If you are weighing what to do with Caterpillar (CAT) after its latest move, you are not alone. The company just announced a long-term strategic partnership with Hunt Energy to deliver power solutions specifically for data centers, riding the wave of AI-driven demand that is stretching energy grids. The initiative will kick off in Texas and aims to roll out up to 1GW of generation capacity across North America. This scale speaks directly to the rising pressures faced by data infrastructure providers and highlights the strategic opportunity in play for Caterpillar.

This announcement comes after a year of steady momentum for Caterpillar’s stock. Shares have climbed 26% over the past year, outpacing many peers, and recent months have seen an even sharper rise. Investors have taken notice, with short-term gains adding to a resilient long-term track record. Returns have more than doubled over five years, indicating that confidence in Caterpillar’s ability to capitalize on infrastructure trends is longstanding. While the Hunt Energy collaboration is the headline, it follows several product launches and deals that have broadened Caterpillar’s reputation as a diversified industrial powerhouse.

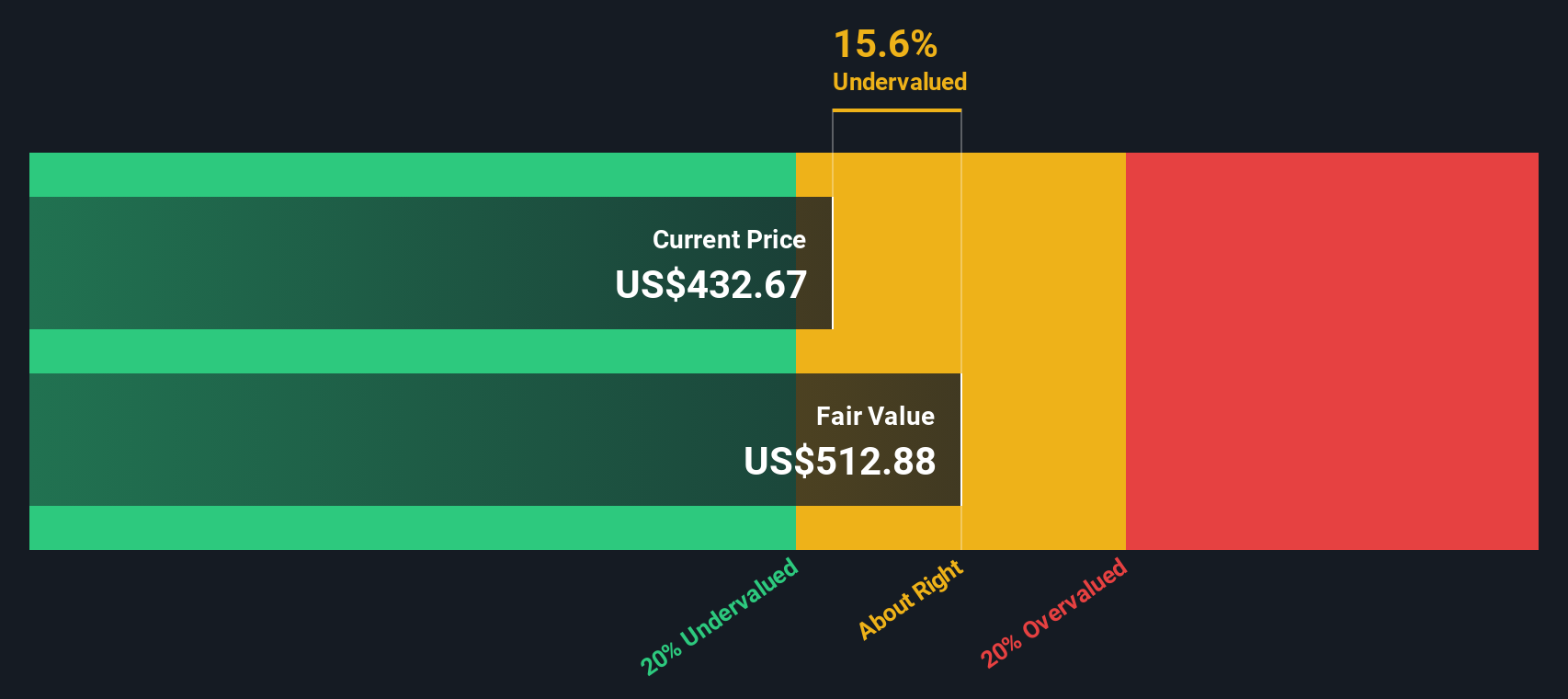

But with shares near their all-time highs and new strategic opportunities in the mix, some may wonder if this is a clear buying opportunity or if markets are simply pricing in years of future growth in advance.

Most Popular Narrative: 36.2% Overvalued

According to the narrative by Bailey, Caterpillar is considered significantly overvalued after factoring in a discount rate of 7.5% and future business growth challenges.

Shrinking stock buybacks will turn away investors who are seeking guaranteed capital returns. Caterpillar being late to electrify and automate their heavy machinery could see customers shift to more technologically advanced competitors.

Want to know what’s driving this bold call? The core of this narrative zeroes in on tough projections for market share and segment growth, with profit assumptions that may surprise even seasoned CAT investors. Curious how the analyst justifies a valuation so far below the current price? Dig deeper and discover the financial mechanics that fuel this eye-catching fair value call. It is not what most expect.

Result: Fair Value of $319.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Caterpillar’s sheer size and resource depth could enable it to leapfrog rivals with breakthrough products. Alternatively, infrastructure demand could surge beyond current forecasts.

Find out about the key risks to this Caterpillar narrative.Another View: SWS DCF Model Suggests Undervaluation

While the previous narrative points to overvaluation, our DCF model comes to a very different conclusion. It suggests Caterpillar could actually be trading below its intrinsic value, which raises new questions about market assumptions.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Caterpillar Narrative

If you have your own perspective or want to investigate the numbers firsthand, you can piece together your own narrative in just a few minutes, or do it your way.

A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by tapping into powerful trends shaping tomorrow’s markets. The Simply Wall Street Screener uncovers opportunities that others might miss, setting you up for smarter decisions and the chance to find your edge. Here are three exciting ways to broaden your strategy right now:

- Unlock reliable income streams and see which companies offer dividend stocks with yields > 3% by checking out dividend stocks with yields > 3%. This could bolster your portfolio with consistent returns.

- Spot emerging tech leaders by searching for AI penny stocks using AI penny stocks to get in early on the next wave of exponential growth potential.

- Tap into market value with undervalued stocks based on cash flows by using undervalued stocks based on cash flows to help you target shares the crowd may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com