend. Share momentum has increased notably, with the stock rising over 20% for the year and contributing to long-term returns that reach into the triple digits over five years.

With this level of activity and growth ambition, some investors may wonder if there is an opportunity here or if the market has already priced in Modine’s expansion into the APAC data center sector.

Most Popular Narrative: 12.3% Undervalued

According to community narrative, analysts see Modine Manufacturing as undervalued at current prices based on ambitious growth expectations and improved margins.

The accelerating build-out of data centers and the need for next-generation cooling solutions are driving extraordinary demand for Modine's products. Management is forecasting the potential to double data center revenues from roughly $1 billion in fiscal 2026 to $2 billion by fiscal 2028. This structural demand from digital infrastructure is expected to materially boost revenue growth and deliver significant operating leverage over time.

Want to see what powers this bullish outlook? The narrative behind Modine’s fair value calls for a sharp ramp up in revenue and profits, using aggressive growth benchmarks usually reserved for industry disruptors. What hard numbers make this price target possible? Dive in and discover the precise expectations fueling this double-digit upside. See for yourself if the optimism stacks up.

Result: Fair Value of $160.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, major risks remain, including potential delays in customer orders and challenges integrating recent acquisitions. These factors could pressure Modine’s future margins and growth.

Find out about the key risks to this Modine Manufacturing narrative.Another View

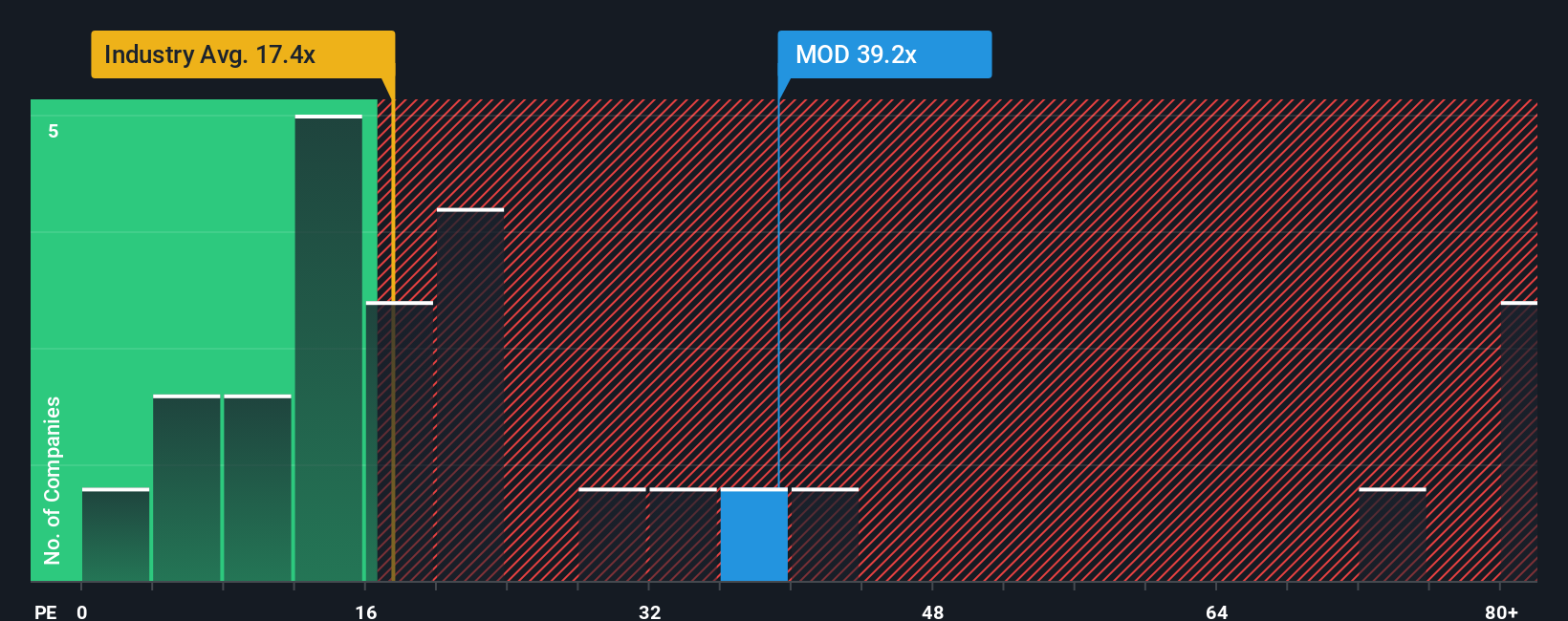

While the first valuation points to upside, a separate look at how the stock trades relative to industry norms raises a caution flag. This alternative approach shows Modine’s shares are valued high compared to its sector. Could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Modine Manufacturing Narrative

If you have a different take or want to dig deeper, you can quickly assemble your own custom view and conclusions in just a few minutes. So why not do it your way?

A great starting point for your Modine Manufacturing research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Opportunities?

Curious about what else is out there? The market is full of standout stocks you might be overlooking, each offering unique angles and potential for outperformance. Don’t let great ideas slip away. Use the Simply Wall Street Screener to spot your next big move before everyone else.

- Spot income-generating powerhouses when you check out companies paying dividend stocks with yields > 3%. This can help you build lasting returns with yields above 3%.

- Jump into the AI revolution by filtering for healthcare AI stocks. Trailblazers in medical technology are reshaping patient care and diagnostics.

- Stay ahead with a list of forward-thinking businesses driving quantum computing stocks. Explore how breakthroughs in quantum tech could transform your portfolio’s future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com