Brightstar Lottery (NYSE:BRSL) is back in the investor spotlight after announcing a $250 million accelerated share repurchase program. Just weeks after the news broke, the company confirmed it bought back more than 13 million ordinary shares. This marks a decisive step to shore up investor confidence and optimize its capital allocation. For those wondering if this move signals a renewed push for growth or simply reflects management’s response to recent market pressures, the buyback warrants a closer look.

These headlines arrive as Brightstar Lottery’s stock performance shows a mixed story. In the short run, shares have jumped 12% over the past month and are up 3% in the last week. Looking at the past year, however, the stock is still down 8%. Despite this lull, Brightstar has delivered a 15% compound annual growth rate over five years, and long-term shareholders have outperformed the broader market, helped by regular dividend increases. The recent buyback is the latest in a series of shareholder-friendly decisions amid ongoing earnings volatility.

With momentum building but last year’s decline still recent, investors may be considering whether the rally is just catching up to fundamentals or if the market has already priced in all of Brightstar Lottery’s potential upside.

Most Popular Narrative: 12.1% Undervalued

According to community narrative, Brightstar Lottery is currently considered undervalued, with analysts pricing in notable upside versus the latest share price. Their valuation is based on a series of bullish growth and margin projections. If these are met, the company's shares could see significant gains in the years ahead.

Ongoing investment in proprietary digital platforms—including the MYLOTTERIES app and integrated OMNIA solution—is reducing customer acquisition costs and bolstering direct-to-consumer engagement. This suggests further net margin expansion as platform scale increases and technology investments deliver returns.

Curious about what is really fueling this bullish price target? The underlying analyst models incorporate forecasts of faster growth, an ambitious profit turnaround, and a higher future valuation multiple than might be expected in today's market. This narrative highlights digital transformation and contract wins as drivers for potential breakout performance. However, the most significant element may be the assumptions regarding how quickly profits recover. Interested in the specific numbers supporting this optimistic view? They are detailed in the full narrative.

Result: Fair Value of $18.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased regulatory scrutiny or a slowdown in Italy could quickly challenge the optimistic outlook that is driving Brightstar Lottery’s current valuation narrative.

Find out about the key risks to this Brightstar Lottery narrative.Another View: Discounted Cash Flow Suggests a Cautious Outlook

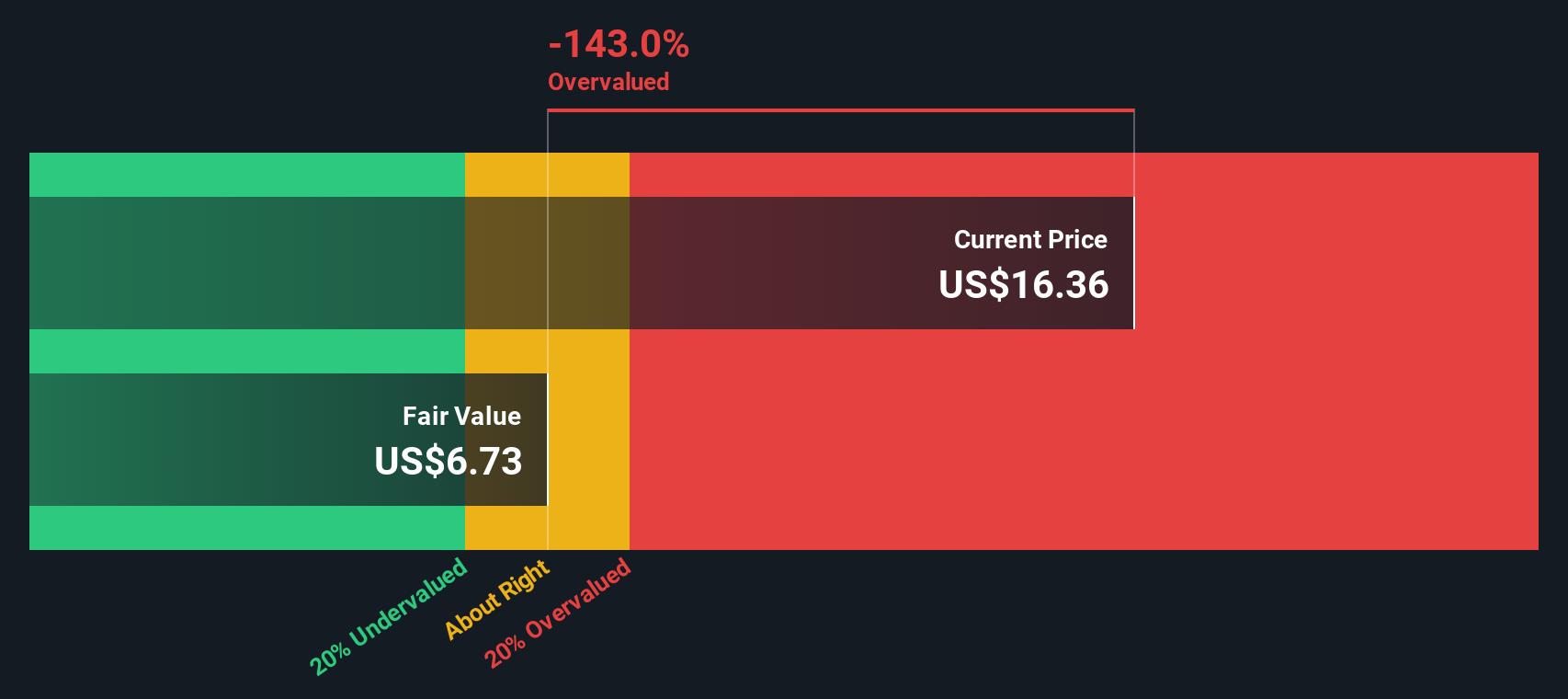

While the consensus price target appears optimistic, our DCF model presents a much more conservative picture and indicates the stock could be trading above its fair value. This raises the question of whether the upbeat narrative from analysts should be reconsidered.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brightstar Lottery Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can easily piece together your own narrative in just a few minutes. do it your way.

A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More Stock Opportunities?

Unlock your next investment win by checking out new ideas that go beyond Brightstar Lottery. Why settle for ordinary stocks when market-shaping trends and smart strategies are just a click away? Take charge and make sure you never miss the kind of opportunities that could transform your portfolio.

- Tap into financial resilience and spot companies positioned for long-term payouts by browsing a curated list of dividend stocks with yields > 3%.

- Unleash your curiosity and track high-potential businesses advancing artificial intelligence in healthcare by exploring healthcare AI stocks.

- Capture value before the market catches on by reviewing leading names in undervalued stocks based on cash flows. See which stocks could offer upside based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com