Most Popular Narrative: 5.4% Undervalued

According to community narrative, Carnival Corporation & is considered undervalued based on projections of robust earnings and margin expansion, supported by several strategic catalysts.

"Carnival's targeted expansion of private destinations, such as Celebration Key (launching July 2025) and the RelaxAway and Isla Tropicale upgrades, directly leverages sustained high demand for leisure travel among a growing global middle class. These unique, highly curated beach experiences provide pricing power over land-based alternatives and are set to significantly increase guest volumes and onboard/ancillary spend per passenger, driving both revenue and net margin growth."

Want to uncover what is fueling this bullish outlook? One bold shift, woven into this narrative, could reshape Carnival’s earnings power for years. The real twist behind the consensus price target comes down to just a few key assumptions that analysts believe will lift profits and unlock value the market may be overlooking. Are you ready to see what could send this stock even higher? The numbers just might surprise you.

Result: Fair Value of $33.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising geopolitical instability and Carnival’s ongoing need for high capital outlays could put pressure on profits and investor confidence in the coming years.

Find out about the key risks to this Carnival Corporation & narrative.Another View: Discounted Cash Flow Model

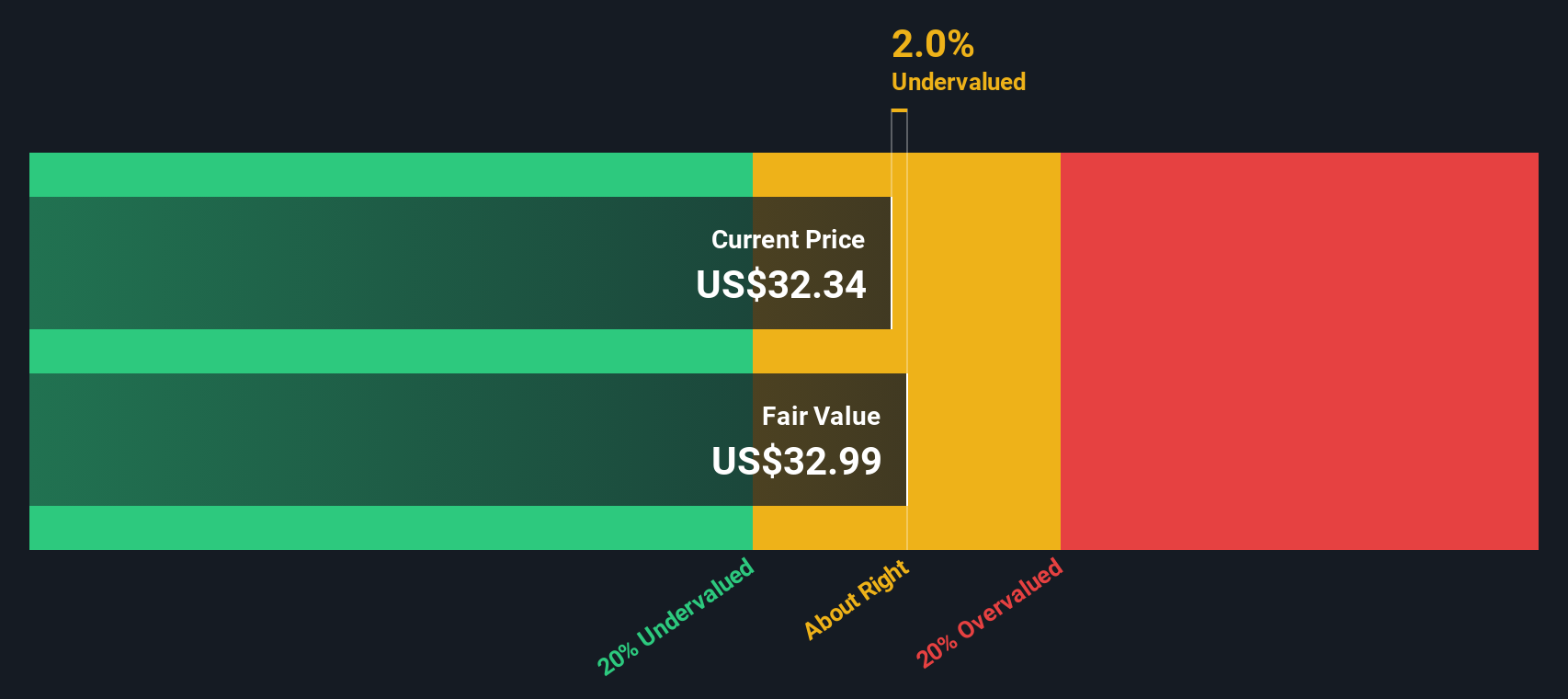

While analyst price targets suggest Carnival’s shares are undervalued based on future growth, our DCF model tells a similar story. This reinforces the idea that value may remain on the table. Could both methods be right, or are they missing something in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carnival Corporation & Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own story for Carnival in just a few minutes. Why not do it your way?

A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Every investor deserves a shot at the next big winner. Don’t stop at Carnival Corporation. There are exciting opportunities waiting for you right now. Take charge of your financial goals and check out these handpicked strategies that could give your portfolio the edge.

- Uncover earnings potential by tapping into undervalued stocks based on cash flows and zero in on stocks trading below their fair value estimates, backed by solid cash flows.

- Grow your income stream by targeting dividend stocks with yields > 3%, featuring companies with dividend yields above 3% and a commitment to rewarding shareholders.

- Embrace technological innovation through AI penny stocks and stay ahead with companies driving advancements in artificial intelligence across global industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com