- In recent weeks, Carnival Corporation has reported record revenues, significant debt reduction, and increased demand for its cruise offerings, while also responding to two drowning incidents at its newly opened Celebration Key destination in the Bahamas.

- A notable development is Carnival's substantial progress in water conservation and desalination technology, reflecting ongoing commitments to both environmental responsibility and operational resilience across its global operations.

- We'll explore how robust cruise demand and enhanced sustainability efforts are influencing Carnival's investment narrative and long-term outlook.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carnival Corporation & Investment Narrative Recap

To be a Carnival Corporation shareholder, you need to believe that record-setting cruise demand and the expansion of destinations like Celebration Key are durable drivers of both growth and profitability. While the recent tragic drowning incidents at Celebration Key have generated attention, they do not appear to pose a material threat to bookings or short-term business momentum, but they do underscore the importance of maintaining strong safety and reputational standards.

Among Carnival’s recent announcements, the opening of Celebration Key stands out as highly relevant. This expansion supports one of Carnival’s most important catalysts, capturing sustained demand and boosting onboard and ancillary revenue per guest, helping underpin recent financial gains, despite the operational challenges that continue to emerge.

However, in contrast to the rapid growth headlines, investors should remain attentive to the reputational and regulatory risks that can arise from...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation & is projected to reach $29.2 billion in revenue and $3.7 billion in earnings by 2028. This outlook hinges on a 4.0% annual revenue growth rate and a $1.2 billion increase in earnings from the current $2.5 billion.

Uncover how Carnival Corporation &'s forecasts yield a $33.09 fair value, a 6% upside to its current price.

Exploring Other Perspectives

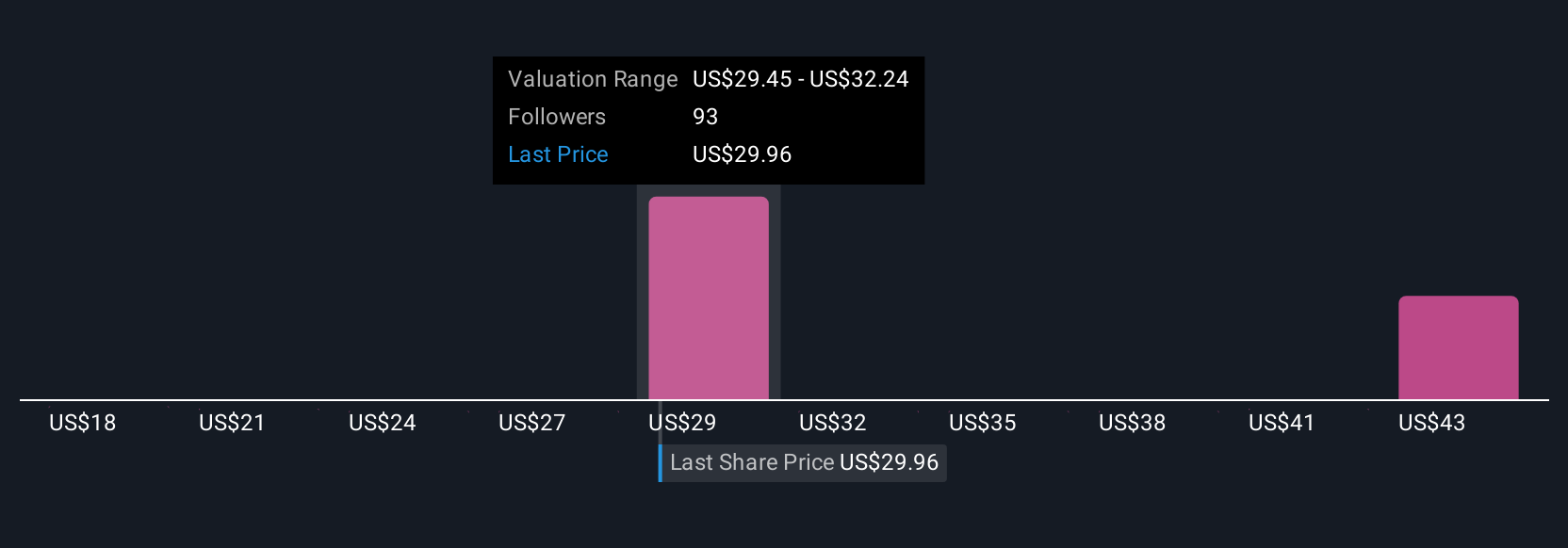

Nine fair value estimates from the Simply Wall St Community range from US$18.30 to US$34, with diverse views on earnings and revenue potential. While new destinations are expanding Carnival’s addressable market, these varied community perspectives highlight how future performance expectations can differ among market participants.

Explore 9 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 9% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com