- Red Rock Resorts, Inc. (NASDAQ:RRR) recently reported a price-to-earnings ratio in line with the US median, despite forecasts pointing to a 9.1% annual earnings decline over the next three years.

- This contrast between average valuation metrics and a more negative earnings outlook relative to the broader market has highlighted growing investor concerns about the company’s future performance.

- We’ll examine how mounting concerns over Red Rock Resorts’ declining earnings outlook might reshape its broader investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Red Rock Resorts Investment Narrative Recap

To be a shareholder in Red Rock Resorts, you need to believe in the long-term growth and resilience of the Las Vegas locals market, as well as the company’s ability to capitalize on expansion projects and evolving demographics. While the forecasted 9.1% annual earnings decline raises questions about the sustainability of short-term momentum, this news does not materially affect the most important near-term catalyst: the ongoing ramp-up and performance of new and revitalized properties. The largest risk remains Red Rock’s high exposure to local economic swings, which could intensify if earnings continue to lag behind national trends.

Among recent company updates, the regular cash dividend announcement stands out as especially relevant to the earnings outlook. Despite the negative earnings forecast highlighted in the latest news, Red Rock Resorts maintained its Q3 dividend at US$0.25 per share, signaling an ongoing commitment to returning capital to shareholders, which may provide some reassurance as expansion projects continue and earnings trends fluctuate.

By contrast, investors should be aware that the company’s heavy concentration in the Las Vegas locals market leaves it...

Read the full narrative on Red Rock Resorts (it's free!)

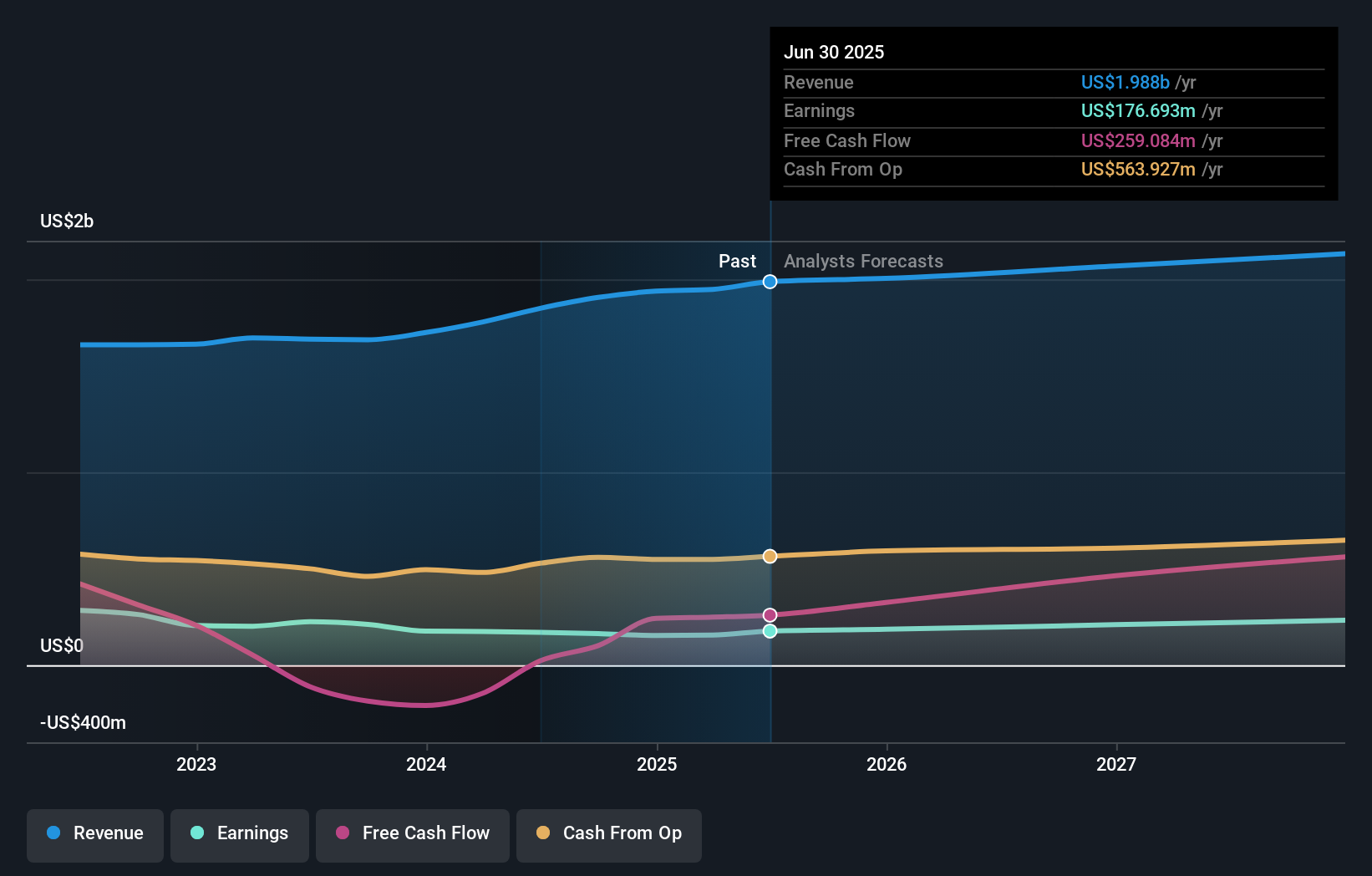

Red Rock Resorts' narrative projects $2.2 billion revenue and $245.8 million earnings by 2028. This requires 2.8% yearly revenue growth and a $69.1 million earnings increase from $176.7 million today.

Uncover how Red Rock Resorts' forecasts yield a $63.23 fair value, a 3% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member estimated fair value at US$98.27, well above current pricing. Community opinions differ widely, especially as recent earnings forecasts spotlight the impact of local market risk on future performance.

Explore another fair value estimate on Red Rock Resorts - why the stock might be worth as much as 60% more than the current price!

Build Your Own Red Rock Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Rock Resorts research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Red Rock Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Rock Resorts' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com