- Earlier this week, Life Time Group Holdings launched LTH Dream, a melatonin-free sleep support powder featuring a triple-magnesium complex, L-Theanine, Sensoril® Ashwagandha, and Phosphatidylserine, now available at its U.S. locations and online.

- This move strengthens Life Time's position in the expanding market for evidence-based, non-melatonin sleep solutions, further broadening its health and wellness supplement portfolio.

- We'll examine how the LTH Dream launch supports Life Time’s efforts to build higher-margin wellness offerings and expand consumer reach.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Life Time Group Holdings Investment Narrative Recap

As a Life Time Group Holdings shareholder, you need to believe in the sustained expansion of premium wellness clubs and the ability to grow high-margin ancillary services like supplements. The LTH Dream launch broadens their wellness portfolio, but its impact on near-term catalysts such as new club openings and revenue per member growth appears incremental; the core risk remains exposure to club development costs and macroeconomic headwinds affecting affluent consumers.

The recent refinancing of Life Time's $995 million term loan at a lower interest rate stands out. While it isn’t directly connected to LTH Dream, it could make a difference for the company’s largest near-term challenge by lowering interest expense and helping maintain capital flexibility for continued investment in club growth and wellness innovation.

But despite these strengths, bear in mind that sustained premium positioning could heighten sensitivity to changes in economic conditions, especially if...

Read the full narrative on Life Time Group Holdings (it's free!)

Life Time Group Holdings' narrative projects $3.8 billion revenue and $457.9 million earnings by 2028. This requires 10.3% yearly revenue growth and a $231.1 million earnings increase from $226.8 million today.

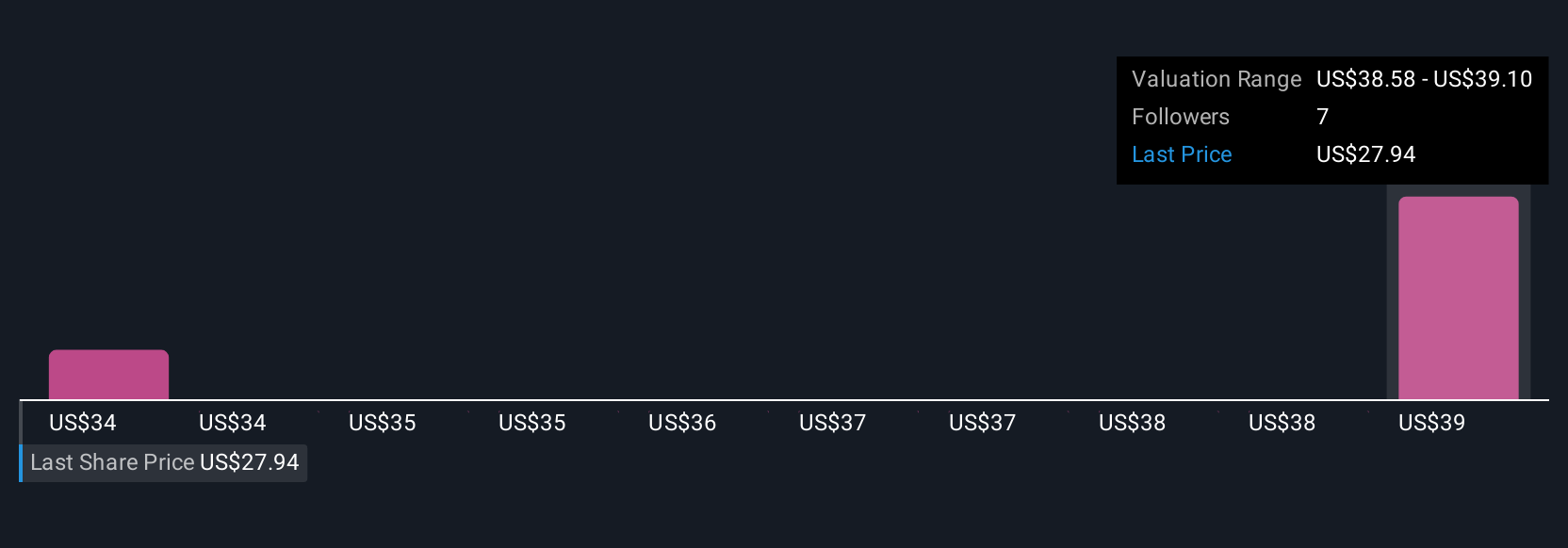

Uncover how Life Time Group Holdings' forecasts yield a $39.10 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value for Life Time stock between US$34.66 and US$39.10, across 2 unique perspectives. With the company aiming for higher-margin wellness offerings, your outlook may depend on where you see the greatest potential for ancillary revenue growth; consider how your assumptions stack up against other views.

Explore 2 other fair value estimates on Life Time Group Holdings - why the stock might be worth just $34.66!

Build Your Own Life Time Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com