- Oshkosh Corporation has recently faced ongoing earnings declines, leading to increased skepticism among investors regarding the company's growth prospects, even as its price-to-earnings ratio remains below the broader market average.

- This skepticism has prompted some shareholders to accept lower selling prices, reflecting caution around potential earnings volatility and uncertainty about the reliability of analysts' growth forecasts for Oshkosh.

- We’ll examine how this investor skepticism over future earnings expectations could influence perceptions of Oshkosh’s long-term investment outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Oshkosh Investment Narrative Recap

To be an Oshkosh shareholder today, an investor needs conviction in the company’s ability to return to stable earnings growth and leverage ongoing demand in its end-markets. Despite recent earnings declines, the company's catalysts and big risks remain largely unchanged, with government contract execution still the most important short-term driver and exposure to end-market cyclicality remaining the key risk for now.

Among recent announcements, the raised 2025 earnings guidance stands out as most relevant, as it offers a counterpoint to the current earnings skepticism. The new outlook, supported by stable demand and limited tariff impacts, may help reinforce confidence if performance tracks guidance, yet only time will tell if these projections materialize as expected.

However, it's worth noting that if key government contracts were to be delayed or reprioritized, investors should be aware that ...

Read the full narrative on Oshkosh (it's free!)

Oshkosh's outlook anticipates $12.0 billion in revenue and $952.9 million in earnings by 2028. This scenario assumes a 5.0% annual revenue growth and a $302.5 million increase in earnings from the current $650.4 million level.

Uncover how Oshkosh's forecasts yield a $144.34 fair value, in line with its current price.

Exploring Other Perspectives

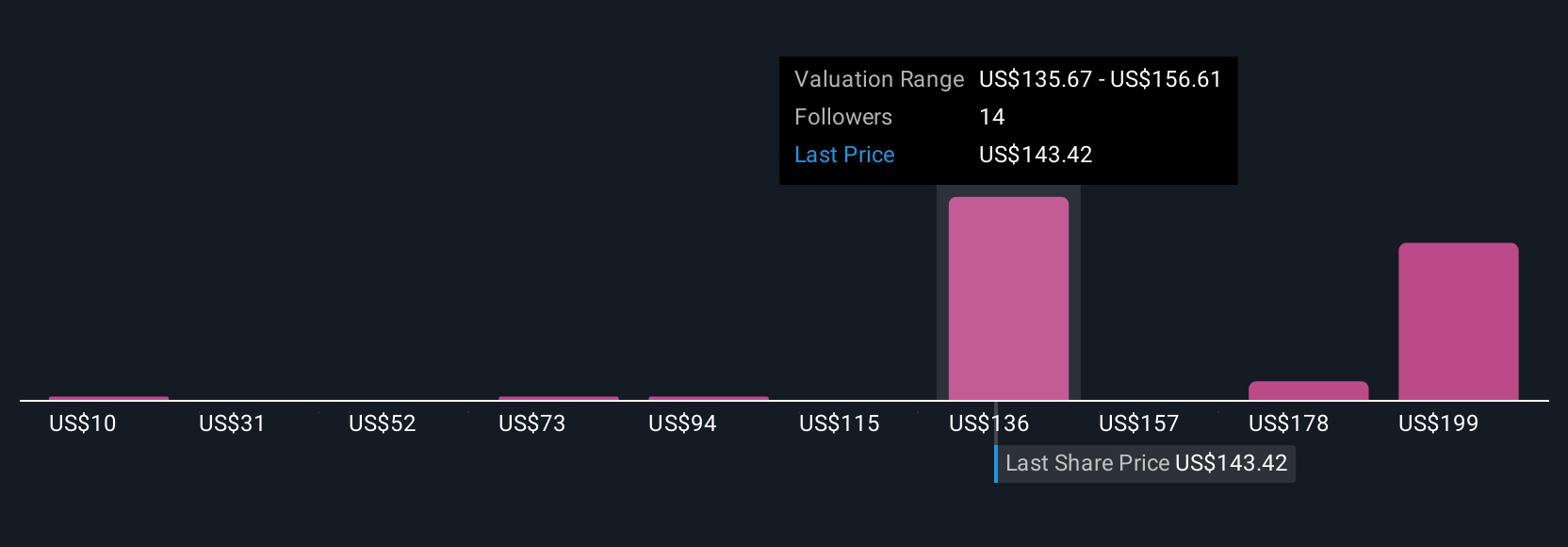

Simply Wall St Community members provided 7 fair value estimates for Oshkosh, ranging widely from US$10 to US$219.57. While contract execution remains a near term catalyst, these opinions show investors can differ sharply on the outlook and invite you to compare several viewpoints before deciding for yourself.

Explore 7 other fair value estimates on Oshkosh - why the stock might be worth less than half the current price!

Build Your Own Oshkosh Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oshkosh research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Oshkosh research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oshkosh's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com