Most Popular Narrative: 16.4% Undervalued

According to community narrative, H World Group is currently seen as notably undervalued relative to its projected growth and operational improvements. The valuation estimate applies a discount rate specific to prevailing company and market conditions.

The ongoing expansion into lower-tier cities and network growth, despite short-term RevPAR pressure and a challenging macro backdrop, positions H World Group to capitalize on rising domestic travel fueled by urbanization and an expanding middle class. This supports robust top-line revenue growth as the economic environment normalizes.

Curious about what is fueling this bullish outlook? The underlying narrative hints at ambitious expansion plans and margin advances that could redefine expectations for future earnings, revenue, and market positioning. Want to uncover the crucial financial forecasts and industry trends justifying the projected fair value? Explore further to see what assumptions are shaping analyst consensus for H World Group’s worth.

Result: Fair Value of $43.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent RevPAR weakness and the risk of overexpansion into lower-tier markets could dampen earnings growth and present challenges to the bullish outlook.

Find out about the key risks to this H World Group narrative.Another View: DCF Model Offers a Different Take

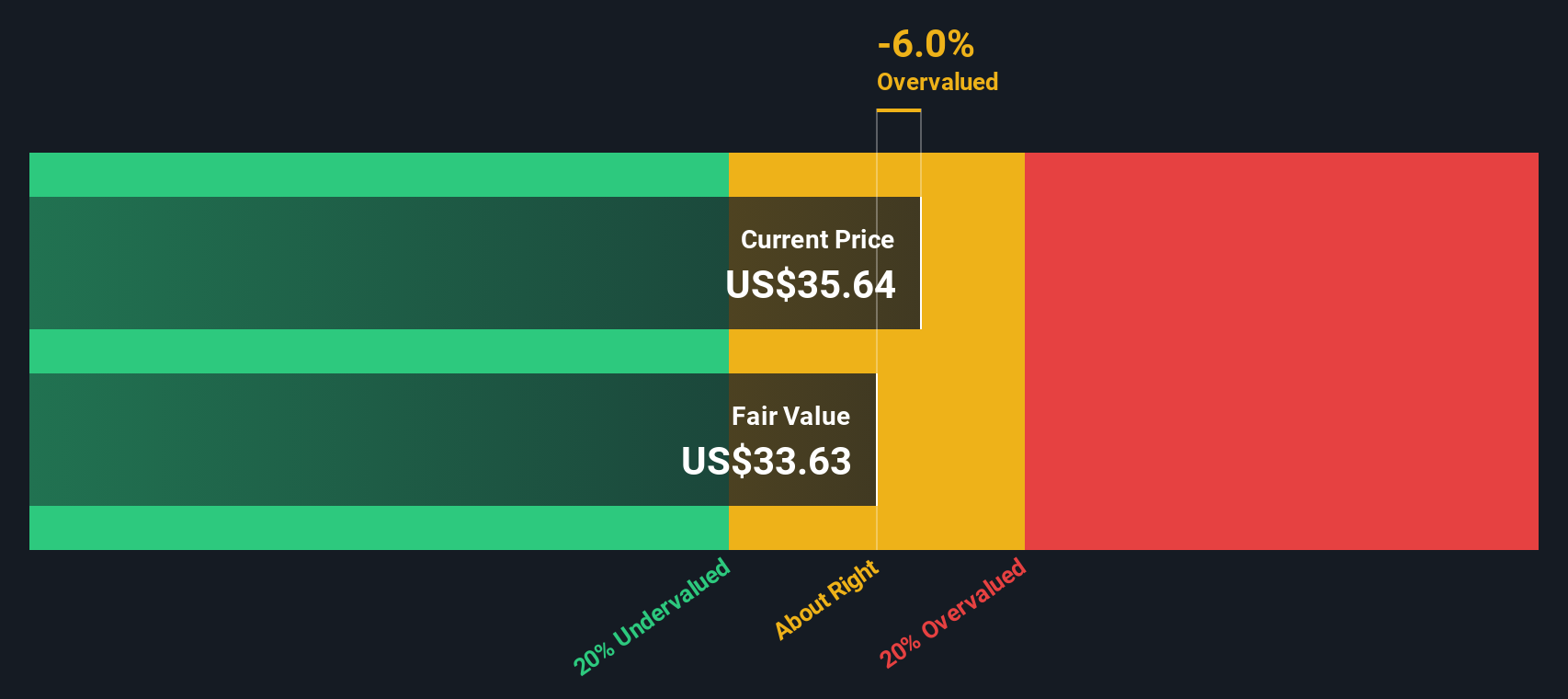

While the earlier view highlights the company's value based on future growth, the SWS DCF model presents a more cautious perspective. It suggests the shares might be priced above their calculated fair value. Which approach reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own H World Group Narrative

If you feel differently or want to interpret the evidence for yourself, you have the tools to shape your own view of H World Group in just a few minutes. do it your way.

A great starting point for your H World Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take your investing to the next level by checking out handpicked strategies you may not have considered. Uncover high-potential stocks chosen for strong credentials and future growth. Don’t just stop at one company — some of the market’s brightest ideas are waiting for you right now.

- Target steady cash flow and boost your portfolio income by browsing a selection of dividend stocks with yields > 3% that deliver above-average yields.

- Ride the artificial intelligence surge and capture tomorrow’s tech leaders with our premier list of AI penny stocks powering innovation in the digital age.

- Capitalize on strong fundamentals where others overlook by seeking out penny stocks with strong financials that pair value with financial health for outsize growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com