- In the past week, Visteon attracted analyst upgrades and attention for its attractive valuation metrics, including favorable P/E and P/B ratios relative to industry averages, and achieved a top industry ranking from Zacks. This renewed analyst support highlights investor perception that the company may be undervalued based on traditional value metrics.

- The increased visibility and strong analyst backing for Visteon's valuation position prompts a closer look at how these signals could influence its overall investment narrative.

- We'll examine how analyst recognition of Visteon's strong value metrics could impact views on the company's future earnings and strategic direction.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Visteon Investment Narrative Recap

To be a Visteon shareholder, you need to believe that the company's technology focus and partnerships can drive growth despite cyclical industry risks and short-term production headwinds. The recent analyst upgrades reinforce the view that its shares may be undervalued on traditional metrics, but do not materially alter the most important catalyst: the company’s ability to win key business with major automakers, nor do they ease the biggest risk tied to potential tariff impacts and global production slowdowns.

Of Visteon’s recent announcements, its raised 2025 revenue guidance stands out as especially relevant to the current market conversation about valuation. This update highlighted the company’s confidence in business momentum, which underpins analyst enthusiasm while reinforcing the critical catalyst of winning new deals and expanding with global OEMs, amidst continued automotive sector volatility.

Yet, while value metrics are attractive, investors should not ignore the risk that, despite industry recognition, Visteon remains exposed to uncertainties surrounding tariff-related costs and...

Read the full narrative on Visteon (it's free!)

Visteon's outlook forecasts $4.3 billion in revenue and $260.2 million in earnings by 2028. This is based on an assumed 3.8% annual revenue growth rate, but a decrease in earnings of $30.8 million from the current $291.0 million.

Uncover how Visteon's forecasts yield a $122.50 fair value, in line with its current price.

Exploring Other Perspectives

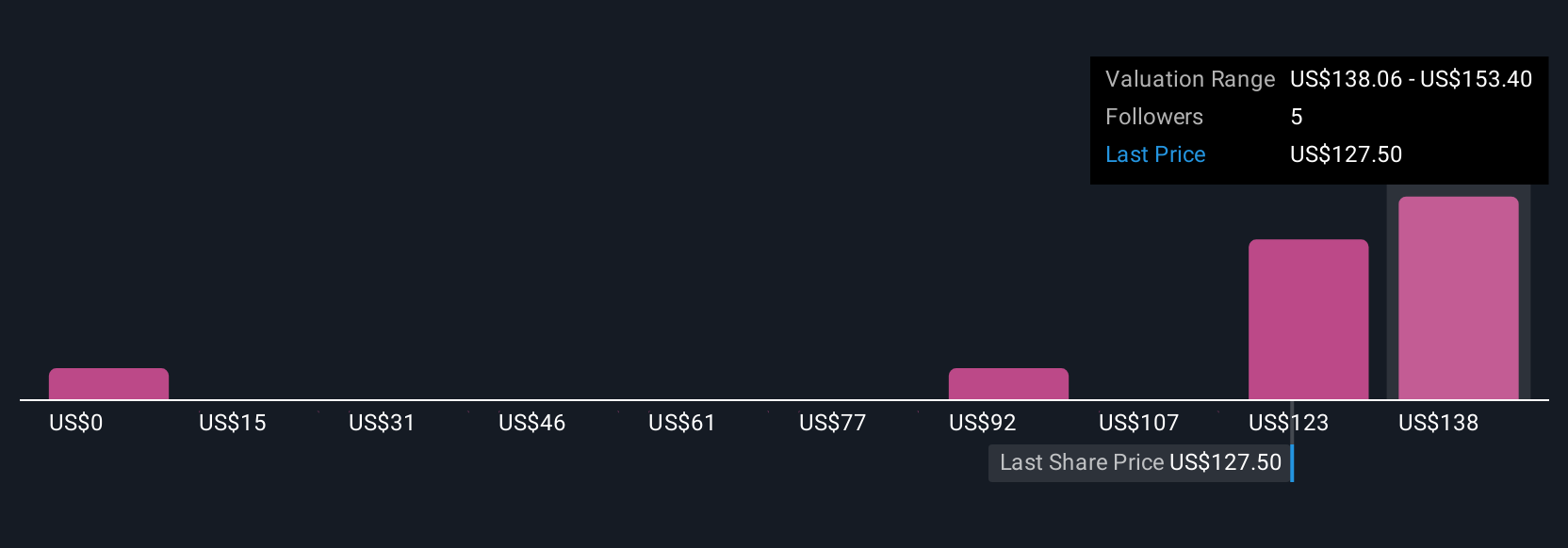

Five Simply Wall St Community member estimates for Visteon's fair value range widely from US$15.34 to US$153.45. While these community views vary, the ongoing risk posed by potential tariff headwinds remains a central concern that could impact future performance.

Explore 5 other fair value estimates on Visteon - why the stock might be worth less than half the current price!

Build Your Own Visteon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Visteon research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Visteon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Visteon's overall financial health at a glance.

No Opportunity In Visteon?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com