- Earlier this month, Hilton Grand Vacations completed a US$400 million securitization of timeshare loans and raised approximately US$302 million through a follow-on equity offering, alongside filing a shelf registration for up to US$1.14 billion in common stock.

- These combined debt and equity transactions significantly enhance Hilton Grand Vacations’ access to capital, which may influence both its growth trajectory and ability to manage its capital structure.

- We'll explore how these recent capital raises, particularly the fresh liquidity from the timeshare loan securitization, may reshape Hilton Grand Vacations’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hilton Grand Vacations Investment Narrative Recap

To be a Hilton Grand Vacations shareholder, you need confidence in the long-term appeal of the timeshare model, steady growth in engaged members, and the company's ability to convert strong leisure travel demand into higher margins. The recent US$400 million securitization and US$302 million equity raise provide meaningful near-term liquidity, but do not fully resolve one of the largest current risks: the persistently high allowance for bad debt and default rates in the receivables book, which remains a major focus for the balance sheet.

Among recent announcements, the US$400 million securitization of timeshare loans stands out, offering a further injection of capital at an average coupon rate of 4.69 percent and high advance rate. This directly relates to funding growth and managing credit risk, providing the company with fresh financial flexibility while also exposing it to the health of customer repayments, a dynamic that is closely tied to the most important short-term business risks discussed.

Yet, one detail investors should not overlook is the company’s exposure should customer loan defaults rise...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations' narrative projects $6.4 billion revenue and $814.7 million earnings by 2028. This requires 12.7% yearly revenue growth and a $757.7 million earnings increase from the current $57.0 million.

Uncover how Hilton Grand Vacations' forecasts yield a $53.56 fair value, a 15% upside to its current price.

Exploring Other Perspectives

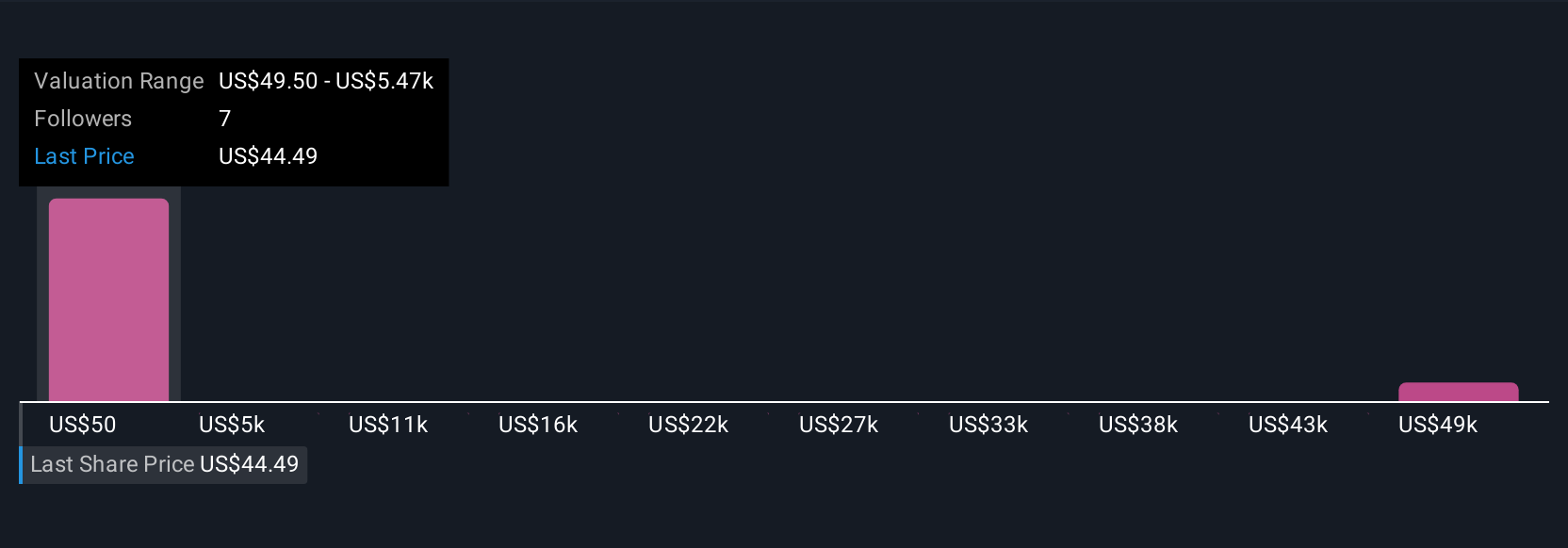

Simply Wall St Community members provided 4 fair value estimates, ranging from US$53.56 up to a high of US$54,269.95. Despite this wide dispersion, ongoing concerns around bad debt allowances and loan default rates remain a critical topic as you evaluate the company’s potential.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be a potential multi-bagger!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com