- PACCAR recently reported its second-quarter 2025 earnings, revealing per-share earnings of $1.37, which exceeded analyst forecasts but reflected a year-on-year decline; revenue and pre-tax income in the Trucks segment also decreased compared to the prior year.

- An interesting takeaway is that recent downward revisions in analyst estimates and a lower consensus rating highlight concerns about PACCAR's near-term growth prospects, even as its quarterly results surpassed expectations.

- We'll now examine how the Trucks segment's revenue weakness might alter the outlook set out in PACCAR's earlier investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

PACCAR Investment Narrative Recap

To own PACCAR stock, an investor typically needs to believe in the company’s ability to generate consistent cash flow and maintain industry leadership through cycles, especially as regulatory and pre-buy demand shape truck orders. The recent Trucks segment revenue weakness and reduced pre-tax income may moderate the pace of near-term improvement, but the most significant catalyst, pre-buying ahead of the 2027 emissions standards, remains intact. However, persistent order softness is the biggest risk and this earnings result could reinforce those concerns for now.

Of PACCAR’s recent announcements, the July launch of its joint venture with Accelera and Daimler to produce lithium-iron-phosphate truck batteries stands out for its relevance. Although this targets long-term demand trends, current quarterly results suggest that the more immediate impact on sentiment and valuation is coming from fundamental trucking market demand, rather than emerging technology partnerships.

By contrast, investors should be aware that sustained weakness in truck orders remains an ongoing challenge that could affect revenue and...

Read the full narrative on PACCAR (it's free!)

PACCAR's narrative projects $32.8 billion in revenue and $4.0 billion in earnings by 2028. This requires 1.8% yearly revenue growth and a $0.9 billion increase in earnings from $3.1 billion.

Uncover how PACCAR's forecasts yield a $104.38 fair value, a 3% upside to its current price.

Exploring Other Perspectives

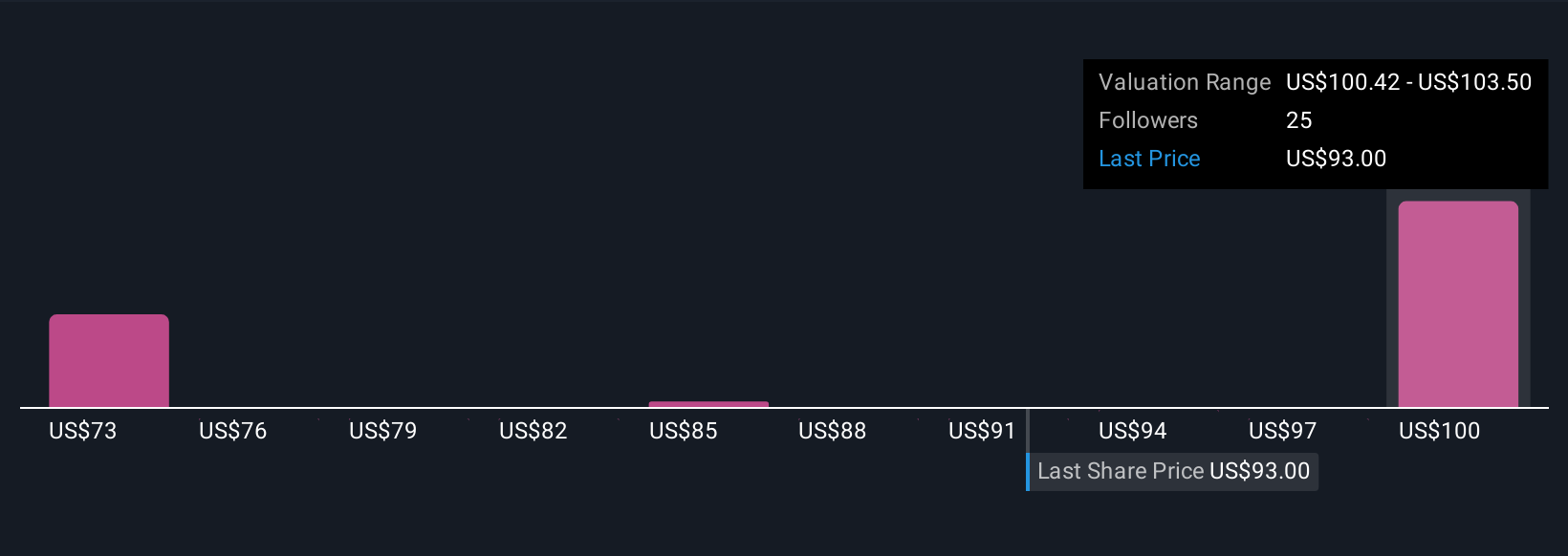

Three members of the Simply Wall St Community estimated PACCAR’s fair value between US$74.77 and US$104.38, highlighting a spread of opinions. When combined with recent analyst concerns about ongoing truck order softness, this range invites you to consider multiple viewpoints on the company’s outlook.

Explore 3 other fair value estimates on PACCAR - why the stock might be worth as much as $104.38!

Build Your Own PACCAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACCAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACCAR's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com