Vail Resorts (MTN) just rolled out its 2025/26 ski season plans, but this was more than a simple calendar update. Alongside revealing opening dates for more than 90 resorts, the company announced upgrades including the new Sunrise Gondola at Park City Mountain, two modern six-seater chairlifts in Switzerland, digital enhancements for ski lessons, and a fresh set of guest perks such as Epic Friend Tickets and the removal of reservation requirements. These announcements immediately caught investor attention, especially given last winter’s guest experience challenges and the recent leadership transition.

The stock’s price action this year has been mixed. After a tough start to 2025 with year-to-date losses, the last three months have shown a 10% rally, pointing to growing optimism. Still, Vail Resorts trades nearly 3% below its level from a year ago and has trailed over a five-year period. Investor sentiment appears to be shifting as the market processes new investments and a sharpened operational strategy.

With this momentum and investment, some are asking whether Vail Resorts is presenting an entry opportunity or if the market has already priced in the company’s next phase of growth.

Most Popular Narrative: 10% Undervalued

According to the community narrative, Vail Resorts is currently viewed as undervalued, with analyst consensus estimating roughly 10% upside compared to its fair value. This outlook is driven by future earnings growth, enhanced margins, and a sharpened focus on guest experience and international expansion.

Continued investment in guest experience through lift, terrain, and food and beverage expansions, along with technology upgrades like My Epic App and AI capabilities, are expected to drive higher ancillary revenue and overall customer satisfaction. These factors may contribute positively to revenue growth.

Curious about what is really powering that bullish price target? There is a bold playbook within analyst assumptions, including improved efficiency, growing profitability, and ambitious projections. The core factors behind this valuation can be found in the forecasted numbers and the expectations included in that fair value.

Result: Fair Value of $181.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if visitation trends remain weak or foreign currency swings continue, these factors could quickly challenge the upbeat analyst outlook for Vail Resorts.

Find out about the key risks to this Vail Resorts narrative.Another View: Our DCF Model Suggests a Deeper Discount

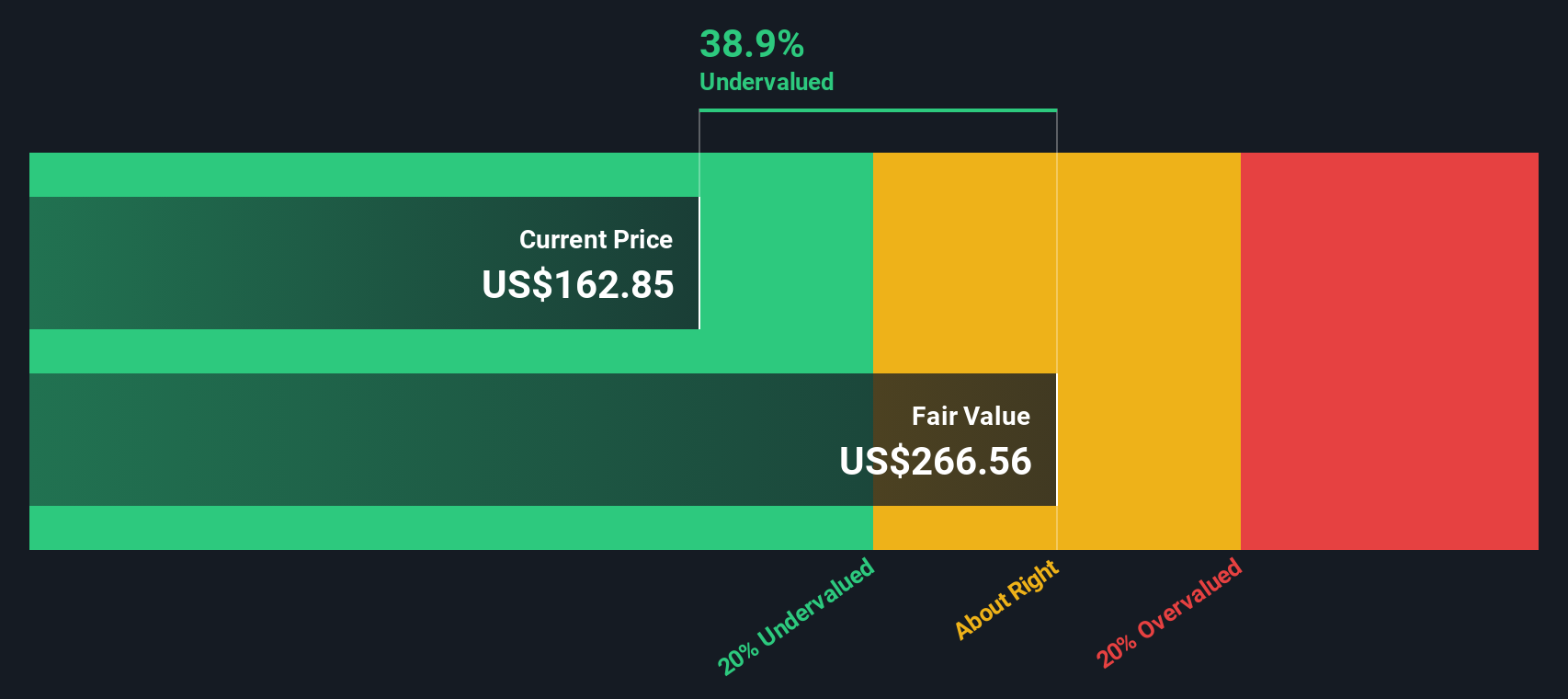

While analysts point to modest upside, the SWS DCF model presents a different perspective, indicating an even greater undervaluation. Could this deeper discount mean the market is overlooking something, or are risks keeping buyers hesitant?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vail Resorts Narrative

If you have a different perspective, or want to examine the numbers on your own terms, you can build your own view in just a few minutes. do it your way.

A great starting point for your Vail Resorts research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors know that opportunity is everywhere. You just need the right tools to spot it. Don’t limit your portfolio to one story when you could capture tomorrow’s breakout trends today. Make the most of your research with these timely stock ideas from Simply Wall Street’s powerful screener:

- Target consistent income by zeroing in on established businesses rewarding shareholders with dividend stocks with yields > 3%.

- Tap into innovation by seeking out pioneers transforming healthcare with healthcare AI stocks.

- Capitalize on potential market disruption by uncovering smart bets among the latest cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com