- On August 12, 2025, Terex Corporation and certain subsidiaries amended their credit agreement, resulting in lower interest rates for U.S. Dollar denominated term and revolving loans and removing a subsidiary as a borrower under the facility.

- This refinancing is expected to provide meaningful cost savings and streamline Terex’s financing arrangements, potentially enhancing the company's financial flexibility and profitability.

- We’ll examine how these reduced financing costs could shape Terex’s investment narrative and outlook for margin improvement.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Terex Investment Narrative Recap

To own Terex stock, you need to believe in the company’s ability to leverage global infrastructure investment trends, manufacturing upgrades, and demand for next-generation equipment to drive steady revenue and margin growth. The recent credit agreement amendment brings lower interest rates and streamlines financing, providing cost relief that could modestly ease near-term margin pressures, though this is unlikely to materially override the biggest current risk: hesitation in equipment purchases and potential revenue softness due to persistent macro uncertainty.

Among recent announcements, Terex’s intention to issue US$750 million in senior notes to fund the Environmental Solutions Group acquisition ties directly to its growth catalysts. This move fits with the idea that operational synergies and increased scale could offset some cyclical pressure, further supporting the case for operational margin improvements as underlying demand fluctuates.

However, investors should be equally aware that, while recent financing improvements help, pressure from prolonged high interest rates and delayed purchasing cycles remains a real concern for...

Read the full narrative on Terex (it's free!)

Terex's outlook anticipates $6.1 billion in revenue and $529.9 million in earnings by 2028. This implies a 5.9% annual revenue growth and a $350.9 million earnings increase from the current earnings of $179.0 million.

Uncover how Terex's forecasts yield a $55.20 fair value, a 7% upside to its current price.

Exploring Other Perspectives

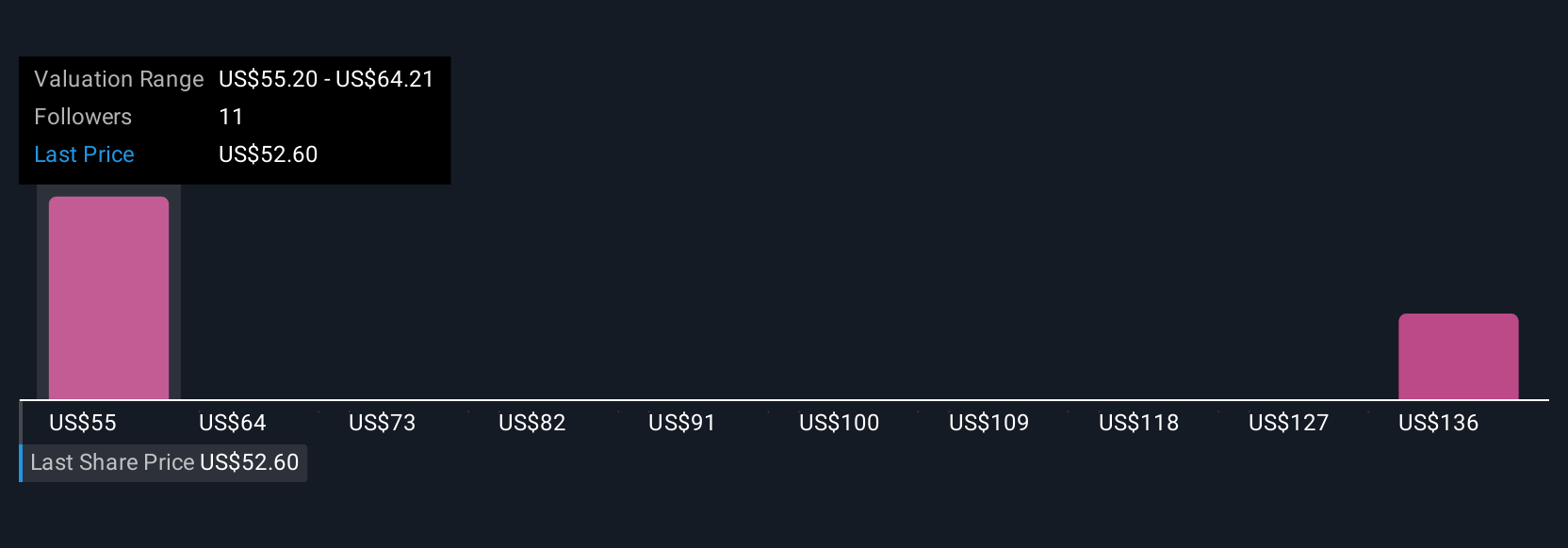

Three community members on Simply Wall St offered fair value estimates for Terex ranging from US$55.20 to US$145.19, highlighting wide opinion differences. With cost relief from refinancing potentially easing margin headwinds, it is worth exploring how such diverse outlooks reflect today's uncertainty and future prospects.

Explore 3 other fair value estimates on Terex - why the stock might be worth just $55.20!

Build Your Own Terex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Terex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terex's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com