- Following comments from Federal Reserve Chair Jerome Powell suggesting the potential for interest rate cuts, shares of Hyatt Hotels recently experienced a strong market reaction as investor sentiment improved across the hospitality sector.

- This development emphasizes how broader economic signals, especially those related to interest rates, can influence performance expectations for travel and leisure companies like Hyatt.

- We’ll now assess how renewed optimism about lower interest rates may further support Hyatt’s asset-light growth strategy and future outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hyatt Hotels Investment Narrative Recap

To own Hyatt Hotels stock today, an investor typically believes in the strength of global travel demand, Hyatt's ongoing asset-light shift, and the company’s resilience in adapting to changing economic signals. The recent optimism around interest rate cuts could spark more leisure and business bookings, supporting Hyatt’s asset-light expansion in the near term; however, the risk of shifting booking behavior in the U.S. and uncertainties around the Playa acquisition still represent meaningful challenges to short-term profitability. The interest rate news is material as it could reinforce demand, but investors must watch booking trends and acquisition hurdles closely.

Against this backdrop, Hyatt’s July 2025 opening of the Royal Beach Hotel Punta Cana under the JdV by Hyatt brand in the Caribbean illustrates the company's push into growing markets and its asset-light approach, an expansion well-timed if rate cuts enhance travel demand. For those focused on near-term catalysts, new property rollouts and loyalty program growth remain key, but lingering risks around booking behaviors and acquisition uncertainties shouldn’t be overlooked.

On the flip side, investors should also weigh the possibility that shifting leisure and business booking patterns in key U.S. markets...

Read the full narrative on Hyatt Hotels (it's free!)

Hyatt Hotels' narrative projects $8.3 billion in revenue and $548.2 million in earnings by 2028. This requires 37.3% yearly revenue growth and a $116.2 million earnings increase from $432.0 million today.

Uncover how Hyatt Hotels' forecasts yield a $154.42 fair value, a 7% upside to its current price.

Exploring Other Perspectives

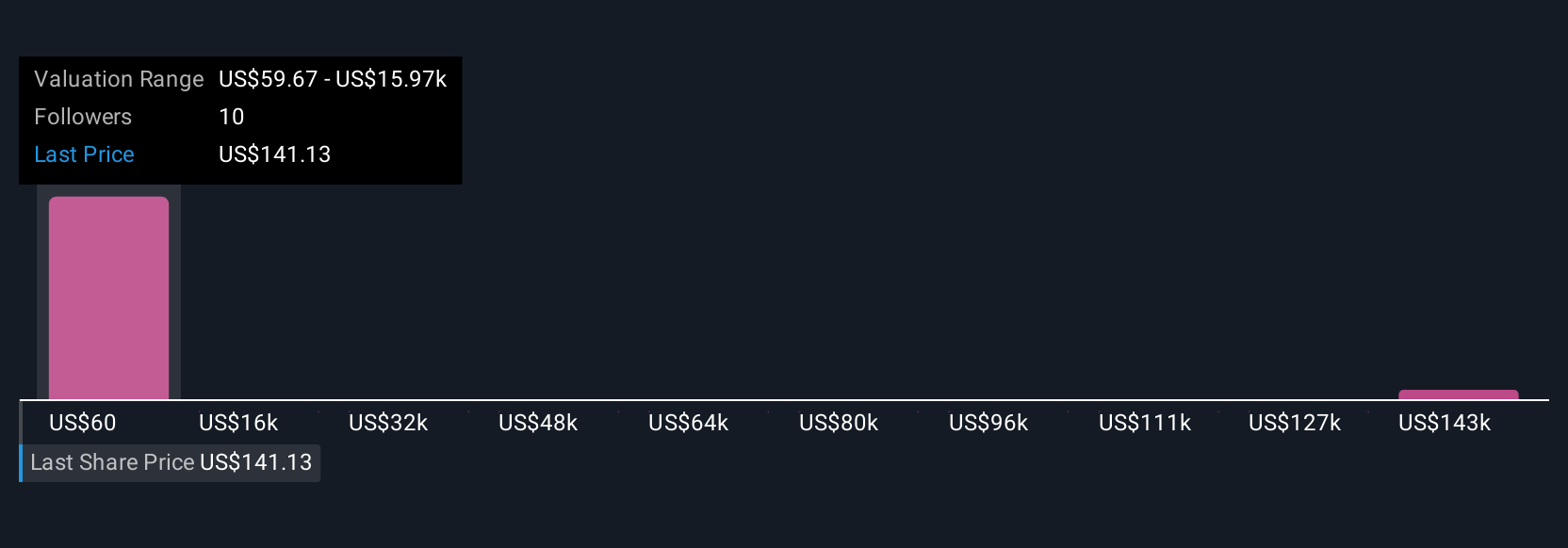

Simply Wall St Community members submitted six fair value estimates for Hyatt Hotels, ranging from US$55 to US$159,128 per share. Amid this wide spectrum of outlooks, emerging risks around shifting U.S. booking behavior remain an important consideration for anyone evaluating the company's performance potential.

Explore 6 other fair value estimates on Hyatt Hotels - why the stock might be a potential multi-bagger!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hyatt Hotels research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Hyatt Hotels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hyatt Hotels' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com